Consumer Products and Automotive

Spending on molds correlates with industrial production of consumer goods.

Consumer Goods Production Growing Faster

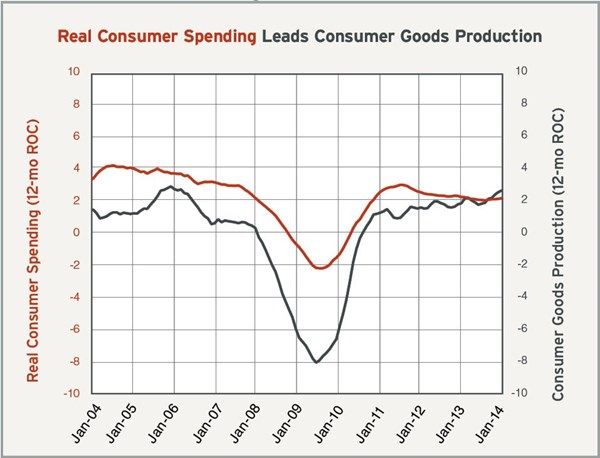

Spending on molds correlates with industrial production of consumer goods. Since February, consumer goods industry prospects for moldmakers have improved. At the time of our last update, consumer goods production was growing at annual rate of roughly 2 percent. In the last three months, that annual rate of change has increased to 2.5 percent, its fastest rate of growth since January 2006. Based on recent month-over-month growth rates, the annual rate of change should continue to accelerate to 3.5 percent over the next quarter, and this should spur production of and spending on molds.

However, the potential growth in consumer goods production may be somewhat limited by the relative weakness in consumer goods spending. Since July 2012, annual growth in real consumer spending has been stuck in the narrow range of 1.9 to 2.2 percent. This is significantly below the historical average of 3.3 percent. While growth in real consumer spending may tick up to 2.2 or 2.3 percent in the coming months, it doesn’t appear that it will grow much faster than that. The primary reason for this is that real disposable income, its best leading indicator, is at its slowest rate in the last four years. Therefore, unless growth in disposable income picks up significantly, real consumer spending growth should remain relatively flat. This would lead to slower growth in consumer goods production and reduced spending on molds for consumer goods.

Motor Vehicle and Parts Production Still Strong

In January, we reported that the then-latest reading (October 2013) for motor vehicle and parts production had hit an all-time high. The good news is that production remains near that all-time high with a February reading of 116.5; however, the rate of growth in production continues to slow. Since November 2012, the annual rate of growth in motor vehicle and parts production has fallen from 18.1 to 6.5 percent. This rate of growth is historically quite high, but it is the slowest rate since the industry began growing again after the 2008 financial collapse. This slowing growth in production is a direct result of the slowing rate of growth in consumer spending on motor vehicles and parts, which is approaching its lowest level since the end of 2010.

Other indicators are pointing to continued strength in the automotive industry. Our automotive business index has grown for 10 consecutive months, and the rate of growth has increased substantially in the first quarter of 2014. In fact, the automotive business index shows that the industry is growing at its fastest rate since March 2012. Most importantly, backlogs are growing again for the first time since October 2013. The annual rate of change in backlogs has been growing at a significantly accelerating rate, indicating that capacity utilization in the automotive industry, and therefore spending on molds, should increase at an accelerating rate.

You can see all of our data related to the automotive industry at gardnerweb.com/forecast/mvp.htm.

Related Content

-

MMT Chats: Digitalizing Mold Lifecycle and Process Performance

MMT catches up with Editorial Advisory Board member Bob VanCoillie senior manager of Kenvue’s mold management center of excellence outside of Philadelphia to discuss mold management via tooling digitalization and OEM expectations and opportunities.

-

Domestic Collaboration Yields Efficiency and Budget Gains For Innovative Tooling Project

Pyramid Molding Group and Lettuce Grow partner to develop optimal tooling for a compact Hydroponic Farmstand.

-

Hammonton Mold, ADOP France Forge Strategic Partnership in Injection Blow Moldmaking

Hammonton Mold Inc., a leading full-service mold shop based in New Jersey specializing in injection blow molds (IBM), proudly announces its official partnership with ADOP France, a prominent IBM mold manufacturer based in Normandy, France.

.JPG;width=70;height=70;mode=crop)