Moldmaking Index Extends Movement in Narrow Growth Range

The Gardner Business Index (GBI): Moldmaking registered 52.6 in February, extending its narrow range of growth readings since September 2018, when it registered less than 200 basis points higher.

Share

Read Next

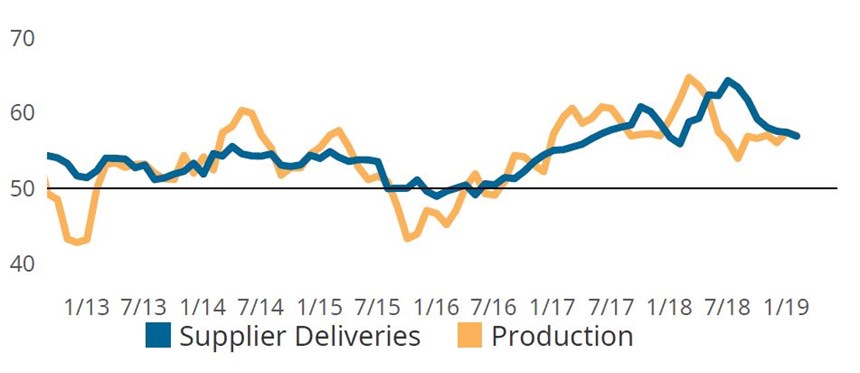

The Gardner Business Index (GBI): Moldmaking registered 52.6 in February, extending its narrow range of growth readings since September 2018, when it registered less than 200 basis points higher. Compared to the same month one year ago, the Index is down 13.7 percent; however, this comparison gauges the latest month’s data against the February 2018 record high reading of over 60.0. Gardner Intelligence’s review of the month’s underlying data reveals that supplier deliveries, production and backlog readings lifted the index — a calculated average of the components — higher. In contrast, new orders and backlogs pulled the Index lower. Only exports registered a contractionary reading during the month.

New orders and production both experienced slowing growth in February with the net resulting being an expansion in backlogs. Changes in the backlog reading are often attributed to the resulting ‘net’ movement in new orders and production. The slowing expansion in supplier deliveries beginning in the second-half of 2018 has resulted in supplier deliveries shadowing production readings in recent months. This suggests that the industry’s supply chain has adeptly rebalanced since experiencing a shock of new orders in early 2018, which caught suppliers with insufficient product volumes.

Related Content

-

Moldmaking Index Suggests Positivity Moving into 2025

Future business expectations surge on the heels of improvements across all components.

-

Moldmaking Activity Accelerated Contraction in July

July’s moldmaking index accelerated contraction for the third month in a row, though the magnitude was considerably less than last month.

-

Moldmaking Activity Contraction Slows in August

Future business expectations still improving, but more slowly.

.jpg;width=70;height=70;mode=crop)