Gardner Industry Report: Appliance & Packaging

Industrial production data for household appliances through the second quarter of 2017 maintained the steady upward trend that started in early 2013. Since the beginning of 2016, packaging consumption has grown between 2 and 5 percent.

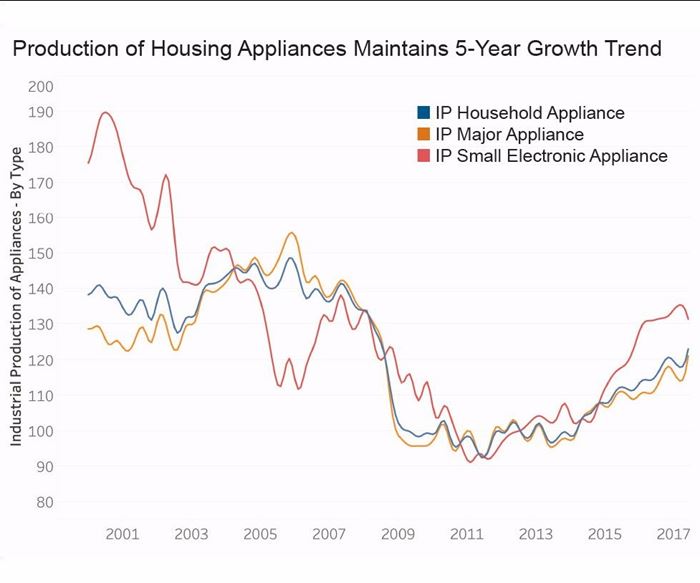

Household Appliance Production Moves Higher

Industrial production of household appliances for the second quarter of 2017 increased from the previous quarter, ending at 120.2. This is only slightly below the post-recession high of 120.3, which occurred during the fourth quarter of 2016. These gains come at a time when the drivers for appliances all indicate support for the market. These drivers include U.S. Treasury interest rates, which directly impact mortgage rates and housing market strength (a figure that is measured by permits and starts).

Industrial production data for household appliances through the second quarter of 2017 maintained the steady upward trend that started in early 2013. Production of small electrical appliances advanced faster than production of major appliances in 2014 and 2015. Over the past 18 months, production of small electrical appliances has minimally increased. Nearly 20 years of industrial production data for appliances suggests that there could be more room for this sector to grow. From 2000 to 2002, the average industrial production for all appliances exceeded 135.3, but production fell to a low of 92.6 soon after the Great Recession in 2011.

Positive Gains for Packaging Industry

Packaging indicators through August continued to show positive gains. Retail sales and food services data can serve as a proxy to packaging consumption, and it suggests that there has been a very steady growth in packaging consumption. Since the beginning of 2016, packaging consumption has grown between 2 and 5 percent. In the year-to-date period through August, monthly nominal retail sales grew, on average, by 3.7 percent from the sales figure for the same period one year ago, exceeding the rate of inflation.

An examination of the historical data for packaging machinery manufacturing and sales of retail and food services shows that the two are highly correlated. Data for packaging machinery manufacturing is reported more slowly than data for retail sales and food services which is available through August of 2017. The tight correlation suggests that currently, packaging machinery should be realizing growth between 5 and 10 percent.

About the Author

Michael Guckes

Michael Guckes is the chief economist for Gardner Intelligence, a division of Gardner Business Media (Cincinnati, Ohio, United States). He has performed economic analysis, modeling and forecasting work for nearly 20 years among a range of industries. He is available at mguckes@gardnerweb.com.

Related Content

-

MMT Chats: Digitalizing Mold Lifecycle and Process Performance

MMT catches up with Editorial Advisory Board member Bob VanCoillie senior manager of Kenvue’s mold management center of excellence outside of Philadelphia to discuss mold management via tooling digitalization and OEM expectations and opportunities.

-

Innovative Mold Building Enhances Packaging Material Efficiency, Elevates Recyclable Design

A manufacturing-focused design and optimized tooling enhance material efficiency in packaging for a new medical instrument.

-

Compact Robotic Palletizer Easily Automates Packaging Process

The Cube cell, complete with a KUKA KR50-R2500 robot, is targeted for small- and medium-sized businesses looking to automate the palletization of their end product.

.jpg;width=70;height=70;mode=crop)