Little Change in Overall Moldmaking Activity Levels

Mold Business Index May 2005

Activity levels for North American moldmakers were little changed in recent weeks. Based on the latest survey for our Mold Business Index (MBI), the MBI value for April is 51.2. This represents a modest 0.9 percentage point decrease from the March value of 52.1. The Production and Employment sub-indices both advanced in the latest month while most of the other components were steady. On the down side, there was another strong rise in Materials Prices, and Backlogs were a bit shorter. The Future Expectations sub-index backed off to a cautiously optimistic value of 67.9.

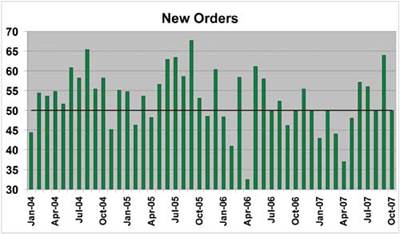

The latest sub-index value for New Orders of molds is 48.2, which means that the number of new orders was steady-to-down when compared with the previous month. The predominant trend in the new orders data in recent months has been a gradual rise, and continued improvement in this component is necessary to generate consistent gains in the other components. Production activity in April increased, as the latest Production sub-index is a solid 60.7.

The Employment component for April is 55.4, which indicates that the total number of workers in the industry increased moderately in recent weeks. The industry’s total backlog was again steady-to-down, as the April Backlog sub-index is 44.6. The number of offshore orders for new molds did not change last month. The Export Orders sub-index is exactly 50.0.

The Mold Prices sub-index for April is 46.4. This means that prices for new molds were flat-to-down last month. The prices paid for materials continue to rise, as the latest sub-index for Materials Prices came in at a discouraging 76.8. Supplier Delivery Times held mostly steady, with this sub-index posting a value of 48.2 in the latest month.

|

April 2005

|

|||||

|

% |

% Equal |

% Negative |

Net % Difference |

Sub-Index

|

|

| New Orders | 29 | 39 | 32 | -3 | 48.2 |

| Production | 32 | 57 | 11 | 21 | 60.7 |

| Employment | 18 | 75 | 7 | 11 | 55.4 |

| Backlog | 18 | 53 | 29 | -11 | 44.6 |

| Export Orders | 0 | 100 | 0 | 0 | 50.0 |

| Supplier Deliveries | 0 | 96 | 4 | -4 | 48.2 |

| Materials Prices | 54 | 46 | 0 | 54 | 76.8 |

| Mold Prices | 11 | 71 | 18 | -7 | 46.4 |

| Future Expectations | 39 | 57 | 4 | 35 | 67.9 |

|

Total Mold Business Index for April 2005: 51.2 The total Mold Business Index is a weighted average of the Sub-Indices for new orders, production, employees, backlog, exports and supplier deliveries. |

|||||

The Future Expectations sub-index for April indicates that moldmakers remain optimistic, but not to the degree that they have been. The latest value is a relatively subdued 67.9. This ebbing of optimism was matched by a small, but noticeable decrease in the reported aggregate capital investment plans for the future.

Foreign competition remained as the most-cited problem that currently plagues the moldmaking industry. Other problems include the soaring costs of materials, healthcare and energy; less favorable payment terms; demand for fast deliveries; and ill-conceived U.S. trade policies.

Our forecast calls for gradually rising activity in the plastics manufacturing and tooling industries throughout the remainder of 2005. This will result in a continuation of the overall trend in the MBI data, which has registered a gradual, but steady gain. Plastics processors are still in a cyclical upturn in spending on new capital equipment. And the continued rise in overall spending on industrial equipment in the U.S. indicates that the demand for new molds will remain in a gradual uptrend for the foreseeable future. Most of the major economic indicators suggest that plastics manufacturing levels in the U.S. increased moderately in recent weeks, and the U.S. economy’s crucial leading indicators are still in a sustainable growth phase.

This means that our Injection Molding Business Index will continue to expand during the next few quarters. Following a gain of 3 percent in 2004, this Index is forecast to increase 5 percent in 2005. Consistent gains in the MBI depend on sustained growth of 4 to 5 percent in the output of injection molded products. The trend in the moldmaking industry also lags the trend in the processing sector by about six months. So as demand for molded products expands in the coming months, orders for new molds will continue to rise.

*The Mold Business Index is based on a monthly survey of North American moldmakers. Mountaintop Economics & Research, Inc. conducts the survey, and then calculates a diffusion index based on 50.0. A value above 50.0 for the MBI indicates that business activity expanded in the previous month, while a value below 50.0 means that business levels declined.

Related Content

MMT Chats: Solving Schedule and Capacity Challenges With ERP

For this MMT Chat, my guests hail from Omega Tool of Menomonee Falls, Wisconsin, who share their journey with using enterprise resource planning (ERP)—and their people—to solve their schedule and capacity load monitoring challenges.

Read MoreTackling a Mold Designer Shortage

Survey findings reveal a shortage of skilled mold designers and engineers in the moldmaking community, calling for intervention through educational programs and exploration of training alternatives while seeking input from those who have addressed the issue successfully.

Read MoreThink Safety: Eliminate Hazards Throughout the Shop

The tooling community is taking advantage of new products for safer mold shops and molding facilities.

Read MoreEditorial Guidelines: Editorial Advisory Board

The Editorial Advisory Board of MoldMaking Technology is made up of authorities with expertise within their respective business, industry, technology and profession. Their role is to advise on timely issues, trends, advances in the field, offer editorial thought and direction, review and comment on specific articles and generally act as a sounding board and a conscience for the publication.

Read MoreRead Next

Are You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read More