COVID-19 Is a Rallying Call to the Plastics Industry to Redesign, Refocus and Reshore

Mold manufacturers who have been critiqued for slow lead times, as compared to the overseas competition, are proving to themselves and customers during COVID-19 that North American mold manufacturers and suppliers can unite and do things at an extraordinary speed.

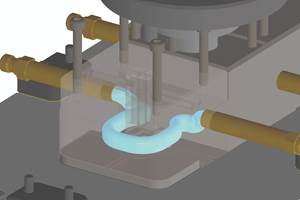

integrated supply chain solution

The North American mold manufacturing industry should be very proud of the speed at which it is operating during this crisis. Mold component and hot runner suppliers are delivering products to mold builders next day, and mold builders are completing five-, six-, eight-, 10-week jobs in 10 days from quote to mold to press.

Let me back up. This crisis revealed that there was a pent-up demand for some of the much-needed medical products, such as ventilators, but instead of being ahead of the curve as a nation, we had to react. The lesson here is that industry needs to better understand the supply chain and the needs of customers. Mold builders must start to explain to their OEM and molder customers that they are capable of doing the work, and then must direct resources to improve internal processes and efficiency.

DME President Peter Smith explained that there are 12 manufacturers of ventilators in North America, so when the virus hit DME began reaching out through the supply chain to understand who was supplying those 12 and what they could do to help. They went direct to the OEM, but most often spoke with customers. Through these conversations, Smith discovered a solution that would help build these urgently-needed molds and provide a strategy for North American mold builders to be cost-competitive with overseas tooling.

“North American mold manufacturing has the engineering prowess to deliver a mold at a lower cost than an overseas mold simply because extra freight will always be a factor. We are close to the customer.”

This brings up the importance of reshoring. The supply chain gets caught up with tooling costs instead of focusing on the final part cost, which would prove that North America is a more viable source. “A mold that performs better during process will always beat the initial price of the tool. The economics of the tool are relatively minor to the ultimate value through the lifecycle of the production,” DME President Peter Smith says.

Moldmakers need to put more pressure on their suppliers to give them the tools so they can compete and do what they can do. For example, quick mold change. “Although this is a 25- to 30-year-old concept, it still speaks to economics today. It is an inexpensive option because you basically drop in an insert, which means every time a change is necessary, a molder only needs to work on the insert side of things, which is exactly what the molder wants to do,” Smith says.

In comes, the newly expanded, simplified, standard MUD® Quick-Change mold base system. “Our part in all of this is guiding customers to standard sizes. Teaching designers that if they can operate within a certain footprint and do a slight mold design change, we can deliver next day. Many companies responded. Mold designers began to understand the flexibility they had in the supply chain,’ Smith says.

The revamped MUD line is an integrated supply chain solution that allows OEMs to work on faster delivery times, reduced supply chain economics, and lower upfront tooling investment. This is a way of bringing North American production into play.

Smith calls this modular standardization, which allows DME to be efficient in its operations and manufacturing, which they can then pass that same value through the supply chain. They help customers build around modular systems that are easy to maintain and offer high-productivity output. Basically, DME is delivering from a speed and cost perspective because they didn't make the solution sophisticated; they kept it simple and modular.

This is DME’s tool to help build North American mold manufacturing. “Our three deliverables to compete with overseas tooling are (1) redesign, so tooling costs are lower than China, (2) deliver faster, and (3) provide more productivity through the processing phase. This works for the majority of mold sizes used in North America.

This expanded, simplified, standardized MUD line for moldmakers will ultimately allow them to push the benefits to the molder, and then ultimately to the OEM where they can benefit from shorter run sizes and more customization.

DME saw a 400-percent boost in demand for its next-day delivery mold base and MUD Quick Change Systems that went out in two weeks.

Related Content

How to Supply Cooling to Additive Tooling

Additive tooling provides limitless options for cooling a mold’s difficult-to-cool areas.

Read MoreHow to Successfully Reshore Tooling

Sloan Valve and Pyramid Molding Group shed light on the dynamics and challenges surrounding the shift toward domestic mold sourcing and the advantages of collaborating with a U.S. supplier to bring tooling back stateside.

Read MorePrecision Micro Finishing Tools Supply Machine, Mold and Die Operations

Titan Tool Supply has made available 100+ products for immediate online order or shipment from stock, supporting advanced manufacturing requirements.

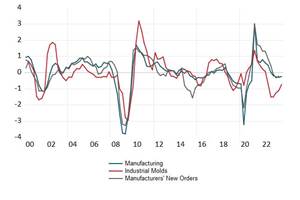

Read MoreNavigating Economic Resilience and Consumer Trends

Consumer behavior provides mold builders insight into the evolving market dynamics of goods and services that helps strategic planning.

Read MoreRead Next

Are You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read More