Manufacturing everywhere is undergoing considerable change. This change can represent a threat to what has worked in the past, or it can represent an opportunity to grow in new markets and for companies to try different things. Gardner Intelligence recognizes the challenges that industry, regulatory and technological change can bring to any shop. The purpose of this 2018 outlook is not only to share the trends that Gardner Intelligence’s data reveals, but to build awareness of these trends as well, so mold builders can better prepare for future opportunities and grow their businesses.

Moldmaking Growth Trends

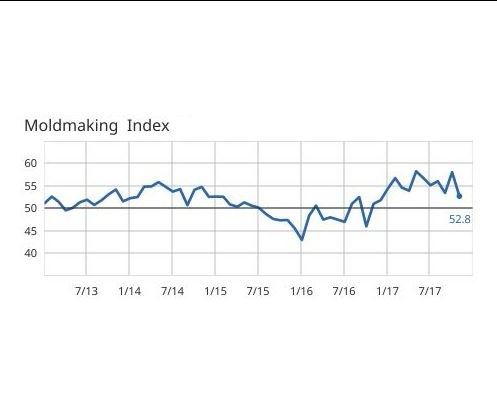

The GBI: Moldmaking Index results between January and October of 2017 broke records with an average index reading of 55.8. By comparison, the last time the index experienced a comparable period of prolonged expansion was in 2014, when the average index reading from January to October was a respectable 53.8.

When interpreting Gardner Intelligence data, a reading of 50.0 means that no change in the industry has occurred. All index readings above 50 represent growth. The greater the number is above 50, the faster the speed at which the industry is expanding. Readings below 50 work in a similar manner but represent industry contraction. The index is calculated by six underlying business conditions: backlog, employment, exports, new orders, production and supplier deliveries. The total index is the average of the movement of these six drivers. During a typical month, all six drivers may be expanding, but those expanding below the average of the six are considered to “pull the index down.”

The two most significant drivers of the Moldmaking Index in 2017 have been the production and new orders components, both of which had multi-year high growth values in 2017 that easily surpassed high records from the past. The readings for new orders in 2017 have been especially strong, which likely explains the growth in backlog and exports figures in 2017. At the end of October, backlog readings reached their 10th consecutive month of expansion. This far surpasses the most recent record for consecutive months of backlog growth, which lasted for three months.

Growth in new orders, which Gardner Intelligence uses as a proxy for demand, has greatly improved in 2017. Data on prices in 2017 indicates that this increased demand for molds is resulting in improved pricing for mold builders. Readings of prices received began improving (or having index scores above 50) in the third quarter of 2016 and have steadily improved through to the present. The full history of data suggests that the industry can expect further expansion in the industry well into the future when the Moldmaking Index registers strong backlogs and strong pricing power.

The full history of data suggests further expansion in the industry well into the future when the index registers strong backlogs and strong pricing power.

Spending Trends

Metalworking Capital Equipment Investment Plans

Each year Gardner Intelligence sends a Capital Spending Survey to metalworking shops asking about their intended spending on equipment for the coming year. If the responses from mold builders who completed the metalworking survey were extended to represent the overall industry, then the top-five projected equipment-based purchases in 2018 would be:

1. Vertical machining centers (< 20 inches Y).

2. Horizontal machining centers (< 400 millimeters).

3. CAD/CAM software.

4. Vertical machining centers (> 20 inches Y).

5. Vision systems.

To clarify, a projection is different from a forecast. Projections are forward-looking statements that are based on the results of a single survey. Forecasts are the predictions of future results, and they are based on a wider variety of data and statistical techniques.

Spending on equipment types other than those in the top five are projected to be greater than in 2017. For example, spending on mold flow analysis software is expected to be strong, as the number of mold builders indicating an intention to purchase this software is more than three times greater than the number of mold builders who indicated the same intention in 2017. Data also shows that mold builders have significantly more interest in purchasing ram-type, horizontal lathe, wire-type and automatic coordinate measuring machine equipment.

