Steel Update: The Rising Cost of Steel

Structural change in the steel industry will change pricing patterns for moldmakers in the next several years.

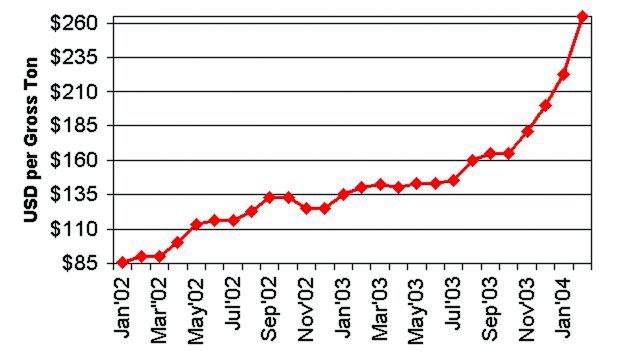

| U.S. and global steel prices have soared in the past months, far beyond levels that anyone inside or outside of the steel industry forecasted last November and December. The purpose of this article is to explain the primary causes of the sudden increase in prices and to provide some insight into the future direction of prices based on an understanding of long-term factors. Hopefully, this information will be helpful to those moldmakers with regard to planning for the short and long term.

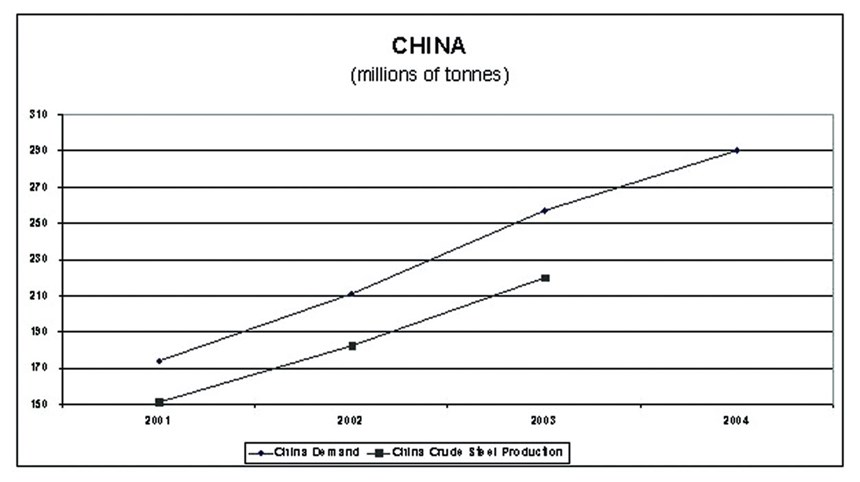

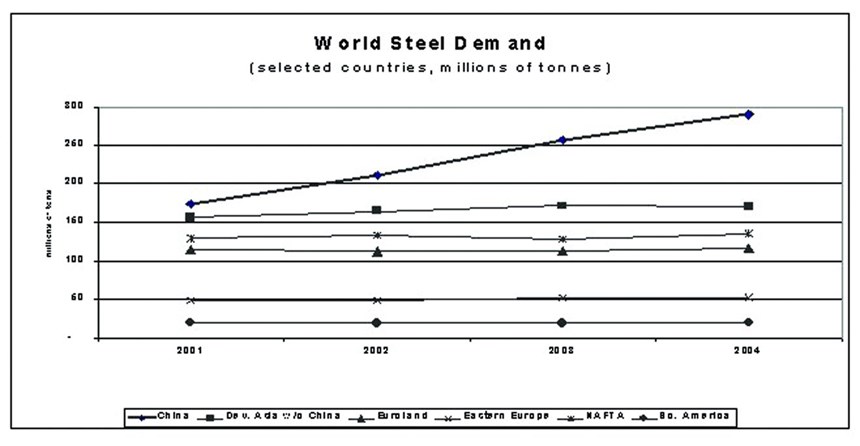

Cause #1: Chinese ConsumptionIt is fairly well known that the primary cause of the increase in global prices has been a rapid increase in steel consumption in China. Figure 1 demonstrates how dramatic this increase is, showing world steel demand over the past few years. The basic message of this graph is that nearly all of the world's increase in consumption has occurred in China; for the rest of the world, steel consumption has been flat. This graph could be taken back even farther and still have the same picture. Since 1997, China has increased consumption from about 100 million tons to around 260 million tons in 2003. This is nearly double the U.S. consumption based on the 2003 figures. It is too early to know for sure how 2004 will finish, but most analysts estimate that China's total consumption will be at least in the area of about 290 million tons. At the same time China's steel making capacity has also increased, but not as fast as the increase in consumption. Figure 2 shows China's steel making capacity compared to its consumption.

