Automotive Industry Beats Expectations

Through the first half of 2018, the automotive industry experienced a level of growth that exceeded the expectations of most experts.

Of the many economic factors that have an impact on the automotive industry, strong employment levels and wage gains are likely two significant factors behind the automotive industry’s performance in 2018. The industry has exceeded the expectations of many experts since the end of 2017. Working counter to these factors is an eroding financial picture in which banks are less willing to provide credit. Additionally, vehicle-loan default rates are well above their long-run levels prior to 2008. The recent net effect of these influences largely has been to offset one another, if not slightly to the benefit of the industry. In the first half of 2018, monthly light-truck and SUV sales remained near the one-million unit market, while car sales during the second quarter were flat, halting an otherwise downward trend.

Strong employment levels and wage gains are likely two significant factors behind the automotive industry’s performance in 2018.

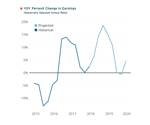

While the exact reasons for any given firm’s future may be unique to that firm’s circumstances, the collective results of this forecast may shed light on the general direction of the industry in the coming months and years. Reviewing Wall Street’s financial projections for 23 automotive firms with cumulative first-quarter revenues of $223 billion reveals a somber outlook for the industry between the second quarter of 2018 and mid-2020. Overall, earnings and revenues by the end of 2018 are projected to be modestly better than a year ago. However, the cumulative projections for 2019 indicate a flat to a slightly downward trend in revenues and contracting earnings.

Although the Gardner Business Index data is not projected, examining only the automotive data seems to support Wall Street’s notions that the industry may need to prepare for a more challenging environment in 2019. In the five quarters ending with the first quarter of 2018, Gardner Intelligence’s data indicated that new orders and production were the fastest growing economic industry drivers. However, by the second quarter of 2018, readings for new orders and production had declined, giving way to higher readings for supplier deliveries and employment. Generally, these are considered lagging indicators, as both are slower to respond to economic growth. While this transition of drivers is no guarantee of an immediate economic slowdown, it is consistent with an industry coming off of peak expansionary times.

About the Author

Michael Guckes

Michael Guckes is the chief economist for Gardner Intelligence, a division of Gardner Business Media (Cincinnati, Ohio, United States). He has performed economic analysis, modeling and forecasting work for nearly 20 years among a range of industries. He is available at mguckes@gardnerweb.com.

Related Content

-

Making Mentoring Work | MMT Chat Part 2

Three of the TK Mold and Engineering team in Romeo, Michigan join me for Part 2 of this MMT Chat on mentorship by sharing how the AMBA’s Meet a Mentor Program works, lessons learned (and applied) and the way your shop can join this effort.

-

Think Safety: Eliminate Hazards Throughout the Shop

The tooling community is taking advantage of new products for safer mold shops and molding facilities.

-

Tackling a Mold Designer Shortage

Survey findings reveal a shortage of skilled mold designers and engineers in the moldmaking community, calling for intervention through educational programs and exploration of training alternatives while seeking input from those who have addressed the issue successfully.

.jpg;width=70;height=70;mode=crop)