"3D printing’s greatest value is not as a technology, but as an enabler to derive greater business value." This is the main finding of a new independent survey sponsored by

Stratasys Direct Manufacturing, a division of

Stratasys established in 2014 as one of the world’s largest 3D printing and advanced manufacturing (AM) services that combines the latest technologies and experience from Solid Concepts, Harvest Technologies and RedEye. Together, they have nine manufacturing facilities scattered throughout the United States with 700 employees, an arsenal of AM equipment, custom formulated materials, and ISO 9001, AS9100, as well as ITAR certifications.

This survey asked professional users of 3D printing: how they will use 3D printing over the next three years, what they see as the greatest benefits of and hurdles to 3D printing adoption, what they believe is its business value, how they see product development evolving, their plans to invest in owning the technology and what they believe the role of service providers will be.

Overall, respondents expect their companies to expand their use of AM, most will increase in-house capabilities to meet the demand, yet many want a partner to augment their internal manufacturing capacity and guide them through the expansion of internal capabilities, providing technical support and design consulting.

Joe Allison, CEO of Stratasys Direct Manufacturing, explained what the survey's findings reveal about the future of 3D printing for professional users: "They confirm that the growth over the next three years will largely come in end-use production with an emphasis in metals. These two trends combine to drive the third trend: a demand for expertise and know-how. Companies need help identifying new additive applications to determine the technology that can best fufill those needs. For end-use part production, they need support in optimizing 3D printing processes to bring costs down, while fully leveraging 3D printing's benefits and its business value."

Stratasys Direct Manufacturing is sharing these results with industry to help advance 3D printing adoption and help manufacturers maximize the business benefits of AM. And, the company is more than ready to help on both of these fronts with its blend of additive and subtractive manufacturing technologies, including its expertise and capabilities in plastics and metals AM (stereolithography, laser sintering, fused deposition modeling™, direct metal laser sintering, urethane casting, CNC machining, tooling, injection molding and professional finishing).

The company has and is expanding its capacity by adding advanced manufacturing centers for end-use parts, tripling its metals capacity in the past 12-15 months, adding CNC centers, improving fused deposition modeling capabilities and bringing its injection molding back to the United States. They have also developed a new optimized service model that involves project engineering, applications engineering, manufacturing engineering, high-end consulting services and professional services.

Stratasys Direct Manufacturing is committed to championing AM into reality saying, "It's time to look beyond the "coolness" of the technology to discover its real business value."

A Look at Some of the Findings

(Survey findings: Data Collection, Survey administrator: SMS Research Advisors, Methodology: Online, Timeframe: April 10 to May 1, 2015, Survey length: 36 questions, Database: Industry list of approx. 40,000 email addresses aggregated from multiple sources, Completed interviews: 700, Statistical accuracy: +/-3.8%)

- Most significant benefits of using AM are more complex design capabilities, reduced lead time for parts, and improvements in manufacturing efficiency. Benefits to outsourcing AM are access to advanced equipment and materials, less investment risk, produce parts not able to be manufactured internally and access to AM expertise.

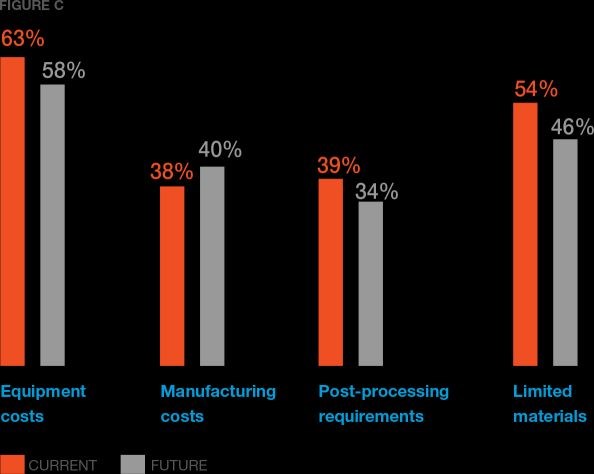

- Two of the top four challenges are financially-based, indicating that cost remains a notable barrier to implementation. Issues having the greatest impact on the AM market range from cost of equipment and mechanical properties to materials available and design accuracy. Interestingly, employee training and education did not come up high on the list.

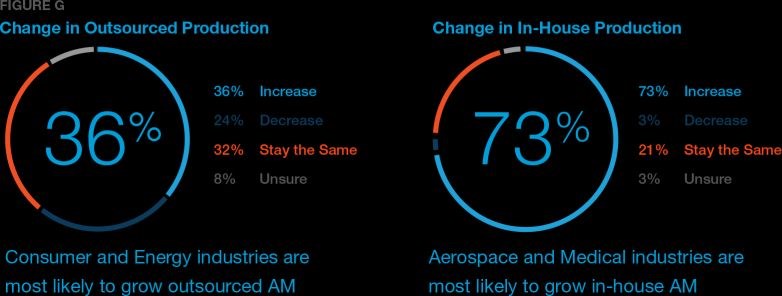

- When it comes to scaling capabilities and the role of the AM service provider, it was found that consumer and energy industries are most likely to grow outsourced AM, and aerospace and medical industries are most likely to grow in-house AM.

- Changes in AM applications by 2018 include aerospace and automotive industries expanding their end-use part production the most, and a higher percentage of new end-use part production will be outsourced to service providers rather than done in-house.

- Respondents want to see further development with metals. This is highly-coveted across all industries, with 84% of respondents interested in seeing more metal material developments. Rubber-like materials and high-temperature plastics are in high demand for future use as well.

- The forecast for process growth according to respondents finds that laser sintering and additive metal processes are prime for future growth, with additive metal use expected to nearly double over the next 3 years. This market is more likely to turn to service providers rather than buy equipment because it can require additional equipment and a team for post processing.

.jpg;maxWidth=300;quality=90)