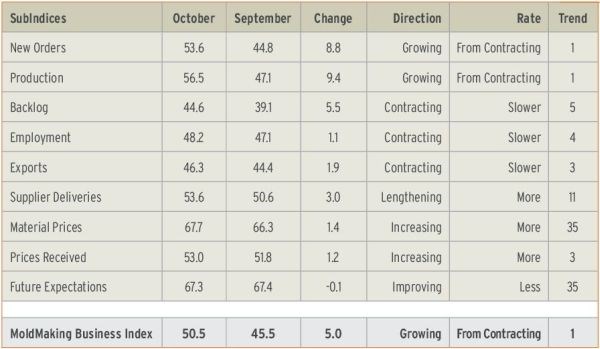

With a reading of 50.5, the MoldMaking Business Index showed that the industry returned to growth in October after contracting significantly the previous month. The index had been in a steady and steep decline since May, but October’s results broke that downtrend. Compared to one year ago, the index contracted for the second month in a row, however the rate of month-over-month contraction was just 0.2 percent. The annual rate of growth has decelerated for two months but is still growing at a fairly significant rate.

New orders rebounded sharply in October and were growing at a rate similar to June and July. Production also made a sharp rebound, growing at its fastest rate since June. Backlogs have contracted for five straight months, but the index grew noticeably compared to September. Compared to one year earlier, the backlog index contracted for the second month in a row, although the annual rate of growth was still very strong.

Based on the trends in backlogs, capacity utilization should continue to increase into the second quarter of 2015, indicating increased capital spending by the moldmaking industry next year. Employment contracted for the fourth month in a row in October, but at a slightly slower rate than in September. Exports contracted for the fourth time in five months, as the dollar has strengthened in recent months. Supplier deliveries lengthened at a faster rate in the month.

Material prices increased at an accelerating rate in both September and October, and the material price index was near its highest level since February 2013. Prices received have grown at an accelerating rate the previous three months, and were increasing at their fastest rate since January. Future business expectations held steady in October.

Plants with more than 100 employees contracted for the first time in 2014, while facilities with 20-49 employees rebounded significantly in October, jumping from an index of 44.8 to 57.9. Companies with 1-19 employees showed significant improvement in the month, contracting at their slowest rate since May.

Custom processors contracted for the second month in a row, however the rate of contraction slowed markedly in October. After two months of contraction, metalcutting job shops expanded at their fastest rate since November 2013.

The North Central–East was the only region to grow in October, with an index higher than 60.0. This was likely due to the strength of the automotive industry.

Future capital spending plans for the next 12 months were up 2.4 percent compared to last October. This was the second consecutive month that the month-over-month rate of change increased. The annual rate of growth accelerated and has been higher than 15.0 percent three of the last five months.

Related Content

-

The Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

-

OEE Monitoring System Addresses Root Cause of Machine Downtime

Unique sensor and patent-pending algorithm of the Amper machine analytics system measures current draw to quickly and inexpensively inform manufacturers which machines are down and why.

-

Editorial Guidelines: Editorial Advisory Board

The Editorial Advisory Board of MoldMaking Technology is made up of authorities with expertise within their respective business, industry, technology and profession. Their role is to advise on timely issues, trends, advances in the field, offer editorial thought and direction, review and comment on specific articles and generally act as a sounding board and a conscience for the publication.

.JPG;width=70;height=70;mode=crop)