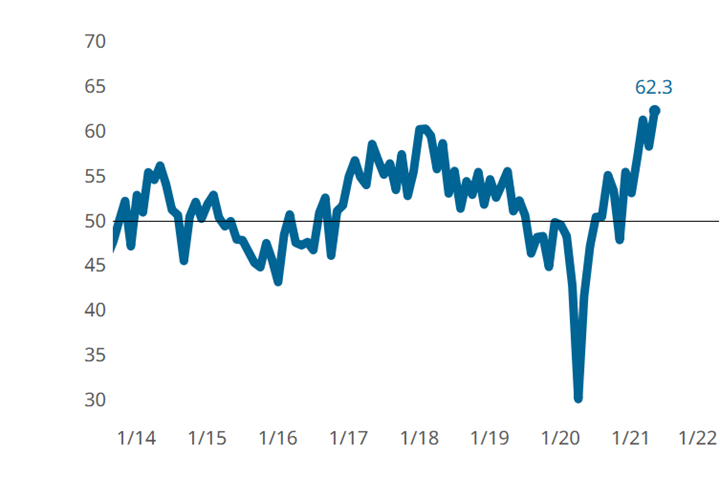

Moldmaking Index Rises Four Points to All-Time High

May’s broad-based Index gains are supported by an accelerating expansion of new orders, production, backlogs, employment and exports activity.

May’s record high reading was the direct result of elevated readings for a wide range of metrics including new orders, production, backlog and employment. The activity reading for supplier deliveries fell for the first time since August 2020.

Rising to a new all-time high of 62.3, the Moldmaking Index extended its accelerating expansionary trend for a sixth consecutive month. May’s reading was supported by the accelerating expansion of new orders, production, backlogs, employment and exports activity. Among these, new orders and backlog activity both reached multi-year highs. Overall, May’s broad-based gains are encouraging for the industry, as a healthy market expansion should be driven by rising demand with production and backlogs chasing quickly behind. This contrasts with the industry’s expansion in recent quarters, which has been the result of struggling supply chains causing inflated Index readings.

Total demand, as proxied by Gardner’s Exports and Total New Orders metrics, continues to outpace the ability of the mold manufacturing marketplace to keep up despite growing levels of new hires. Backlog activity currently stands at a three-year high.

The decline in the supplier deliveries reading indicates that a smaller proportion of the mold and moldmaking industry experienced slowing supplier delivery conditions. However, even with May’s six-point decline, supplier delivery activity is still far above historical norms, implying that supply chain conditions are still far from typical. Upstream conditions continue to stymie production as evidenced by the enduring spread between new orders and production readings. Despite hiring activity setting a two-year high in the latest readings, new orders activity continues to outpace production, resulting in sharply higher backlog readings which now stand at a three-year high.

Related Content

-

Moldmaking Accelerated Contraction in June

June’s moldmaking index took a relatively steep downward turn, landing at a new low for the year.

-

May Moldmaking Index Trends Downward

Contraction, experienced by most May components, continues to be familiar territory for the GBI: Moldmaking Index.

-

Contraction in Moldmaking Activity Slowed According to GBI

The moldmaking index almost bounced back to November’s reading but stopped one point shy, as most components slowed or stabilized contraction in December.

.jpg;width=70;height=70;mode=crop)