Moldmaking Industry Ends 2021 on Rollercoaster

December’s Moldmaking Index studies reports of a production surplus, slowing expansion, a contractionary reading for export orders and an overarching outlook on the 2021 calendar year.

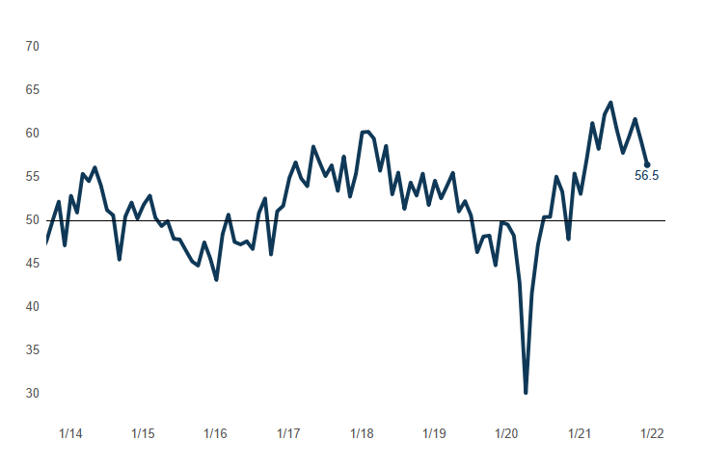

The Moldmaking Index ended 2021 well below its 2021 high, but also modestly above its January start. This could signal that while the industry is finding its post-COVID-19 footing, there is still much work to be done.

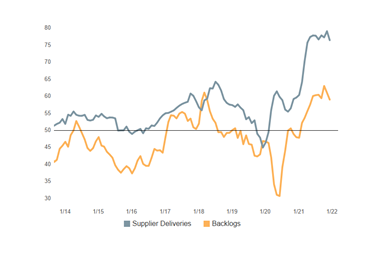

The Gardner Business Index (GBI): Moldmaking declined more than two points to end December at 56.5. For much of 2021 the Index’s readings demonstrated an unusual sequence of sharp “sawtooth” movements, moving higher for two months followed by two months of decline. At year-end, the Index finished only 3 ½ points above its January 2021 reading, but more than seven points below its mid-year high. December’s results were pulled lower by the slowing expansion in supplier deliveries, new orders, production and employment activity. Further pressuring the overall index reading was the first contractionary reading for export orders activity since April. Despite greater volatility in supplier delivery activity in recent months, readings remain within a 10-point band, the bottom of which remains well above even the highest of pre-pandemic levels.

Challenging supply chain conditions throughout 2021 restrained production and thus elevated backlogs. Not only are backlog readings presently at record highs, but they have remained at such levels for an unprecedented length of time.

Moldmakers reported the widest “production surplus” for all of 2021 during December as measured by the positive difference between production and (total) new orders activity readings. That only three months in 2021 registered surpluses is unusual for its low frequency. Historically, production surpluses have been more likely than not; however, when elevated supplier delivery readings indicate weak supply chain performance—as is the case presently—production deficits become much more frequent.

Related Content

-

Moldmaking Activity Contraction Slows in August

Future business expectations still improving, but more slowly.

-

GBI: Moldmaking Undertakes Slightly Slowing Contraction

While most component activities remained unchanged in September, employment and supplier deliveries indicate a brief let-up from the contraction trend.

-

Moldmaking Activity Accelerated Contraction in July

July’s moldmaking index accelerated contraction for the third month in a row, though the magnitude was considerably less than last month.

.jpg;width=70;height=70;mode=crop)