Spending on mold flow analysis software is expected to be strong, and mold builders have significantly more interest in purchasing ram-type, horizontal lathe, wire-type and automatic coordinate measuring machine equipment.

Plastics Processing Capital Equipment Investment Plans

Gardner Intelligence also conducts a capital spending survey for the plastics processing industry. The results of the 2017 survey, which asked for projected spending in 2018, indicate that next year should be an exceptionally strong year with total growth of 20 percent. Within this, primary processing and auxiliary equipment spending for injection molding, blow molding and thermoforming should increase by approximately 25 percent and 15 percent, respectively. From the 347 responses received, Gardner projects 2018 new spending of $4.5 billion.

The results of the 2017 survey indicate that next year should be an exceptionally strong year with total growth of 20 percent.

According to the survey results, the top five equipment-type purchases by dollar amount in 2018 will be:

1. Hot runner molds.

2. Injection molding machines (horizontal/electric).

3. Blow molding machines.

4. Cold runner molds.

5. Robots.

The survey results indicate a significant difference in consumption of new equipment by plant size. The results suggest that firms with between 20 and 49 employees are expanding their spending the most. The results also suggest the spending by firms with fewer than 20 employees is expected to contract by 26 percent. While spending projections between the two groups is directionally different in 2018, the combined spending of both categories at $1.9 billion is expected to be divided approximately equally. For comparison sake, large plants of more than 250 employees are expected to increase their spending by 32 percent, which would generate a smaller total of $1.3 billion in 2018.

Examining only the primary processing equipment data from the survey, consumption in 2018 is projected to be very strong. Among major machine types, spending in both blow molding and thermoforming is projected to contract by more than 30 percent. Projected consumption of cold runner and hot runner molds in 2018 is expected to grow significantly, with hot runner mold consumption more than doubling from last year’s projected level. Furthermore, processing equipment data suggests that spending on injection molding machines is projected to increase by 15 percent. However, when including all injection molding components, Gardner Intelligence projects a 32-percent increase in 2018 over 2017.

Leading Growth Indicators

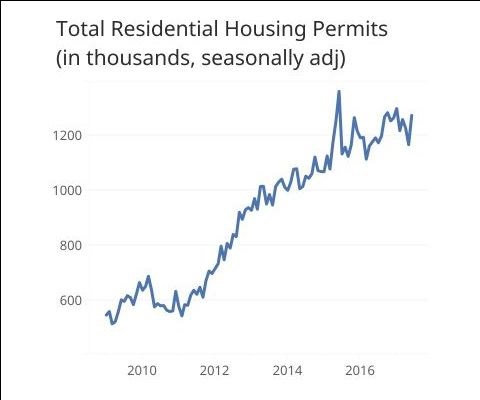

An overarching, leading indicator of plastic part production and consumption is the housing market, specifically figures in home building and family formation. Both result in significant direct, indirect or direct and indirect consumer consumption of plastics across all end markets in the form of products and the packaging of those products.

Authorized housing permits of both homes started and not started showed strong growth through the third quarter of 2017. The latest permit authorization data, when compared to new household formations and historical permits data, suggests that permit volumes could quite easily increase without the concern of a correction from an oversupply of housing. In fact, recent data suggests that there is a lack of single-family housing, which partly explains the strong appreciation of housing prices in recent years.

Millennial-driven, future household formations will continue to grow well into the 2020s. Millennials were born between 1980 and 2000. Home purchasing data informs us that the average millennial is getting married at approximately 30 years of age and purchases a house between 33 and 34 years of age, according to Zillow. The weighted average birth year of a millennial is 1998, which suggests a fair amount about where the housing market is likely to go in coming years. Specifically, if consumption by age remains relatively constant, the demand that is based on new household formation between now and the early 2030s should propel plastic product consumption well into the next decade at least. Also, homeownership rates among millennials fell between 2006 and 2015 before turning upward in mid-2016. As millennials make up for lost time from the impact of the Great Recession and from paying off debt from student loans, it is possible that there will be an above-normal growth in new household formations and thus in the demand for homes.

