Business Activity Surges on New Orders, Backlogs and Employment Gains

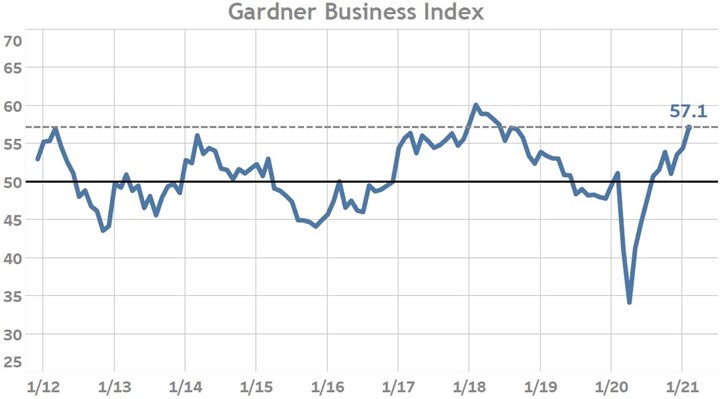

February reached a high of 57.1. Orders and backlog readings for the month rose to levels last reported in mid-2018 with March’s employment activity matched readings last reported in mid-2019.

The Gardner Business Index moved steadily higher during February thanks to expanding new orders, backlog and employment activity. Supply chain challenges continue to stymie the industry and hinder further production gains.

Business activity levels as recorded by the Gardner Business Index (GBI) expanded during February to 57.1 thanks to further activity gains in new orders, backlogs and employment. Excluding export activity, all index components reported rising levels of business activity over the prior month. New orders and backlog readings for the month rose to levels last reported in mid-2018 and March’s employment activity matched readings last reported in mid-2019. The encouragement created by these gains however was tarnished by a 6-point rise in the supplier delivery reading. Rising delivery readings indicate that order-to-fulfillment times are lengthening and that manufacturers in general are struggling to obtain the upstream goods necessary to complete their orders. Removing the inflationary impact of the supplier delivery reading from the overall Index would have resulted in a March reading of 54.1, placing this series at its own 2½ year high.

Challenging supply chain conditions coupled with strong new orders activity since August may explain why backlog activity levels have been moving quickly higher since crossing above the ‘no-change’ level of 50 in December. Furthermore, the widening spread between expanding total new orders and contracting exports implies that domestic new orders are more than offsetting foreign orders weakness. Historically new orders activity leads changes in employment by several months. The last few quarters of data seem to reconfirm this as the initial jump in new orders back in Q3 2020 seems to have now given rise to a Q1 2021 surge in hiring.

Material prices and prices received expanded for their 11th and 6th consecutive month, respectively. The present reading for materials prices at just below a reading of 84 indicates that the great majority of manufacturers across the U.S. are being impacted by the rising cost of upstream goods. February’s 4-point rise broke the all-time high reading set in mid-2018. One important distinction between now and then is the smaller proportion of firms which are presently receiving higher prices to help offset rising costs. This will have significant consequences on the profitability of manufacturers in 2021.

Gardner Intelligence does its utmost to provide regular and informative updates on the state of manufacturing considering the challenges posed by COVID-19. Gardner cannot thank our survey participants enough for their insights and on-going support. We hope that you will continue to tell us how your businesses are faring. Only through your participation are we able to assess the current state of the industry and assess where it may be heading. We would encourage our followers and publication subscribers to regularly visit our website blog and connect with Gardner Intelligence on LinkedIn and see our YouTube Channel.

.jpg;width=70;height=70;mode=crop)