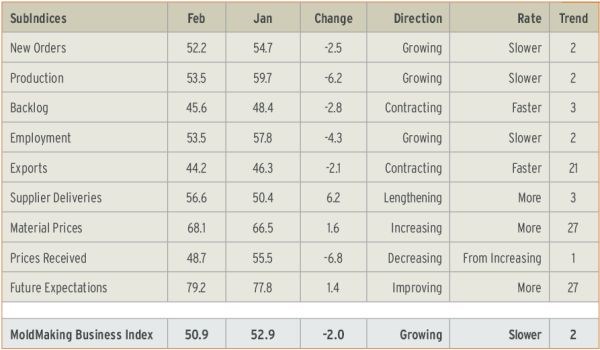

With a reading of 50.9, Gardner’s MBI showed that the moldmaking industry has expanded in four of the previous five months. Generally, the industry has been improving since August. February’s index was 0.8 percent lower than it was last February, the first time the month-over-month rate of change contracted since last September. However, the annual rate of change has contracted at a slower rate each of the last three months. This is a further indication that the industry is moving in a positive direction.

New orders grew for the second straight month and for the fourth time in five months. However, the rate of growth was slower than in January. Also, production expanded for the second straight month and for the 12th time in the last 14 months, although the rate of growth fell noticeably in the month. Because production has been growing at a faster rate than new orders, backlogs have been contracting at a generally faster rate since November. But, the backlog index has been higher than it was one year ago for a number of months, which is a sign that capacity utilization and capital spending in the industry should increase in 2014. Employment has been trending up at an accelerating rate since September. In fact, it is growing at the second-fastest rate since July 2012. Exports, on the other hand, are contracting at their second-fastest rate since December 2012. Supplier deliveries have been lengthening more and more since August 2013.

Material prices increased at the third-fastest rate in the history of the index, which began in December 2011. However, the prices received index dropped rather significantly to contraction from growth. This is the first time prices received have contracted since November. In spite of the slower growth in the overall index, future business expectations reached their highest level in the history of the index. Expectations have improved steadily and significantly since November 2012.

While custom processors (molders) grew in February, they contracted at a significant rate in the month. Metalcutting job shops (moldmakers) contracted slightly and have done so two of the last three months. With these processors and job shops contracting, the growth in the index is being driven by OEMs.

The South Atlantic region grew the fastest in February and has grown for four consecutive months. It was followed by the East North Central, which has expanded in four of the last five months, and the West North Central region, which has grown for two straight months. The Pacific region contracted at a rather modest rate, while the Middle Atlantic region contracted at quite a significant rate.

Future capital spending plans were 7.4 percent higher than they were in February 2013. This is the second month in a row and the third time in four months that the average spending per plant was higher than it was one year earlier. However, the rate of increase the last two months has been the slowest since the survey began.

Related Content

-

Tackling a Mold Designer Shortage

Survey findings reveal a shortage of skilled mold designers and engineers in the moldmaking community, calling for intervention through educational programs and exploration of training alternatives while seeking input from those who have addressed the issue successfully.

-

The Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

-

Editorial Guidelines: Editorial Advisory Board

The Editorial Advisory Board of MoldMaking Technology is made up of authorities with expertise within their respective business, industry, technology and profession. Their role is to advise on timely issues, trends, advances in the field, offer editorial thought and direction, review and comment on specific articles and generally act as a sounding board and a conscience for the publication.

.JPG;width=70;height=70;mode=crop)