News on Manufacturing and Capital Spending Provide Encouraging News for Accelerating Growth as 2010 Progresses

Total Mold Business Index for December 2009: 45.8

The Mold Business Index (MBI) for December 2009 is 45.8. This is a 4.2-point decrease from the previous month’s value of 50.0, but it is still a 7.2-point increase over the MBI value of 38.6 from December of last year. This month’s data indicate that overall business activity for North American moldmakers slipped in the fourth quarter of 2009 after a moderate increase during the third quarter. However, there was a gain in overall Employment levels in the most recent quarter. The downward pressure on Mold Prices persisted in December and Materials Prices were steady-to-higher. Future Expectations eased to 63.9 in December.

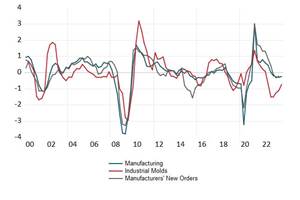

Despite the sluggish demand for new tooling as 2009 came to an end, the prevailing trends in the major manufacturing and end-market indicators continue to support our forecast of gradual improvement in 2010 and beyond. The latest manufacturing surveys and industrial production reports showed robust gains in manufacturing in recent months. New orders for durable goods (excluding transportation) not only increased in the latest report, but the uptrend accelerated.

An important component of the durable goods report is the details on core (nondefense, excluding aircraft) capital goods, and they were especially strong at the end of 2009. Core capital goods orders rose 2.9%, and shipments rose 0.8% in November. Through the first two months of the fourth quarter, core capital goods shipments were running 6.7% at an annual rate above the third quarter average. Thus, the news on manufacturing and capital spending provide encouraging news for accelerating growth as 2010 progresses.

As for our own MBI, the number of New Orders for molds declined for the third straight month in December. This sub-index is 33.3. Production activity also declined modestly, as the latest Production sub-index is 47.2. The Employment component is 52.8 indicating that there was yet another rise in overall payrolls in December. Backlogs shrank a bit in the latest month, as the Backlog component is 47.2 for December.

The Mold Prices sub-index for December is 36.1. This indicates that the pressure from customers to lower the price of new molds remains intense. The prices paid for materials were steady-to-higher, as the latest sub-index for Materials Prices is 52.8. Supplier Delivery Times were steady-to-slower, as this sub-index posted a value of 47.2. There was a small decrease in the number of offshore orders for new molds, as the Export Orders sub-index is 47.2.

The most-cited problem confronting North American moldmakers in recent weeks is the uncertain future of the U.S. economy. Other problems receiving multiple mentions were: overcapacity in the mold industry; receiving payment for work; the credit crunch; the trade policies of the U.S. government and the lack of qualified personnel.

Our Injection Molding Business Index (a measure of production levels for injection molders) increased in the fourth quarter of 2009 when compared with the previous year. The latest forecast calls for a gain of 7% in the coming year. The total amount of injection molded goods produced was flat-to-slightly-higher in 2009. Consistent gains in the Mold Business Index depend on sustained growth of 4 to 5% in the output of injection molded products. The trend in the moldmaking industry lags the trend in the processing sector by about six months.

December 2009 | |||||

% Positive | % | % Negative | Net % Difference | Sub- Index | |

| New Orders | 11 | 45 | 44 | -33 | 33.3 |

| Production | 28 | 39 | 33 | -5 | 47.2 |

| Employment | 22 | 61 | 17 | 5 | 52.8 |

| Backlog | 22 | 50 | 28 | -6 | 47.2 |

| Export Orders | 0 | 94 | 6 | -6 | 47.2 |

| Supplier Deliveries | 6 | 83 | 11 | -5 | 47.2 |

| Materials Prices | 6 | 94 | 0 | 6 | 52.8 |

| Mold Prices | 6 | 61 | 33 | -27 | 36.1 |

| Future Expectations | 44 | 39 | 17 | 27 | 63.9 |

The total Mold Business Index is a weighted average of the sub-indices for new orders, production, employees, backlog, exports, and supplier deliveries.

Related Content

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreUnited Grinding Announces Support for the Reshoring Initiative

According to the Reshoring Initiative, the rate of reshoring job announcements has grown from 10,000 per year in 2010 to 350,000 per year in 2022.

Read MoreNavigating Economic Resilience and Consumer Trends

Consumer behavior provides mold builders insight into the evolving market dynamics of goods and services that helps strategic planning.

Read MoreWhat You Should Consider When Purchasing Modified P20 Steel

When buying P20 steels that have been modified, moldmakers must be aware of the variations and key issues that affect delivery, cost and lead times.

Read MoreRead Next

Are You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More