Automotive Trends

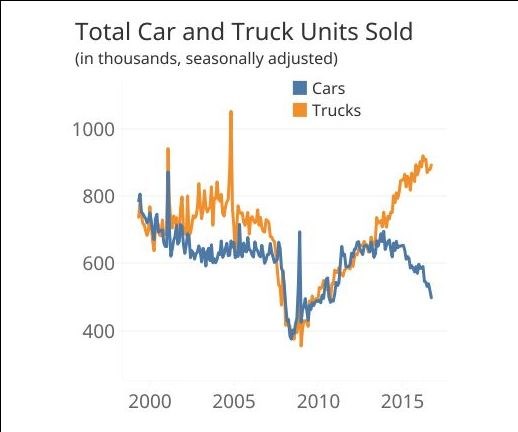

Speaking of long-term trends, there are significant factors that will impact vehicle demand. Examples include powertrain development, body material and autonomous vehicles. During the last two years, U.S. automotive sales have grown as the growth in light truck sales has more than offset the simultaneous decline in car sales. Through the first three quarters of 2017, car sales continued to decline, while sales growth in light trucks was largely flat and thus unable to offset a decline in total vehicle sales. In brief, there are several headwinds in the industry. Assuming that all or most of these will be short-term concerns, Gardner Intelligence’s long-term outlook for the industry is positive.

The short-term headwinds include a slowing of financing, a lengthening of loan terms and an inability from original equipment manufacturers (OEMs) to sustain the exceptional growth of finance incentives on new vehicle sales. Lending and loan data suggests that banks may have over-lent in recent years, as delinquency rates on auto loans have been trending higher since 2014. The auto-loan delinquency rate is currently at 3.92 percent, which is well above its 20-year average. However, the persistence of low unemployment into the future should help to mitigate delinquencies on auto loans.

