Medical Industry Trends Point to Strong 2018

Gardner Business Index data trends point to medical manufacturing expansion.

Gardner Intelligence predicts 2018 will be a strong year for medical manufacturing growth based on data that medical goods manufacturers supply for the Gardner Business Index (GBI). Since the second quarter of 2017, Gardner Intelligence data indicates that new orders growth has and continues to outpace production. These two GBI components were the primary drivers of the GBI among medical devices and equipment manufacturers in 2017. As 2018 began, it appeared that those two GBI components would achieve that feat again.

Since the second quarter of 2017, Gardner Intelligence data indicates that new orders growth has and continues to outpace production.

The 2017 period in which new orders grew in excess of production should have resulted in increased GBI readings for supplier deliveries, as manufacturers increased their consumption of inputs in order to meet the demands of the medical industry. However, Gardner Intelligence data indicates that this was not the case, as 2017 readings for supplier deliveries did not significantly change in response to growing new orders. If Gardner Intelligence’s interpretation of the data is accurate, then unresponsive supplier deliveries figures from 2017 through to the present have partially hindered production from the ability to respond fully to increased new orders growth, which leaves the gap in production and new orders. As one might expect (and as the data confirms), backlog readings from 2017 changed drastically, from registering contractionary readings in the first quarter to setting multi-year highs by the fourth quarter.

As the medical industry continues to meet growing demand, Gardner Intelligence’s outlook for the medical manufacturing industry is strong. In time, Gardner Intelligence expects that improvements in the supply chain and additional capital expenditures will narrow and ultimately erase the gap in new orders and production. According to Gardner’s data measuring expected capital spending over the next 12-months, data from medical manufacturers during the three-month period ending January 2018 indicated an approximately 40 percent increase in capital equipment as compared to the expected spending data from the same months one-year ago. New capital equipment investments may help the industry more aptly respond to changes in new orders. However, new investments are not likely to properly or fully compensate for the seeming bottleneck that unresponsive supplier deliveries have created.

As the medical industry continues to meet growing demand, Gardner Intelligence’s outlook for the medical manufacturing industry is strong.

Wall Street analysts covering medical devices, instruments and supplies support this positive outlook for the medical industry. Based on 56 publicly traded, U.S.-listed firms with revenue forecasts for 2018, analysts expect a revenue growth of 11.9 percent in 2018. Analysts also expect earnings margins to increase from an actual median level of 13.5 percent in the third quarter of 2017 to 16.1 percent in the third quarter of 2018 and to over 17 percent in 2019.

About the Author

Michael Guckes

Michael Guckes is the chief economist for Gardner Intelligence, a division of Gardner Business Media (Cincinnati, Ohio, United States). He has performed economic analysis, modeling and forecasting work for nearly 20 years among a range of industries. He is available at mguckes@gardnerweb.com.

Related Content

Steps for Determining Better Mold Prices

Improving your mold pricing requires a deeper understanding of your business.

Read MoreThink Safety: Eliminate Hazards Throughout the Shop

The tooling community is taking advantage of new products for safer mold shops and molding facilities.

Read MoreThe Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

Read MoreTackling a Mold Designer Shortage

Survey findings reveal a shortage of skilled mold designers and engineers in the moldmaking community, calling for intervention through educational programs and exploration of training alternatives while seeking input from those who have addressed the issue successfully.

Read MoreRead Next

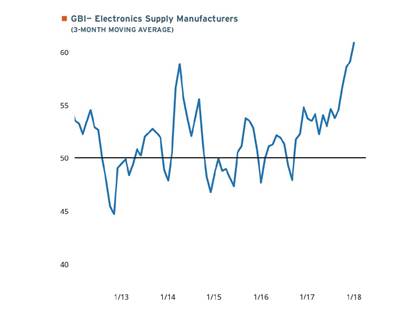

Electronics Revenue Projects Modest Growth in 2018

Forecasts of electronics industry spending have steadied, but recent Gardner data signals expansion may be just ahead.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More

.jpg;width=70;height=70;mode=crop)