Moldmaking Industry Expansion Slows “‘All Around”’ in May

Moldmaking continues on the slowing expansion trend for the month of May according to Gardner Business Intelligence’s latest report on the Moldmaking Index.

GBI: Moldmaking shifts between accelerated and slowed expansion in short periods of time. The May index was consistent with trends, showing a second month straight of slowed expansion.

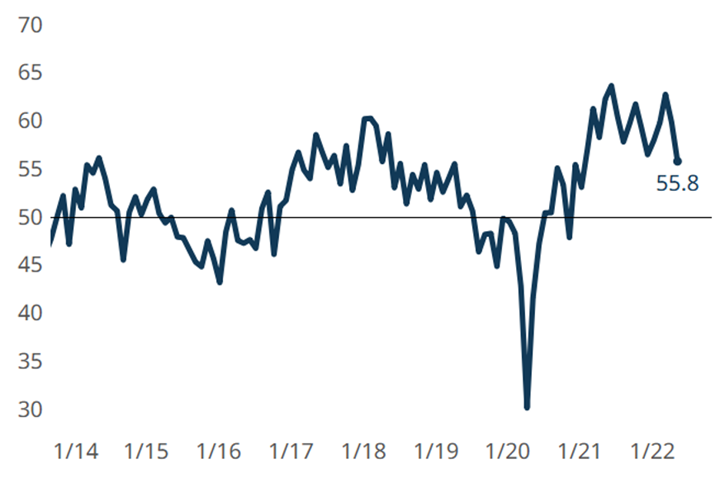

The Gardner Business Index (GBI): Moldmaking closed May at 55.8, four points lower than April of this year and 6.5 lower compared to May 2021. While moldmaking has not seen an Index this low since January 2021, the industry still reports expansion, albeit at a slowing rate the past two months. The month’s decline is not surprising based on Gardner Business Intelligence’s examination of April’s Index.

The message in April was “if recent (past 12-month) history repeats itself, we can expect one more month of slowed expansion before accelerated expansion kicks in again.” May is that “one more month.” The pressure is really on history’s predictive power come June.

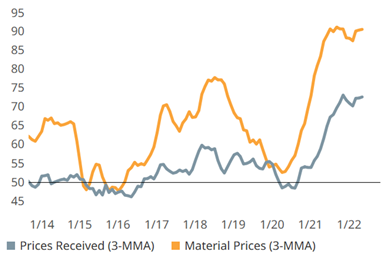

Pricing is not factored into GBI indices, though pricing questions are asked in the GBI survey. The trends between material prices and prices received are the same at differing levels, which have widened over time. (This graph plots three-month moving averages.)

Unlike April’s indices, most components behaved in a similar manner for the May GBI: Moldmaking, indicating slowed expansion. Out of all of the components, new orders and production declined the most, followed by a smaller decline in backlog. Supplier deliveries showed a fourth month of slowed expansion, a reading that still reflects artificial highs due to supply chain issues, and the employment index showing accelerated expansion for the third consecutive month.

Included in the GBI survey — but not factored into the Index — are pricing metrics, which are mentioned here for additional perspective. Starting two years ago, the materials price index has consistently shown accelerated expansion, before peaking in July 2021 and leveling off. The prices received index has shown a similar pattern but at lower levels, with the gap relative to materials pricing widening over time. This indicates that shops are paying more for materials than they’re able to pass along in pricing.

Related Content

-

May Moldmaking Index Trends Downward

Contraction, experienced by most May components, continues to be familiar territory for the GBI: Moldmaking Index.

-

Moldmaking Sector Sees Future Optimism Despite Current Challenges Subhead

Strong future expectations signal potential rebound as automotive and medical sectors prepare for growth.

-

Moldmaking Activity Begins 2024 With Slowed Contraction

January index reading reflects February-March 2023 readings as it slinks toward a reading of 50. There are high hopes that it may continue on this path to sustained expansion for 2024.