Moldmaking Index Advances as Components Move Towards ‘Normal’ Levels

The Moldmaking Index signals decelerating contraction as all components report improved readings.

The Gardner Business Index (GBI): Moldmaking registered an 11-point improvement over April’s all-time low reading to end May at 41.6. For the first time since the government curtailed normal business operations to prevent the spread of COVID-19, all components of the Index moved towards more ‘normal’ levels. Excluding supplier deliveries, all components moved higher from their prior month readings although each remained below a reading of 50. This situation signals that the industry is experiencing a slowing contraction, meaning that while conditions deteriorated further in the most recent month they did so at a slowing rate compared to the prior month.

The Moldmaking Index moved more than 11 points higher in May. Readings for new orders, production, exports, backlogs and exports along with a decline in the supplier deliveries reading were welcomed news as they indicate a turn towards more typical business conditions.

For a second month the supplier delivery reading fell. By the nature of how this question is asked, quickening supplier deliveries lower the Index’s reading. Quickening deliveries may provide the first evidence that upstream suppliers are moving toward more normal operations after experiencing significant disruptions in recent months. The resumption of deliveries appears to be coming with an additional cost to it as the May results reported a growing proportion of moldmakers reporting higher material prices. The ability of moldmakers to pass along their own prices increases was more tepid.

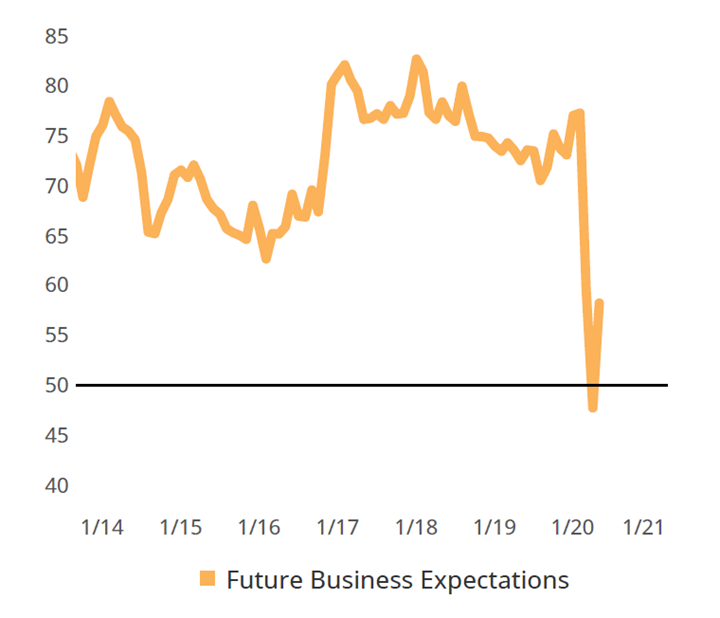

As business activity components made their first moves towards a recovery economy in May, business sentiment within the industry also improved. Business sentiments increased by 14-points, bringing sentiment back to the levels experienced in 2015 and 2016.

The improvement in the Index’s components pushed business sentiment back towards levels last experienced during the slow-growth period of 2015 and 2016. Prior to the COVID-19 crisis, the business sentiment reading had never registered below 50.0.

Related Content

-

Moldmaking Activity Begins 2024 With Slowed Contraction

January index reading reflects February-March 2023 readings as it slinks toward a reading of 50. There are high hopes that it may continue on this path to sustained expansion for 2024.

-

Moldmaking Accelerated Contraction in June

June’s moldmaking index took a relatively steep downward turn, landing at a new low for the year.

-

May Moldmaking Index Trends Downward

Contraction, experienced by most May components, continues to be familiar territory for the GBI: Moldmaking Index.

.jpg;width=70;height=70;mode=crop)