Wall Street Upgrades Near-term Outlook for Electronics Industry

Wall Street’s latest near-term outlook for the electronics industry has markedly improved since Gardner’s last review of the industry based on third quarter 2018 actuals and projections.

Share

Wall Street’s latest near-term outlook for the electronics industry has markedly improved since Gardner’s last review of the industry based on third quarter 2018 (3Q18) actuals and projections. Reported 4Q18 and 1Q19 revenues and earning significantly beat expectations in part due to better than expected economic and business conditions while America renegotiates its trade agreements with multiple major trading partners.

Based on data from among the 85 firms used in our study, actual year-over-year earnings growth ending in March was 3.3%, besting the Wall Street’s beginning of the year consensus estimate of -1.0%. Actual first quarter earnings growth of 4.9% was also significantly better than the expected 1.3% contraction in earnings1. While 4Q18 and 1Q19 actual results beat estimates, Wall Street’s outlook in 2020 has dampened significantly with expectations for revenue and earnings growth now both in the single-digits area, down from the double-digit growth formerly expected during 2020.

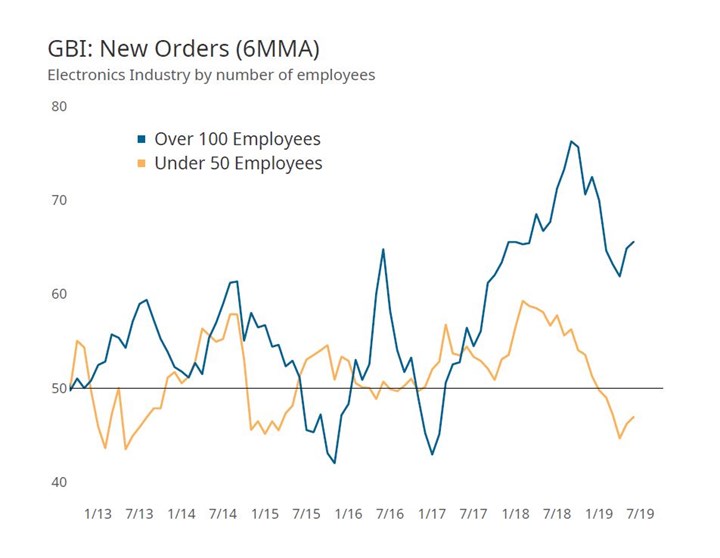

Electronics manufacturing data collected from Gardner’s Business Index through May suggests that the industry is stabilizing after coming off nearly two years of accelerated growth. Year-to-date data for supplier deliveries, new orders and production suggest modest growth that is in-line with historical norms. Contractionary readings in both backlogs and exports have pushed the total index reading among manufacturers serving the electronics industry to below 50, indicating a net contraction in business activity. That total new orders continue to register above 50, while export activity contracts implies that domestic demand for electronics products is replacing lost demand from foreign consumers of manufactured electronics.

Gardner’s year-to-date survey data also suggest that electronics manufacturers are reporting experiencing different business conditions by size with larger firms reporting strongly accelerating new orders activity and firms with fewer than 50 employees reporting flat to contracting new orders activity. Although smaller firms report experiencing contracting new orders activity, production has remained stable as firms deplete backlogs.

Related Content

-

MMT Chats: 5 in 5 with Neu Dynamics

MoldMaking Technology editorial director Christina Fuges chats with Kevin Hartsoe, president of Neu Dynamics to reveal their five best practices for improving efficiencies in culture, technology, process, measuring success and staying competitive ... in 5 minutes.

-

The Connector Conundrum: 3D Printed Mold Tooling’s Role in Innovation

ReelView Fishing faced an electronics obstacle in the development of its new technology for underwater video. Additive manufacturing for moldmaking enabled the speed necessary to iterate to a solution.

-

Thriving on First-Off Molding Projects

Christina Fuges talks to Kevin Hartsoe, president of Neu Dynamics in Ivyland, Pennsylvania, about the company’s focus on the electric vehicle market, the key to its success, projects in the pipeline as well as supply chain and workforce challenges.

.jpg;width=70;height=70;mode=crop)