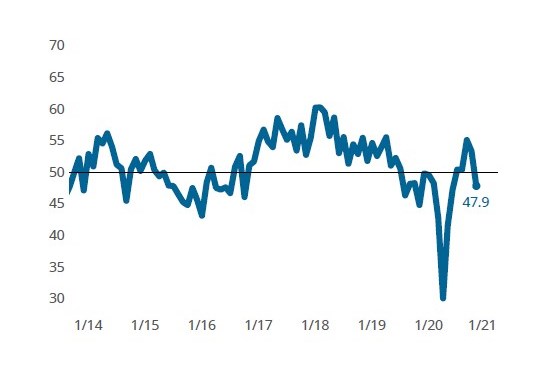

Moldmaking Industry Ends Four-Month Expansionary Run

Slowing new orders, production and backlog activity result in a 47.9 reading for November, indicating a potential incoming challenge for the world supply chains as we enter 2021.

Between October and November, business activity, as measured by four of the Index’s six components, transitioned from expanding to contracting. Additionally, export activity reported an accelerating contraction during the same period.

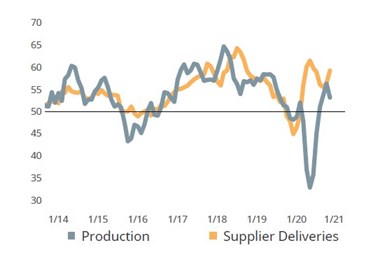

November’s Moldmaking Index at 47.9 ended a four-month rally during which the proportion of moldmakers and molders reporting improving business conditions briefly matched the cyclical highs from 2018 and early 2019. November’s contraction from October’s 53.4 reading resulted from slowing new orders, production and backlog activity.At the end of the month, only the reading for supplier deliveries remained above a level of 50, which is defined for most index components as the boundary line between expanding and contracting business activity.

The seasonal increase in shipping demand combined with vaccine distribution will put additional burdens on logistics providers in the near-term. This will further slow order-to-delivery times which are represented by elevated supplier delivery readings and likely impede future production activity.

As we near the close of the calendar year, world supply chains will be challenged more than ever as an influx of seasonal package shipping and vaccine distribution further compound the existing logistics challenges already imposed by regulations designed to slow the spread of COVID-19. It is highly probable that this combination of constraining events will lengthen the order-to-fulfillment time of orders placed by moldmakers and molders on their upstream suppliers, keeping the supplier delivery activity reading well above normal levels in the months to come. Calculating the Moldmaking Index without the influence of supplier deliveries would have resulted in a November reading of 45.7, placing overall activity near the bottom of its historic business cycles.

Related Content

-

November GBI Saw a Drop in Moldmaking Activity

The moldmaking index experienced a high degree of accelerated contract, primarily driven by production, new orders and backlog readings.

-

Moldmaking Index Suggests Positivity Moving into 2025

Future business expectations surge on the heels of improvements across all components.

-

GBI: Moldmaking Undertakes Slightly Slowing Contraction

While most component activities remained unchanged in September, employment and supplier deliveries indicate a brief let-up from the contraction trend.

.jpg;width=70;height=70;mode=crop)