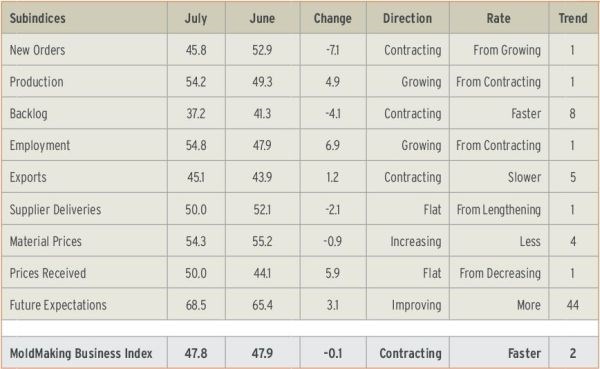

With a reading of 47.8, the Gardner Business Index showed that the moldmaking industry contracted in July for the second month in a row at a nearly identical rate. This was the first time the index contracted for two consecutive months since August and September 2013. Compared with one year earlier, the index has contracted for five straight months.

New orders contracted for the first time since last September, while, after contracting in June, production increased at the fastest rate since this past March. The combination of contracting new orders and increasing production pushed the backlog index, which has contracted every month since last December, to its lowest level since December 2012. This trend in backlogs indicates that capacity utilization will likely fall for at least the remainder of 2015. After contracting in June, employment increased in July at its fastest rate since June 2014. In fact, other than that June contraction, the employment index has trended up steadily since last September. Employment tends to be a lagging economic indicator, however. Exports remained mired in contraction due to the relatively strong dollar, and supplier deliveries did not lengthen for the first time since November 2013, indicating increasing slack within the supply chain.

Material prices have increased at a constant rate since April, but the rate of increase is still significantly below almost any other time in the history of this survey, which began in December 2011. Prices received were unchanged in July, the first time they did not decrease since last December. Future business expectations improved from June but have generally trended down in 2015.

After significant growth in June, plants with 100-249 employees and those with more than 250 employees contracted in July. This was the first time the largest facilities contracted since December 2013. Companies with 50-99 employees were the only ones to expand in July, having done so in two of the last four months.

Custom processors contracted at their fastest rate since September 2014, having expanded the previous two months. Metalcutting job shops expanded for the second time in four months, although the rate of growth in July was relatively weak.

Future capital spending plans were below $400,000 per plant for the second month in a row and fell in July to their lowest level since the survey began. Current spending plans were more than 50 percent below their historical average. Compared with one year earlier, spending plans have contracted by at least 66 percent each of the last four months.

Related Content

-

OEE Monitoring System Addresses Root Cause of Machine Downtime

Unique sensor and patent-pending algorithm of the Amper machine analytics system measures current draw to quickly and inexpensively inform manufacturers which machines are down and why.

-

Mold Design Review: The Complete Checklist

Gerardo (Jerry) Miranda III, former global tooling manager for Oakley sunglasses, reshares his complete mold design checklist, an essential part of the product time and cost-to-market process.

-

Making Quick and Easy Kaizen Work for Your Shop

Within each person is unlimited creative potential to improve shop operations.

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)