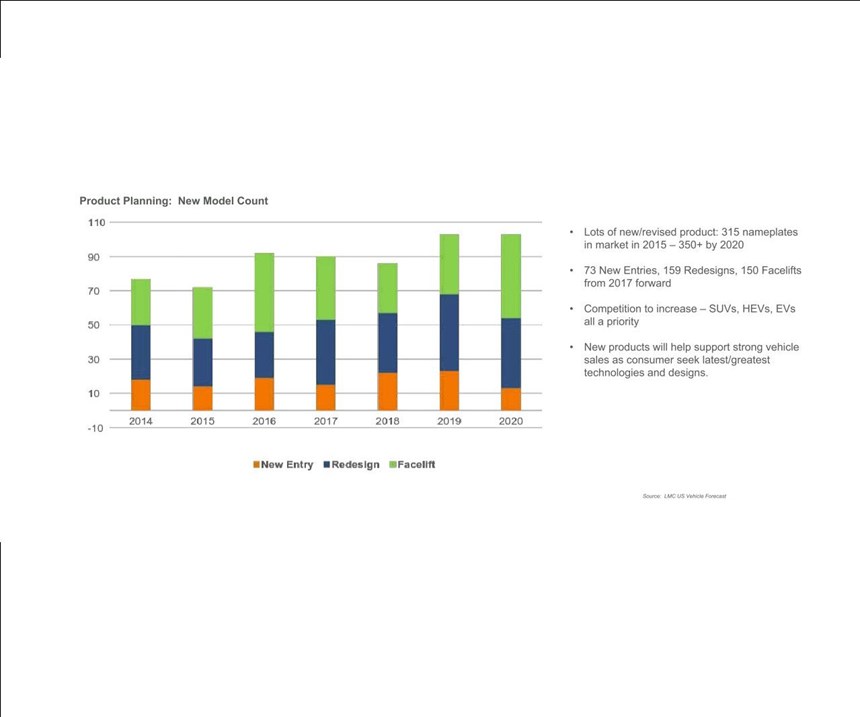

It is important to note that these headwinds in the industry do not represent the entire automotive industry story. In fact, mold builders can look forward to opportunities in 2018 and 2019, as OEMs strategically invest in equipment and technologies over the next few years to position themselves for a very different automotive industry. According to the U.S. Vehicle Forecast by LMC Automotive, OEMs are expected to create more new models in 2018 and 2019 than in recent years. Outside of normal competitive pressures to produce attractive new models, regulatory pressures to meet aggressive miles-per-gallon goals will force manufacturers to create new models with more efficient drivetrains. Additionally, those regulatory pressures may force manufacturers to create models that are significantly lighter, or to create models with more efficient drivetrains and to create lighter models. This will drive the use of different building materials and thus also new tooling.

Mold builders can look forward to opportunities in 2018 and 2019, as OEMs strategically invest in equipment and technologies over the next few years to position themselves for a very different automotive industry.

Medical Trends

Another market that consumer spending impacts is medical. U.S. industrial production of medical equipment and supplies in the year-long period ending in October 2017 had fallen nearly 7 percent. Looking at the last decade of U.S. data, indexed production of equipment and supplies was relatively stable between the end of the Great Recession and 2015. Production began to diminish as early as the beginning of the second quarter of 2016. By the third quarter of 2017, production had fallen to 92.4, putting the index at its lowest level in more than a decade. While production has been contracting, pricing continues to increase with a third quarter index reading of 117.7, representing yet another all-time high.

Although medical production data is disappointing, demographic data for the United States suggests that the demand for additional equipment will naturally move with the aging of the baby-boomer population and the increased aging of the population born after the boomers. According to the U.S. Census Bureau, “By 2030, more than 20 percent of U.S. residents are projected to be aged 65 and over, compared with 13 percent in 2010.”

What This All Means

Several of the major plastics processing drivers that Gardner Intelligence tracks indicate that the moldmaking industry can expect additional growth in both the short and the long term. New environmental standards and technological advancements in the automotive industry will look to plastics processors for solutions. Demographic trends suggest that the United States will see many years of strong new household formation ahead of it and a need for additional housing, goods and associated purchases. Lastly, other demographic trends suggest that the total number of citizens in their senior years will only increase the need for additional medical goods. Gardner Intelligence survey projections and the Moldmaking Index data both agree with the macroeconomic data that the industry can expect gains in 2018.

About the Author

Michael Guckes

Michael Guckes is the chief economist for Gardner Intelligence, a division of Gardner Business Media, Inc. (Cincinnati, Ohio, United States). He has performed economic analysis, modeling and forecasting work for nearly 20 years among a range of industries. He is available at mguckes@gardnerweb.com.

Related Content

Predictive Manufacturing Moves Mold Builder into Advanced Medical Component Manufacturing

From a hot rod hobby, medical molds and shop performance to technology extremes, key relationships and a growth strategy, it’s obvious details matter at Eden Tool.

Read MoreMold Builder Uses Counter-Intuitive Approach for Mold Challenges

Matrix Tool Inc. answers customers’ hard questions with creative solutions for cavity spacing, tool sizing, runner layout and melt delivery that reveal the benefits of running in a smaller press size at lower cavitation but higher yield.

Read MoreMold Builder Uses Metal 3D Printing to Bridge Medical Product Development to Production

Westminster Tool uses metal additive manufacturing for medical device OEM, taking lessons learned from R&D in the prototype mold phase to full-scale production molding in a fraction of the time.

Read MoreThe In's and Out's of Ballbar Calibration

This machine tool diagnostic device allows the detection of errors noticeable only while machine tools are in motion.

Read MoreRead Next

Outlook for 2017: Cautiously Optimistic

Despite limited economic and manufacturing climates, mold builders can continue to grow with a solid business strategy and a focus on operational excellence.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)