Additive Fabrication Creates New Markets for Investment Casting

The development of production-quality direct patterns is changing the cost structure of investment casting.

One of the oldest manufacturing methods known to man, investment casting has been in use for more than 5,000 years. Today, millions of castings are created every year in a wide range of alloys, shapes and sizes.

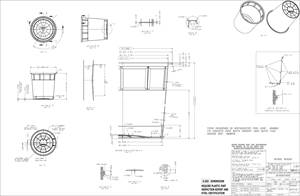

The process is straightforward: a wax pattern in the shape of the desired casting is dipped into a ceramic slurry and coated with a refractory sand several times to build up a ceramic shell. The shell is then heated to melt out the wax pattern leaving a ceramic shell, which will act as a mold for the casting. The shell is fired to harden the ceramic and molten metal is poured into it. Once the metal has solidified, the shell is cracked off to retrieve the casting.

Investment casting offers several advantages over other metal manufacturing processes. It provides good surface finish, can deal with geometric complexity that would be difficult or impossible to create with other manufacturing methods and can be used with nearly any castable alloy.

Like the injection molding process, a tool is required to create castings. Wax patterns are created in a mold, typically called a wax pattern die, very similar to an injection mold. And, like injection molding, the cost and time required to create the tooling limit the range of production volumes for which the process is feasible. For projects with small volumes of castings, the cost of tooling usually cannot be justified and a lower cost method is used.

For more than a decade, various rapid prototyping technologies have been used to create prototype patterns for investment casting. Such patterns are often referred to as direct patterns (patterns created directly without the use of tooling).

While the cost of a direct pattern is significantly higher than the cost of a molded wax pattern, no tooling is required and patterns can generally be obtained within a few days. As a result, the use of direct patterns for prototype castings has seen widespread acceptance in the industry and virtually every investment foundry creates prototype castings in this manner.

Direct Pattern Technology

While several rapid prototyping technologies can be used to make direct patterns, just four technologies are responsible for more than 99 percent of such patterns created each year. Those four include:

1. Stereolithography—the SL process is used to make hollow parts with an internal hexagonal rib structure called direct patterns. They are built hollow to allow the pattern to collapse internally as it heats up instead of expanding and cracking the relatively fragile shell. In addition, the hollow structure significantly reduces the amount of material that must be removed from the shell significantly. Since SL resins are thermoset materials and will not melt like wax, they must be burned out of the shell.

2. Thermojet—This now discontinued system builds parts using inkjet printing technology to deposit droplets of molten wax. Because the parts are wax, they process very much like the wax patterns investment foundries use every day, making processing them very easy to cast.

3. Laser Sintering—LS systems can build patterns using a polystyrene powder. Since the resulting part is somewhat porous, the pattern is typically dipped in wax to seal the pattern for use as an investment casting pattern. LS patterns must be burned out of the shell to evacuate.

4. SolidScape—Another process that uses inkjet printing technology to build wax parts, the Solidscape system can build small, highly detailed and accurate parts. Solidscape systems are widely used to create patterns for jewelry.

Advantages

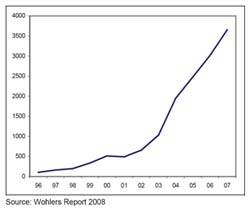

Initially limitations in both accuracy and surface finish of direct patterns limited their use to prototype castings. In the last five years, however, direct patterns have improved in quality to the point that they rival molded wax patterns. As a result, direct patterns are now increasingly being used for production castings. It is estimated that more than 50,000 direct patterns are cast each year and that approximately 40 percent of those are used for production rather than prototype castings.

As might be expected, direct patterns are being used for low-volume production runs where the total cost of patterns is less than the cost of tooling. In such cases, it has enabled foundries to both lower the cost of components to their customers as well as deliver them faster.

What is most interesting, however is that direct patterns are increasingly allowing investment foundries to enter a market that previously had never been open to them—very small quantities of metal components. A number of industries including defense, aerospace, custom equipment, and racing frequently have need for very small quantities of metal components.

For the majority of those applications, investment castings would easily meet the physical requirements of the application: requirements such as accuracy, surface finish and material properties. However, the cost of tooling effectively rules out investment casting as well as most other metal manufacturing methods as a means to create them.

With no tooling cost, machining is the low-cost method of manufacture in such situations. As a result, a large machining industry has developed to provide small quantities of machined components.

The development of production-quality direct patterns is changing the cost structure of investment casting. Even though the cost of direct patterns is much higher than the cost of molded wax patterns, there is no tooling cost. Consequently, the total cost of manufacturing for a few castings is much lower than for molded wax patterns, and in many cases makes it very competitive with machining, even on single parts.

Direct patterns have an added advantage in that virtually any geometry that can be imagined can be built, even those that could not be molded or machined. Consequently, they can be used to create components that pre-viously could only be made as assemblies of several individual components, providing even more cost savings.

Market Growth

A number of investment foundries are aggressively pursuing this market. Not only are they finding that they can compete effectively against machining, they are making better margins than they ever did on high volume orders on which they built their business.

In addition, it is a market that is much less susceptible to foreign competition. Like the injection molding industry, investment casting has lost market share to overseas competitors with significantly lower cost structures. The lower volumes and increased emphasis on turnaround time in this segment of the market make it much less attractive to foreign foundries.

Very few people anticipated that the most significant impact of additive fabrication technologies on this established manufacturing process was to give it new life in markets in which it could never before compete. It will be very interesting to see how it impacts other established manufacturing processes.

Related Content

It Starts With the Part: A Plastic Part Checklist Ensures Good Mold Design

All successful mold build projects start with examining the part to be molded to ensure it is moldable and will meet the customers' production objectives.

Read More6 Ways to Optimize High-Feed Milling

High-feed milling can significantly outweigh potential reliability challenges. Consider these six strategies in order to make high-feed milling successful for your business.

Read MoreAdvantages and Disadvantages of Copper and Graphite Electrodes

Both copper and graphite provide approximately the same end result, so it is important for a shop to consider the advantages and disadvantages of each material in order to discover what would work best in their shop floor environment.

Read MoreThe Benefits of Hand Scraping

Accuracy and flatness are two benefits of hand scraping that help improve machine loop stiffness, workpiece surface finish and component geometry.

Read MoreRead Next

The Impact and Evolution of Additive Fabrication

SAn executive summary of the annual Wohlers Report that provides quantitative and qualitative analysis on the additive fabrication industry worldwide.

Read MoreThought to Part: Rapid Manufacturing

An example where rapid product development and direct digital manufacturing can work.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More

.jpg;maxWidth=300;quality=90)