May Mold Business Index Reports Industry Mostly Unchanged for 3 Months

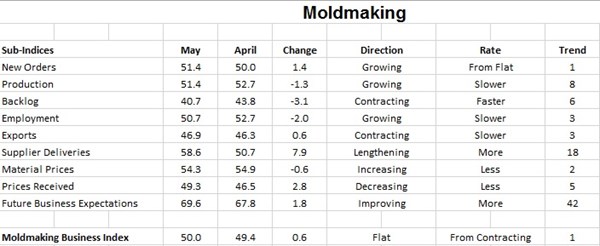

With a reading of 50.0, the Gardner Business Index showed that the moldmaking industry contracted was unchanged in May. The previous two months had very slight contractions. Therefore, the industry has been virtually unchanged for the last three months.

With a reading of 50.0, the Gardner Business Index showed that the moldmaking industry contracted was unchanged in May. The previous two months had very slight contractions. Therefore, the industry has been virtually unchanged for the last three months. Overall, the industry remained at its healthiest level since 2012. However, compared with one year ago, the index has contracted nearly 10 percent or more each of the last three months. And, the annual rate of change contracted in May for the first time since February. So, the industry remained strong in May but there were signs of softening.

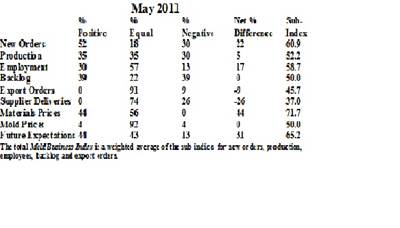

New orders increased somewhat in May after being unchanged the last two months. Production increased for the eight month in a row, but the index has fallen the last four months. Production has been relatively stronger than new orders. So, the backlog has fallen at an accelerating rate since the third quarter of 2014. The backlog index was at its second lowest level in May since September 2013. Trends in backlogs showed that capacity utilization in the industry will grow at a slower rate or contract for the remainder of 2015. Hiring increased for the third month in a row. The employment index has been on a steady rise since September 2014. Exports continued to contract, although the index has seen modest improvement since the summer of 2014. Supplier deliveries lengthened at their fastest rate since February 2012.

Material prices have increased the last two months after decreasing the two months prior to that. But, the rate of increase in material prices was still well below almost any other point in the index’s history, which stretches back to December 2011. Much of the price decrease and smaller price increases was likely on the molding side of the industry due to lower resin prices. Prices received have contracted at a modest rate throughout 2015. Future business expectations improved slightly from last month. The expectations index has been hovering around 70, which is roughly the historical average, since November 2014.

Facilities with 20-49 employees contracted for the second time in three months. Companies with fewer than 20 employees have contracted every month but two since August 2012.

Both custom processors and metalcutting job shops have not grown in the same month for three straight months. May saw custom processors expand somewhat. These companies have grown every month but one since October 2014. Metalcutting job shops contracted in May and have contracted two of the last three months. Conditions in these companies have been much more up and down since August 2014 than the conditions at custom processors.

The North Central – West was the fastest growing region for the second month in a row. The rate of growth has accelerated significantly each month. The Northeast has grown at steady but slower rate than North Central – West the last two months. The North Central – East had a significant drop in its index in May, to 41.2 from 51. 3.

Future capital spending plans remained very weak. Spending plans in the last two months have been less than 50 percent of the historical average. And, the one-month rate of change has contracted more than 25 percent for seven consecutive months. The annual rate of was contracted more than 26 percent in May.

Read Next

Are You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read More

.JPG;width=70;height=70;mode=crop)