Share

Read Next

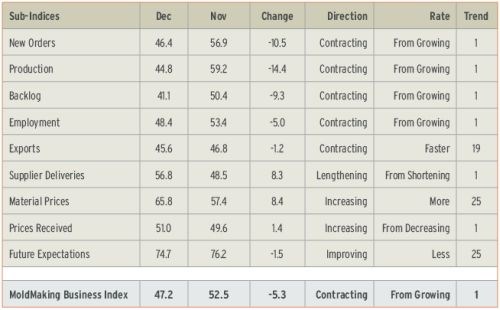

With a reading of 47.2, the MBI showed that the moldmaking industry contracted in December at its fastest rate since August 2013. While this contraction comes after two months of growth, the industry is on the uptrend. In each of the previous three months, the index had been higher than it was one year earlier. These are the only three months since the index began in December 2011 that have seen month-over-month growth.

The main reasons for the contraction were drops in new orders, production and backlogs. New orders fell significantly, contracting for just the third time since December 2012. Production dropped even more than new orders, contracting for only the second time since the previous December. Backlogs also contracted, after growing in November for the first time since April 2012. Despite the drop in the backlog index, the general trend has been slower contraction in backlogs. This indicates that capacity utilization in the moldmaking industry should improve in 2014. Employment also contracted for the first time since December 2012, and exports continued to contract at a fairly consistent rate. Supplier deliveries have been lengthening at an increasing rate since December 2012. After a slower rate of increase for most of 2013, material prices increased at a faster rate in December, and prices received increased for the first time since July 2013. Future business expectations have improved dramatically since June 2013 and are at their second-highest level since March 2012.

Custom processors (molders) have grown throughout 2013, however, in December their index dropped to its lowest level since the index began. While metalcutting job shops (moldmakers) grew significantly in November, they moved back into contraction in December, although that rate of contraction has been slowing since August 2013. So, the conditions at molders were responsible for the decline in the index in December.

The Middle Atlantic and South Atlantic regions grew for the second month in a row, while the East North Central region contracted after growing the previous three months. The West North Central region contacted at its fastest rate since December 2011.

Future capital spending plans were 10.7 percent less than they were in December 2012, the second time in three months that the month-over-month rate of change contracted. The annual rate of change slowed from November to December, but the rate of growth is still quite strong. The overall uptrend in the index over the past few months indicates that capital spending should improve in 2014.

Related Content

-

Top 10 Topics to Cover During an ISO 9001 Manufacturing Audit

Take a look at this practical hands-on approach to conducting a quality audit.

-

Tackling a Mold Designer Shortage

Survey findings reveal a shortage of skilled mold designers and engineers in the moldmaking community, calling for intervention through educational programs and exploration of training alternatives while seeking input from those who have addressed the issue successfully.

-

Mold Design Review: The Complete Checklist

Gerardo (Jerry) Miranda III, former global tooling manager for Oakley sunglasses, reshares his complete mold design checklist, an essential part of the product time and cost-to-market process.

.JPG;width=70;height=70;mode=crop)