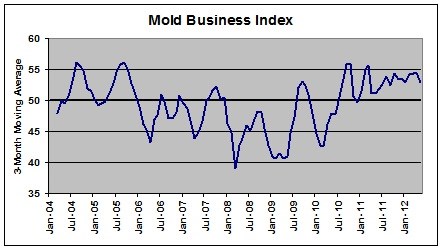

Total Mold Business Index for May 2012: 51.5

For the thirteenth consecutive month, overall activity levels for North American moldmakers increased in May. The Mold Business Index (MBI) for May 2012 is 51.5 (a monthly value over 50.0 indicates growth for the month). The latest MBI value is a 2.8-point decrease from the April value of 54.3, and it is a 2.0-point decrease from the 53.5 posted in May of 2011.

Caption: Our Mold Business Index has stayed well into growth territory so far this year despite the fact that the overall U.S. economy lost momentum in the second quarter. This is not a sustainable situation, and we will need the recovery to accelerate soon. Our best prediction is that this period of sluggish growth will be temporary, and overall growth rates will begin to pick up again later this summer. Be forewarned that this forecast is based on the assumption that the troubles in Europe will be solved gracefully and the Euro zone will not unravel. In a normal recovery, the problems in Europe would not be much cause for alarm in the U.S., but we have yet to achieve a normal recovery. We are vulnerable to a meltdown over there. On a positive note, crude oil and gasoline prices are declining, and evidence that the residential real estate and construction sectors continue to heal is slowly accruing. Data source: Mountaintop Economics & Research, Inc.

Though the headline value for our MBI indicated overall growth in recent weeks, there was some underlying weakness. Small declines were registered in New Orders and Backlogs. These were mitigated by gains in overall Production and Employment levels for the industry. Supply conditions worsened as Supplier Delivery Times expanded and Materials Prices were higher. Mold Prices were steady, and Future Expectations remained optimistic.

The momentum in the U.S. economy has slowed noticeably so far in the second quarter. Europe’s turmoil and the decelerating growth in many of the emerging world’s economies are two significant problems. This has constricted global demand for U.S. exports, but a bigger problem is the fear of a potential crash in the world’s stock and credit markets. This would further undermine business confidence. The memories of the last financial meltdown in this country and the Great Recession that ensued are still vivid, and any hint of a return to those days will cause banks to stop lending and firms to pull back on investment and hiring.

The overall jobs market has slowed substantially in the second quarter. Monthly payroll figures, which averaged nearly 250,000 this past winter, fell to an average of less than 100,000 this spring. Businesses have clearly become more cautious. So far, the data do not indicate that companies have not increased layoffs, but they are no doubt putting their hiring plans on hold while the drama in Europe unfolds. There may also be some anticipation of the political battles sure to come as Congress confronts the “fiscal cliff” scheduled for January 1, 2013 and the Treasury once again nears its statutory debt ceiling.

Sadly, the outlook increasingly relies on the actions of global policymakers. In order for the recovery in the U.S. economy to continue to gain momentum, the Euro zone must solve its problems. The Federal Reserve is increasingly expected to launch another round of quantitative easing by purchasing mortgage securities. This would push mortgage rates even lower than their current record lows though it is not clear that it would have much of a simulative effect on the overall economy. Additionally, Congress and the President must come to agreement over tax and spending policy in a satisfactory manner before the first of next year.

Demand for new molds slowed modestly in May, as the New Orders component for our MBI registered 46.3. This is only the second time in the past year that the data on new orders did not indicate an increase. The Production sub-index advanced smartly from last month to register a robust 61.1. At 59.3, the Employment component is still quite high, and it indicates that moldmakers still need new employees. With orders down and production up, backlogs must have declined. Not surprisingly, the Backlog component this month is 42.6.

For the second straight month, the Mold Prices sub-index for May is 50.0. Mold prices are firm, but respondents still report that strong pressure on prices persists. The prices paid for materials and components are still rising, but the upward momentum has slowed. The sub-index for Materials Prices is 59.3. The Supplier Delivery Times component is 40.7, so delivery times are longer still. There was a small decline in offshore orders, as the Export Orders sub-index is 48.1.

The most-cited problem confronting North American moldmakers in recent weeks is the shortage of skilled labor. Other problems receiving multiple mentions are: demands from customers for longer payment terms, shorter lead-times, and lower mold prices; uncertainty about the U.S. economy and the federal government; and foreign competition.

The Mold Business Index is based on a monthly survey of North American mold makers. Using the data from this survey, Mountaintop Economics & Research, Inc. calculates a diffusion index based on 50.0. A value above 50.0 for the MBI indicates that business activity expanded when compared with the previous month, and a value below 50.0 means that business levels declined.

Read Next

How to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More

.jpg;maxWidth=300;quality=90)

.jpg;maxWidth=970;quality=90)