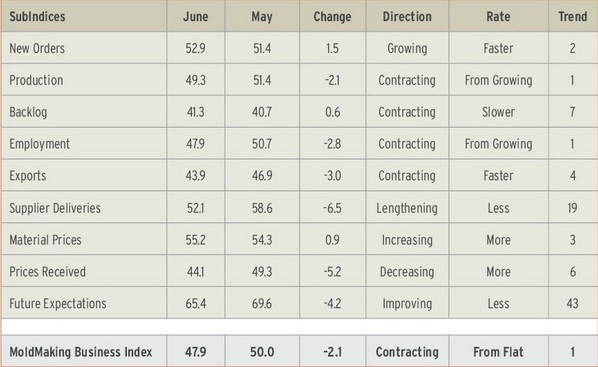

Total MoldMaking Business Index for June 2015: 47.9

With a reading of 47.9, the Gardner Business Index showed that the moldmaking industry contracted for the second time in three months. June’s index was the lowest since October 2014 and the second-lowest since December 2013. The index has trended down consistently since this past February.

With a reading of 47.9, the Gardner Business Index showed that the moldmaking industry contracted for the second time in three months. June’s index was the lowest since October 2014 and the second-lowest since December 2013. The index has trended down consistently since this past February.

The good news is that new orders have increased the previous two months at an accelerating rate. Production, which contracted for the first time since September 2014, has trended down at a significant rate since its peak in January. The strength in new orders relative to production has not affected the backlog index yet, but should soon. Backlogs have contracted every month but one since June 2014, and since November, the index has trended down significantly. The employment index had steadily improved from September 2014 to May 2015, but it fell notably in June. The export index, which has trended down fairly sharply since February, fell to its lowest level since December 2012. Supplier deliveries generally have lengthened more since last September.

Material prices have increased at a fairly consistent rate for three months, however, the material price index was still below its lowest level since November 2012. Prices received decreased significantly in June, reaching their lowest level since the survey began in December 2011. Future business expectations had improved from August 2014 to March 2015, but have softened since that time. They were about five percent below average in June, the first time they have been below average since last August.

Facilities with more than 100 employees have done quite well in 2015 and expanded significantly in June. Companies with fewer than 100 employees have contracted for some time, however. Those with 50-99 employees have contracted four of the last five months, while companies with 20-49 employees have contracted three of the last four months. Companies with 1-19 employees have contracted every month but one since May 2014, and in June, they contracted at their fastest rate since last September.

Custom processors expanded for the second month in a row and for the seventh time in eight months. Metalcutting job shops, however, have contracted three of the last four months. June showed their fastest rate of contraction since August 2013.

The only region to expand in June was the North Central-East, which has grown eight of the last nine months. The West recorded a moderate contraction for the third straight month. Both the North Central-West and the South Central had fairly significant contractions in June, while the Northeast and Southeast contracted hard after growing in May.

Future capital spending plans for the next 12 months fell to just 40 percent of the historic average. In June, spending plans fell 70 percent compared with one year earlier. Spending plans have contracted at least 66 percent in each of the last three months.

.JPG;width=70;height=70;mode=crop)