Cause #2: Raw Material ShortagesScrap Iron Ore Coke Cause and Effect

The other impact from these shortages is supply and demand. The global steel market has shifted in favor of the supplier. However, the shortages of scrap, iron ore and coke have had the effect of taking capacity out of the market. Most steel companies are not capable of running at full capacity. They are losing production turns due to shortages. Cause #3: Shipping Cause #4: Global Pressure It is true that China is planning to increase its own steel making capacity. The Chinese government recently announced that it plans to add 120 million tons of steel making capacity in the next few years. The key point is that even if it adds the capacity it will not solve the problem. There are not enough raw materials to go around; therefore, additional capacity will only add to the problem, not solve it. The Chinese impact on supply and demand is likely to last for several years to come. Based on the understanding of the world supply and demand situation, it is difficult to see prices retreating a great deal. We will probably see prices level off and plateau soon and they are likely to retreat some time in the second half of this year. However, they are not likely to drop a great deal as they have in the past. A 20 percent drop in prices may be likely, but it is just as likely that prices will rebound shortly thereafter, maybe not to current levels but not very far from them either. We can conclude this discussion with a few thoughts. If we accept the premise that the market dynamics on a global basis has changed, how does a steel consumer move forward? The best strategy for the future, for steel consumers, is to work to establish a relationship with a steel supplier. A real old- fashioned relationship where companies work together to solve problems and look for ways to work together that are in the best interest of both parties. For the past several years, these kinds of relationships seem to have gone out of style and were replaced by an adversarial system designed to drive down prices to the lowest point possible. This will be unsuccessful in the future and consumers must reconsider their options.

|

||||

MoldMaking Technology Onlin

Related Content

Editorial Guidelines: Editorial Advisory Board

The Editorial Advisory Board of MoldMaking Technology is made up of authorities with expertise within their respective business, industry, technology and profession. Their role is to advise on timely issues, trends, advances in the field, offer editorial thought and direction, review and comment on specific articles and generally act as a sounding board and a conscience for the publication.

Read MoreTackling a Mold Designer Shortage

Survey findings reveal a shortage of skilled mold designers and engineers in the moldmaking community, calling for intervention through educational programs and exploration of training alternatives while seeking input from those who have addressed the issue successfully.

Read MoreDynamic Tool Corporation – Creating the Team to Move Moldmaking Into the Future

For 40+ years, Dynamic Tool Corp. has offered precision tooling, emphasizing education, mentoring and innovation. The company is committed to excellence, integrity, safety and customer service, as well as inspiring growth and quality in manufacturing.

Read MoreMMT Chats: Solving Schedule and Capacity Challenges With ERP

For this MMT Chat, my guests hail from Omega Tool of Menomonee Falls, Wisconsin, who share their journey with using enterprise resource planning (ERP)—and their people—to solve their schedule and capacity load monitoring challenges.

Read MoreRead Next

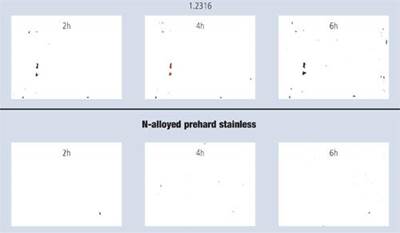

Prehardened Stainless Mold Steel Optimized by Nitrogen Alloying

To prevent the negative effects of microstructural inhomogenities in some tool steel—such as on machinability, polishability, corrosion resistance and mechanical properties—a new alloy has been created with a more homogeneous microstructure.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More