Minding the Business

This toolmaker and low-volume injection molder’s diversification shows that business savvy can be just as critical to success as an efficient manufacturing process.

The leaders of Midwest Mold Services are craftspeople at heart. Given the shop’s origins in automotive industry production tooling, such a mindset was virtually a requirement for expanding into its first dedicated manufacturing space in 1994. Yet, President and CEO John Hill says he learned early on that efficient production of high-quality plastic injection molds wouldn’t be enough for the shop to succeed. Moldmaking is a business, and Hill and his team run their own operation as such.

The company’s expansion into new markets and new capabilities during the past decade has further driven this lesson home. Although automotive production tooling still constitutes about 80 percent of work, the 37-employee shop’s customer base now hails from a wide variety of industries, from consumer products to medical, telecommunications and power generation. Attracting that business required an entirely new specialty: molding prototype and low-volume plastic parts. Yet, Hill says the shop’s diversification never would have been successful—or even happened in the first place—without efforts to plan for the future, minimize risk, improve tracking of costs and profits, and get the word out about the shop’s capabilities.

Planning Growth

The shop’s transition mirrored a critical turning point in Hill’s own career. By 2004, he’d reached a point where the road ahead didn’t seem much longer than the path he’d already traveled. “I was in my late 40s, and I’d worked in this trade my entire life, but I’d only just started thinking about something other than ‘grow, grow, grow,’” he recalls. “I was really focused on ensuring a sustainable future.”

Midwest Mold Services certainly needed such a focus. That’s not to say the shop hadn’t been successful—quite the contrary. Ten years in, it was gearing up for its fourth expansion since its modest beginnings as a captive shop performing engineering changes and repairs for a custom molder, Hill says. However, outgrowing facilities every few years proved expensive. It would be far better, reasoned Hill and his team, to decide just what size company they wanted to be, dial in their processes and profit margins accordingly, and grow into the next new space: a 37,000-square-foot plant in Roseville, Michigan, that the business still occupies today.

By 2006, however, large portions of the building remained unused. Forced to search outside its core business to fill capacity, Midwest Mold Services was one of the first companies to participate in a market diversification program offered by the Michigan Manufacturing Technology Center (MMTC), a consultancy organization for small and mid-sized businesses.

Minimizing Risk

The first order of business was deciding just what sort of additional work to pursue. Guided by the MMTC, the shop prioritized one factor above all: minimizing risk.

That would be relatively easy with low-volume and prototype tooling, because the shop could leverage existing resources to realize the same advantages already benefitting its core business. For instance, to reduce labor rates, the shop had come to rely heavily on palletized HMCs that enable operators to set up one pallet while the other is in the workzone (today, it uses an HM 600 from OKK USA Corp.). High spindle speeds (like the 20,000 rpm on the company’s Makino V56 VMC) would also prove useful for the new work, as would robust EDM capability. (Today, EDM resources include an OPS Ingersoll Gantry Eagle from MC Machinery Systems, Inc. that minimizes electrode wear, as well as an Agie Advance sinker paired with a System 3R USA LLC Robot and Makino SNC 64 high-speed machining center.)

Yet, moving into that arena still required new capabilities in the form of an all-electric, 165-ton Roboshot injection press from Milacron Plastics and, two years later, a second, 330-ton Roboshot. Still, any risk inherent in this investment was tempered by the fact that, similarly to the technology mentioned above, molding capability would benefit the core automotive business and the new low-volume specialty alike. “Doing sampling in-house has saved money compared to outsourcing it,” Hill says about the former segment of work. “It has also helped us better understand the issues our customers face on a daily basis.” As for the latter segment, molding capability was essential, because profit wouldn’t be derived from the tools themselves but from the plastic parts they’d be used to produce.

Focusing on Profit Centers

That notion took some getting used to, but recognizing profit centers and directing resources accordingly was critical to the success of the company’s diversification, Hill says. “At first, we were quoting the new segment of work with a mold builder’s mindset: To make money on the molds,” he explains. “We had to learn that we didn’t need to do this. Rent, overhead and other costs were already covered by our core business, and we didn’t have to achieve our regular shop rate to make money on molded parts.”

