By the Numbers: Total MBI for March 2015: 49.6

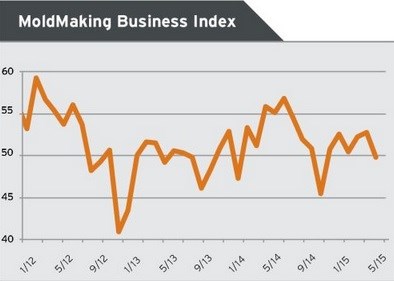

With a reading of 49.6, the Gardner Business Index showed that the moldmaking industry contracted very slightly in March for the first time in six months.

With a reading of 49.6, the Gardner Business Index showed that the moldmaking industry contracted very slightly in March for the first time in six months. Since January 2014, the industry has expanded in all but two months, but compared with one year earlier, the industry has contracted two of the last three months. In March, this contraction was more than 10 percent compared with March 2014. That was the fastest rate of month-over-month contraction since April 2013. The industry continued to grow on an annual basis, however.

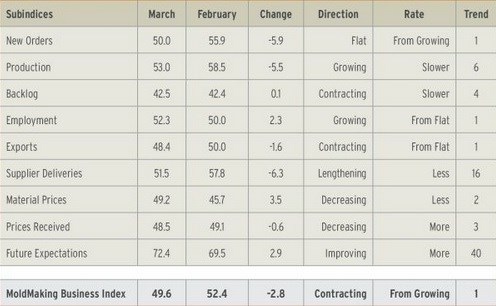

New orders were flat for the second time in four months, but these flat months have been offset by strong growth in new orders in the other months. Production increased for the sixth straight month, and, while there have been significant ups and downs, the production index has generally trended up since last July. The backlog index, however, has fallen considerably since November, although it was slightly higher in March than in February. Compared with one year earlier, backlogs contracted at an accelerating rate in both months. The trend in backlogs indicates that capacity utilization has hit a peak in this cycle. Employment increased for the third time in five months—a trend that has been improving since September—and that index was at its highest level since June 2014. Exports have contracted two of the previous three months, while supplier deliveries lengthened at a significantly slower rate in March. In fact, it was the slowest rate since September.

Material prices decreased for the second month in a row. February and March were the only two months since the survey began that material prices decreased. Prices received contracted slightly for three consecutive months. Future business expectations improved noticeably in March, with that index reaching its highest level since last June, and expectations have been above their historical average for five straight months.

Plants with 100-249 employees continued to grow in March, while facilities with 19 employees or fewer contracted for the fourth month in a row. The overall index changed because of the dramatic decline in the index for facilities with 20-49 employ-

ees. In March, this index fell to 49.0 from 60.9. March was the first month of contraction for these facilities since September.

Custom processors expanded for the fifth month in a row, while metalcutting job shops contracted for the second time in four months. However, metalcutting job shops have been generally expanding since November 2013.

.JPG;width=70;height=70;mode=crop)