Mold Industry Continues to Slip

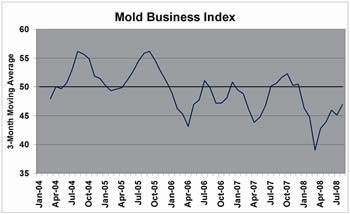

46.7 Total Mold Business Index for September 2008 The total Mold Business Index is a weighted average of the sub-indices for new orders, production, employees, backlog, exports and supplier deliveries.

The MBI for September is 46.7. This is a 3.8-percentage point decrease from the August value of 50.5. The Employment and Backlog components registered steady readings, while declines were reported in the other sub-indices. The persistent rise in the costs of steel and resins kept the Materials Prices component elevated. This sub-index is not included in the overall calculation of our MBI, so the rising prices of materials does not push the Index value higher and is not interpreted as positive news. The Future Expectations component escalated to 73.9.

The latest data from our Mold Business Index (MBI) survey indicates that the mold industry continues to slip, but it is not entirely without reasons for hope and optimism. There is little doubt now that the U.S. economy is in a recession; however, most indicators of business activity continue to perform better than in previous downturns. Overall economic growth will be flat-to-negative for the remainder of the year, but we remain confident that the underlying fundamentals for manufacturers will gradually improve during the early months of 2009.

The data from the plastics industry have been in a downtrend so far this year, and it appears that the downward trajectory will gain momentum as 2008 comes to an end. The good news is that the levels of plastics manufacturing activity remain higher than they were during the last recession. Our Injection Molding Business Index is down 6% for the year-to-date. The Index is expected to hit a cyclical bottom in the fourth quarter of this year, and then it will start posting monthly gains in the first half of 2009. This means that demand for plastics products, as well as new molds and tooling, are near their cyclical bottoms and will gradually increase in 2009.

The sub-index for New Orders of molds was 45.7 in September, indicating that new business levels were moderately lower for the month. Production levels were also lower, as the latest Production sub-index was 43.5. The Employment component was 50.0, which means that there was no net change in overall payrolls last month. There was no reported change in the industry’s backlogs, as the Backlog component was 50.0 in September.

The Mold Prices sub-index for the latest month was 47.8. This was another improvement over the previous month, and it suggests that the prices received for new molds are stabilizing. The prices paid for materials increased once again, but the data indicate that the prices are starting to level off. The latest sub-index for Materials Prices was 67.4. Supplier Delivery Times were moderately slower, as this sub-index posted a value of 43.5. There was no significant change in the number of offshore orders for new molds, as the Export Orders sub-index was 47.8.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Related Content

Think Safety: Eliminate Hazards Throughout the Shop

The tooling community is taking advantage of new products for safer mold shops and molding facilities.

Read MoreMaking Mentoring Work | MMT Chat Part 2

Three of the TK Mold and Engineering team in Romeo, Michigan join me for Part 2 of this MMT Chat on mentorship by sharing how the AMBA’s Meet a Mentor Program works, lessons learned (and applied) and the way your shop can join this effort.

Read MoreThe Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

Read MoreTop 10 Topics to Cover During an ISO 9001 Manufacturing Audit

Take a look at this practical hands-on approach to conducting a quality audit.

Read MoreRead Next

Mold Industry Bending, But Not Breaking

50.5 Total Mold Business Index for August 2008 The total Mold Business Index is a weighted average of the sub-indices for new orders, production, employees, backlog, exports and supplier deliveries.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More