Electronics and Automotive

Electronics could see stronger growth, while automotive production likely to slow in 2016.

Electronics Industry Could See Spurt of Stronger Growth

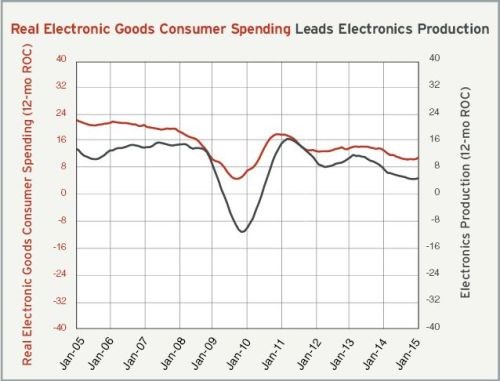

Consumer spending on electronics has seen steadily slowing growth since late 1999, and electronics production has generally followed suit. However, the industry could see a spurt in growth in the second half of 2015.

The rate of growth in real disposable income has been accelerating rapidly and is growing at the fastest rate in almost eight years. In response, consumer spending on electronics has grown at an accelerating rate since the end of 2014. This accelerating growth rate has not been enough to break out of the downward trend since 1999, but at least it is positive in the short term. As long as incomes continue to grow faster, then so should electronics spending.

Electronics production has seen its growth slow even faster than electronics spending. This could be because of an increase in imports, but world trade has generally slowed in the last year, so electronics production could be poised for accelerating growth as we head into 2016.

Growth in Automotive Production Likely to Slow into 2016

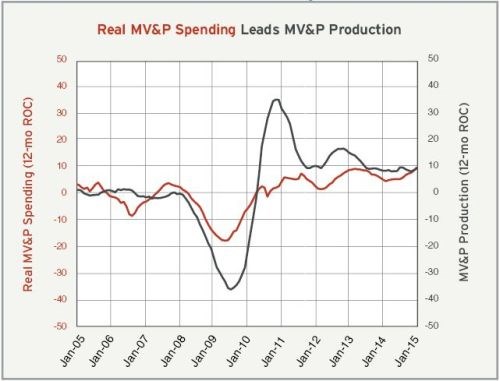

The automotive industry has been fairly strong since 2010. Interest rates were low and incomes improving, which spurred spending on motor vehicles and parts. Later this year and into 2016, however, the industry is likely to see its slowest growth since 2010. Let’s take a look at the leading indicators to see why that’s the case.

In May 2015, real motor vehicle and parts spending was at its highest level since July 2005 and at its third-highest level ever. Since 2010, despite some ups and downs, the annual growth rate in spending has generally accelerated. This year, the annual rate of change has grown at a rate of about 8.5 percent, which was the fastest rate of growth in spending since late 2002 and more than double the historical average.

While all the spending numbers are quite positive, the trend within the spending data indicates it is likely to grow at a slower rate in the near term. The one-month rate of change in each of the last four months has been slower than any of the previous nine months. So the annual rate of growth is likely to slow to at least 5.0 percent in the next five months. That’s not bad, but it is much closer to the historical average than the rate of growth the industry has seen the last couple of years.

Of course, production tends to lag spending, typically, by zero to six months. So, if the industry is entering a period of slower growth in spending, then motor vehicle and part production should see slower growth in 2016. Growth in production also is likely to slow because, since 2010, it has been well above the rate of growth in spending (see chart). In fact, the industry has almost never seen the two growth curves so far apart. Some of this difference is due to the severe contraction in production in 2009, which made the rebound in production in 2010 even greater. However, the early 1980s saw a similar contraction in automotive production without the significant difference in growth between spending and production in that recovery.

Related Content

Making Mentoring Work | MMT Chat Part 2

Three of the TK Mold and Engineering team in Romeo, Michigan join me for Part 2 of this MMT Chat on mentorship by sharing how the AMBA’s Meet a Mentor Program works, lessons learned (and applied) and the way your shop can join this effort.

Read MoreThe Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

Read MoreEditorial Guidelines: Editorial Advisory Board

The Editorial Advisory Board of MoldMaking Technology is made up of authorities with expertise within their respective business, industry, technology and profession. Their role is to advise on timely issues, trends, advances in the field, offer editorial thought and direction, review and comment on specific articles and generally act as a sounding board and a conscience for the publication.

Read MoreTop 10 Topics to Cover During an ISO 9001 Manufacturing Audit

Take a look at this practical hands-on approach to conducting a quality audit.

Read MoreRead Next

Are You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More

.JPG;width=70;height=70;mode=crop)