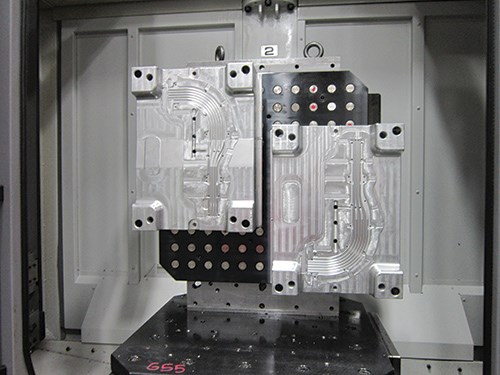

Based on this understanding, the shop’s approach to lower-volume tools is markedly different. As Hill puts it, “Our emphasis is on designing a process that will produce a quality part, not just on designing a mold.” He emphasizes that this isn’t about cutting corners so much as designing according to customer requirements and avoiding wasted effort. For instance, a low-volume tool typically doesn’t require as much attention to outside mold areas, such as water manifolds, hydraulics, shot counters, sequential valve gating (SVG) hot halves and quick-mold-change (QMC) plates. Time and energy are better spent standardizing the process (see image on page 14) and ensuring a production-quality plastic part, which the customer cares about far more than the outside of the mold.

Tracking Dollars

Another significant change is the shop’s move from tracking costs in very broad terms to a much more detailed breakdown. “Instead of just ‘build,’ we’ll track 2D machining, 3D machining, ‘trode manufacturing—there are multiple levels just under that one category,” Hill explains. “We can’t usually increase our prices, but finding out what’s costing profits can be just as useful.”

One example is outsourcing. Unlike a production house, a custom mold manufacturing business can never assume it will operate consistently at 100-percent peak capacity, Hill says. That’s why the goal of the 2004 expansion was to reach a size that would enable taking on 80 percent of projected peak workload while letting outside partners handle the other 20 percent.

Although this approach has always worked for Midwest, it had never before tracked outsourcing costs in any detail. Doing so revealed that the shop’s choice of partners often limited potential revenue, even if the job as a whole remained profitable. “We now strive to work with manufacturers with a shop rate that’s relatively on par with our own, or less than that,” Hill says. “Outsourcing to shops with higher rates eats into our profits.”

Sold on the Web

The MMTC helped with more than just diversification. The organization also helped Midwest Mold Services create a new website that, within the next 18 months, helped secure roughly $800,000 worth of new business. Although he was skeptical of its impact at first, Hill says the site remains the shop’s best source for new inquires today.

When a quote does come in, he also has to act more like a salesman than ever before. With more avenues for serving customers, directing them to the right solution is more complicated. That’s particularly true for prototype work, given that the shop’s offerings beyond injection molding include 3D printing, epoxy molding and cutting directly into plastic.

All in all, Hill says properly minding the business side of the operation is critical to ensuring Midwest Mold Services remains a reliable fixture in the supply chain for years to come. “With our talent and equipment, I’m confident we can build anything,” he says. “Does that automatically translate to profits? Absolutely not. I believe people, process and product combined, properly measured and monitored, are the contributing factors to profitability in any business.”

Related Content

Dynamic Tool Corporation – Creating the Team to Move Moldmaking Into the Future

For 40+ years, Dynamic Tool Corp. has offered precision tooling, emphasizing education, mentoring and innovation. The company is committed to excellence, integrity, safety and customer service, as well as inspiring growth and quality in manufacturing.

Read MoreSteps for Determining Better Mold Prices

Improving your mold pricing requires a deeper understanding of your business.

Read MoreTackling a Mold Designer Shortage

Survey findings reveal a shortage of skilled mold designers and engineers in the moldmaking community, calling for intervention through educational programs and exploration of training alternatives while seeking input from those who have addressed the issue successfully.

Read MoreMMT Chats: 4 Keys to a Successful Mold-Building Operation: Innovation, Transparency, Accessibility and Relationship

MoldMaking Technology Editorial Director Christina Fuges chats with Steve Michon, co-owner of Zero Tolerance in Clinton Township, Michigan, about the excitement of solving problems, the benefits of showing gratitude, the real struggle with delegation and the importance of staying on top of technology. This episode is brought to you by ISCAR with New Ideas for Machining Intelligently.

Read MoreRead Next

How to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More