Homeowners Drive the Appliance Market More than Home Buyers

The limited construction of new homes may tamp demand for appliances going into new homes, but these same conditions may entice current homeowners to upgrade their appliances and home furnishings.

Those who have been paying attention to the housing market in 2018 have heard a lot of lackluster news. Stock indexes that track the housing sector, like the iShares U.S. Home Construction ETF (ITB) and SPDR S&P Homebuilders ETF (XHB), have fallen over 30 percent between their first quarter 2018 highs and their valuations as this article goes to press. Equities analysts in this sector see unaffordable home prices, the rising costs for home building materials and rising interest rates as three of the most significant factors that restrict greater growth in the market. But, if they were to see price as merely a tool that balances supply with demand, and if they were to think about how limited supplies and strong demand can influence prices, then the picture of the market would look significantly different.

On the supply side, U.S. New Housing Permits during the first three quarters of 2018 averaged 111,000 units monthly, which is the highest reading since 2007 and more than double the 2009 average. According to Realtor.com, the average U.S. home in September was on the market for 65 days, down 6 percent year-over-year. During the same time, prices were up 7 percent. However, in many non-rural markets, the median days on the market have been far fewer, while median home prices have grown much faster. In combination with the well-known fact that manufacturing and construction labor is in incredibly short supply, this data is one of the biggest reasons that the volume of new homes being constructed is not higher.

This leaves us with a market in which people can easily sell their home, but struggle to find another. This indicates that the market is not weak but rather is underserved significantly, which has two major implications for appliances. On one hand, the limited construction of new homes tamps demand for appliances going into new homes. On the other hand, these same conditions may entice current homeowners to upgrade their appliances and home furnishings, knowing that they will be in their current home longer than they may have anticipated previously. A strong labor market and increasing wage growth are two significant factors that help support home improvements. In fact, data indicates that U.S. inflation-adjusted, residential, fixed investment in home improvements has increased drastically in the last four years ending in 2017, growing over 30 percent.

A strong labor market and increasing wage growth are two significant factors that help support home improvements.

Financial data from publicly traded firms in the home furnishings and fixtures market—as opposed to data from the housing construction market—supports this underlying macroeconomic picture. Real revenue growth—calculated using a 12/12 rate of change at 4.7 percent—is slightly greater than the overall national growth rate. Furthermore, since early 2017, the home fixtures and furnishings market has increased capital expenditures growth at over 10 percent on a trailing 12-month basis, suggesting that the industry is seeking new ways to use technology to solve its labor shortage and one of its fundamental constraints in increased new-home construction levels. Overall, a more sophisticated understanding of the housing market is necessary for one to truly understand the underlying value in the appliance market.

About the Author

Michael Guckes

Michael Guckes is the chief economist for Gardner Intelligence, a division of Gardner Business Media (Cincinnati, Ohio, United States). He has performed economic analysis, modeling and forecasting work for nearly 20 years among a range of industries. He is available at mguckes@gardnerweb.com.

Read Next

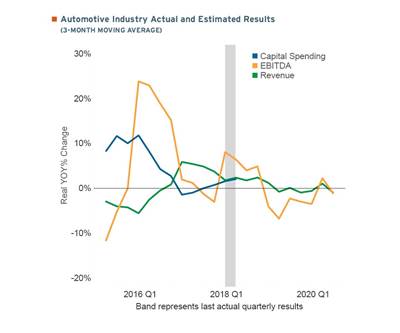

Automotive Industry Beats Expectations

Through the first half of 2018, the automotive industry experienced a level of growth that exceeded the expectations of most experts.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)

.jpg;maxWidth=970;quality=90)