Mold Business Index: A One-Year Retrospective

Since this is the month of our annual directory issue, we thought it would be interesting to offer a one-year review of our Mold Business Index (MBI).

Share

Read Next

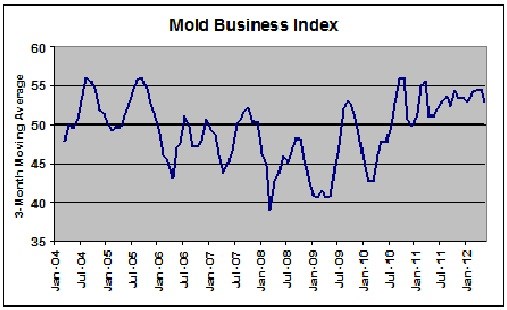

Since this is the month of our annual directory issue, we thought it would be interesting to offer a one-year review of our Mold Business Index (MBI). You have likely seen the reports on the MBI that run as a regular column each month in this magazine. But in case you are not familiar with our Index, here is a brief explanation. Each month we survey our North American readers and ask them ten questions about the changes in pertinent business conditions they experienced during the past month. The results of this survey are aggregated and then used to calculate an index with a base of 50. An index value above 50 means that the combined responses indicated an increase during the preceding month, while a value below 50 indicates that the combined answers decreased in the past weeks.

Starting with July, 2011, here is how the MBI has looked for the past twelve months.

Total MBI--The overall MBI is a weighted average of the answers to the first five questions of the survey. These questions pertain to the changes in new orders, production levels, the number of employees, backlogs, and export orders).

For the first time in its history, the total MBI stayed at or above the 50-level in every single month during the past year. To be accurate, this was not the strongest 12-month period in terms of the total number of molds produced by the industry over a one-year stretch. But in terms of percentage growth, this past year was one of the best we have enjoyed for a long time. Market conditions could certainly be better, but for the most part the situation steadily improved in the past year.

New Orders—We consider the New Orders component to be the most important part of the total MBI. It is a good indicator for not only the trends in market demand for new molds, but it is also a leading indicator of market demand for new injection molding machinery. New molds represent a large capital expenditure, and demand for new molds tends to increase after a sustained period of rising demand for plastics parts. The same can be said about the market for new machines.

During the past year, the New Orders component of our Index fell below the 50-line only twice (November and May). This indicates that, like the expansion in the overall U.S. economy, the market demand for molds experienced brief periods of consolidation (you hear the term “fits and starts” frequently used), but the longer-term trend was one of gradual, moderate growth. We expect this pattern to continue for the next twelve months.

Number of Employees—For the past two years, the Employment component of our MBI has been well above the 50-line. This indicates that the total payroll for the North American mold making industry has expanded during this time. Survey respondents regularly report that there is a shortage of qualified workers to fill the existing job openings. In fact, this is regularly cited as one of the biggest threats to the future of the industry.

Supplier Delivery Times and Materials Prices—Our questions concerning the supply conditions for mold makers have been unequivocally negative in the past year. Simply stated, Supplier Delivery Times are steadily getting longer, and Materials Prices are sharply higher. Exacerbating these problems is the fact that there is increasing pressure from the customers of mold makers to lower the price of molds and shorten their leadtimes. Thus, mold makers have spent the past year in a vice between slower, more expensive suppliers and increasingly demanding customers. The only remedy to these pressures is greater productivity. And whether moldmakers gain this productivity by working harder, working smarter, or investing in better equipment, it is unlikely that these pressures will abate anytime soon.

Mold Prices—Fortunately, there has been some relief in the past year from the downward pressure on mold prices. Our survey indicates that overall mold prices have actually been flat-to-higher during this time. The improvement in mold prices has not been as rapid as the rise in the cost of materials, so margins are far from fully recovered. But from a historical perspective, this past year has been the best twelve-month span in the Mold Price index since 2005.

Future Expectations—Our last survey question each month asks mold makers what their expectations are for the coming year. Experience teaches us that mold makers are by in large an optimistic bunch. Only in once in its history, during the depths of the past Great Recession, has this index ever dipped below the 50-level. In the past year, our Future Expectations index rose to its pre-recession peak. It has slipped a bit in recent months, but it is still quite high.

For what it’s worth, I agree with the respondents’ current expectations of the future: the next twelve months will bring further improvements in both economic growth and business conditions for mold makers providing the policymakers in Congress and over in Europe do not screw things up.

Caption: After a long period of market decline, business conditions for North American mold makers improved in the past year. The market is coming out of a deep hole, so there is much work yet to be done. But at least we have started moving in the right direction. The rate of expansion in the overall U.S. economy must accelerate if we are to sustain the momentum in the mold industry, and this is taking much longer than we would like. We believe that the most likely outcome is that market conditions for all North American manufacturers will continue to improve gradually in the coming year.

Read Next

Are You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More