Working with Competitors Builds Business for Michigan Companies

A manufacturing co-op expands markets, saves money and keeps small companies in business.

There is strength in numbers, as the saying goes, and for businesses that work together there also is synergy, opportunities, cost savings and profitability.

This is the case that Adaptive Manufacturing Solutions (AMS) makes in explaining its reason for being. AMS (Burton, MI) is eight Michigan companies that market complementary services to OEMs in areas ranging from tool and die making to processing and metrology. AMS calls itself an American keiretsu, a Japanese term for companies with interlocking business relationships and shareholdings.

The goal of AMS, says Laurie Moncrieff, General Manager, is to offer OEMs one-stop shopping for their design and manufacturing needs. For the member companies, AMS increases access to customers, while reducing the costs associated with developing and maintaining new business.

“AMS, with its one-stop shopping, has no hesitation in quoting on contracts because we have the resources backing us up,” she says.

How It All Began

The cooperative was formed in June 2007 after eight years of strategizing. Moncrieff, who is also President of Schmald Tool & Die (Burton, MI), one of the member companies, began discussing plans for the venture with two firms. She had worked with similar groups in pilot programs sponsored by the state of Michigan. The thinking was that in Michigan, which was suffering the loss of manufacturing jobs to outsourcing, small companies like moldmakers would fare better by combining resources and working together to generate business rather than competing against each other.

Moncrieff says that some companies she spoke with saw the advantages of this when she began putting the idea together. “Others were slow to get on board, but as the economy turned [with the recession of 2000], they began to see the value.”

How It Works

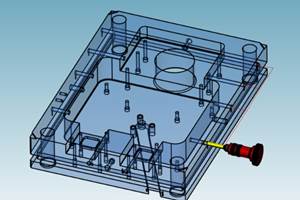

Most AMS members are relatively small—one has only four workers. Combined, AMS has 300 employees and sales of $63 million. Capabilities include: design and engineering; tool and die making; fixtures and gauges; precision machining; fabrication (injection molding, thermoforming, extrusion, vacuum forming and rotational molding); metrology; packaging, and materials handling.

Each member operates as a prime contractor or subcontractor. The idea is that any company can bid for a contract as long as one or more of the members can do the work. If Company A, a moldmaker, wins a bid for a job that requires tools, processing, quality inspection and assembly, it can do the toolmaking and subcontract the other functions to members. The members also operate as independent companies, but when a job requires additional capabilities, AMS members have the right of first refusal.

Moncrieff calls the process “workload leveling.” By sharing work, each member reduces redundancies, makes fewer sales calls, fewer investments in machinery or capabilities and has lower overhead. And because members pay monthly dues, they share marketing and some employee expenses. AMS has a full-time person on staff specializing in government business whose services are available to every member. There also is a full-time marketing person. Both would be major, if not prohibitive expenses for some of the members.

New Business Opportunities

AMS has exposed members to a range of new business and given them an opportunity to diversify. Moncrieff, for example, says that when she bought Schmald Tool & Die in 1997, almost all of its work was automotive. Automotive is now around 60 percent, and she wants it to be no more than 20 percent.

Key among the new markets is aerospace, which accounts for 2 percent of Schmald’s business; though Moncrieff says the company is just starting to work in the area. Other markets with high growth potential include alternative energy, mass transit, medical and military. In 2008, AMS brought in about $400,000 worth of business, Moncrieff says. This year, the keiretsu is bidding on a number of high-value jobs, including a $3.2-million military smoke grenade, a “large medical contract” and alternative-energy projects ranging from wind and solar power to biomass and nuclear.

“To get a shot at these opportunities, a company must be in the market [knocking on doors],” Moncrieff says. “We are mostly small companies. Doing this on your own is expensive and time-consuming. Most owners can’t afford that much time away from their businesses.” With every member looking for contracts, “we can spread ourselves out and be present in numerous bids, plus meet a lot of people. We have more boots on the ground.”

Moncrieff says that in some areas, especially those connected to aerospace and nuclear energy, members need special quality certifications to compete for jobs. But even this can be done economically. In most cases one member learns the certification procedure and teaches it to the others.

One-stop shopping reduces an OEM’s need to source multiple suppliers. Sometimes the fabrication talent AMS offers leads to a different way of producing parts that is effective and more economical. “We have constant conversations with each other,” Moncrieff says, “which is great for brainstorming ideas.”

She is the third generation of her family to run Schmald Tool & Die, which was started by her grandfather in the 1940s. In an interview with Fortune Small Business magazine in 2007, Moncrieff said that as a small company, Schmald didn’t have the resources to break into aerospace and other non-automotive markets. As it was, sales declined to $3.5 million in 2006 from $4.5 million the year before, a period when one of her biggest customers was financially troubled auto-parts maker Delphi Corp.

Success Strategy

Moncrieff believes that cooperatives like AMS are a way that small manufacturers, especially moldmakers, can be successful in a difficult business environment. In many cases, state and local agencies are helpful in getting such efforts off the ground, and grants and other subsidies may be available to build an organization.

She advises companies to be careful in selecting members, work hard at developing communications among them, and be certain every rule is spelled out in advance. “It takes time and energy,” Moncrieff says. “A lot of companies want to join AMS, but we are cautious. We have a great group and everyone gets along well.”

Much of the success of AMS can be measured in what members could have lost, as in what they’ve gained. “In the past, companies would pass up work [because they didn’t have the capabilities]. Now, even if members see something that’s not a fit for them, they bid on it and subcontract the work to a member who can do it.”

Related Content

Hybrid Milling/Drilling Machine Reduces Total Mold Machining Time

MSI Mold Builders now squares, plus drills and taps eye-bolt holes on 50% of its tools in a single setup using a five-axis milling/drilling center with a universal spindle.

Read MoreCAM Automation Increases Mold Production, Quality

Mold builder switches CAM software package after 20 years to take advantage of innovative programming strategies that reduce mold machining programming and processing times.

Read MoreCT Scanning Helps Micro Molder Reduce Cost of First Article Inspections

CT scanning services performed by 3D ProScan, a division of NyproMold Inc. provides MTD Micro Molding with accurate, high-resolution internal and external measurements performed about seven times faster and at significant cost savings.

Read MoreHow to Clean and Maintain Molds With Intricate Conformal Cooling Channels

A water-based, eco-friendly plastic mold cleaning system helps Rankine-Hinman Manufacturing restore flow rates and avoid big-ticket failures on complex and costly molds.

Read MoreRead Next

Niche Auto Molds Prove to Be a Profitable for Cavalier Tool

Capitalizing on its specialty of molds for fans and shrouds in the automotive industry—on their own terms with no PPAP—drives this moldmaker’s success.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More