Make Way for Change

Moldmakers can increase their chances of success by forming a strategic plan, adapting to industry change and seeking new ways to address growth.

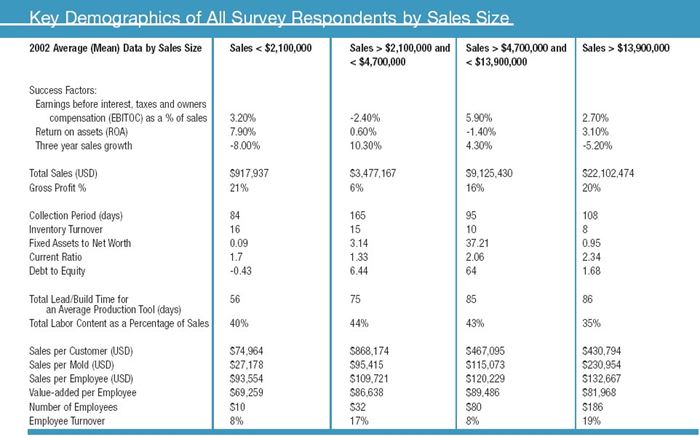

Plante & Moran recently concluded its biennial survey of the mold manufacturing industry for 2003 and the results share a trend that is occurring in the industry (see Chart 1). The health of the industry is believed to lie in the development of a manufacturer's mentality versus a craftsman's-hence, the industry is now referred to as a mold manufacturing industry rather than a moldmaking industry.

Business Climate

Some mold manufacturers are doing fairly well while others are doing rather poorly; the rest are in a continued subsistence mode that appears to have started in 2000. The good news is the production efficiencies of the North American mold manufacturer have been dramatic, with more than a 20 percent time reduction to produce an equivalent tool from two years ago. The bottom line is great productivity improvements, global competition, a continually sluggish economy, excess capacity and lack of differentiation among mold manufacturers are causing intense competition for sales, pricing pressures, liquidations and an occasional consolidation.

In addition, the molding industry also is beginning to consolidate. A little consolidation can cause huge disruptions when the typical mold manufacturer has two customers that provide 80 percent of the total sales. This consolidation will not only reduce the number of potential customers, but also will increase the customer's sophistication. As design software becomes more robust, reliance on the mold manufacturer will reduce. The combination of intense competition, reduction in the number of customers, more sophisticated customers and robust mold design software has some molds that were once viewed as value-added now treated as commodities.

Growth

Size and growth help, especially when you have excess capacity-but neither guarantee success. You cannot grow yourself to profitability, but you can shrink yourself to extinction. In fact, 50 percent of survey respondents had no or negative sales growth for the last three years. Therefore, any growth was considered important for profitability and return on assets. We trust the economy will rebound, and while some hope the government will intercede to protect the industry-don't bet on it. Many customers will not be happy with govern-ment interference and may just move overseas (if they haven't already) if they can't compete locally for a global market. Therefore, assume any rebound for the local mold manufacturing industry will be modest and seek new ways to address growth.

Strategy and Change

Forty-four percent of the respondents do not prepare a formal strategic plan. Now is the time to re-evaluate your business model and strategy. The business climate has changed the way your customers view you and the value your company provides. A mold manufacturer that helps the customer differentiate itself from the competition is truly a valued partner.

Tool building is no longer confined to a local source. The answer does not lie in accepting a smaller profit or being more productive, but rather a whole new business model. The industry has the creativity, the courage and the resolve to invent the next business model. When evaluating your business model, consideration should be given to the following points:

- Be the local source for customer odds and ends. Repairs, engineering changes and maintenance will become a larger component of total sales. For smaller molders with limited resources, this may be seen as the easy choice, but it is limited because they have little input in the design and build of the mold.

- Develop a strategic source to build blended tools. Currently, there are several virtual companies/consortiums that already compete in this market. A global source can build 50 to 80 percent of the tool, and the local mold manufacturer would build the rest of the tool as well as provide design support, tryout, job management and warranty support to the customer. Finding and managing another partner several thousand miles away is a skill that needs to be developed and perfected. The customer is looking for price that performs; low costs are necessary.

- Develop an expanded view of the service definition. We are producing parts rather than molds. The industry role should be more than what happens between the platens. Perhaps the future mold manufacturer will be responsible for the launch dynamics of all the part production requirements. These can include material conveyance, drying, coloring, regrind reprocessing, setups, fixtures, gages, transfer lines, robotics, end of arm tooling, assembly and decorating. The goal is to help the molder/customer develop and launch a robust process that ultimately reduces the reliance of labor to produce the parts. This strategy becomes a collaborative process with the customer. The mold manufacturer becomes a launch specialist providing manufacturing and process design engineering. The tool building may become a blended service, with some components built globally but delivered locally. Customer relationships will be limited in number, with program requirements larger and more involved. The customer may be a multiprocess/material component manufacturer with design engineering, scheduling and distribution skills to serve his or her market. Customers often are looking for a cost-effective extension of themselves.

- Mold manufacturers need to adapt by choosing to specialize in the uniqueness of the molds they produce. These can include very fast turnaround molds, multimaterial molding/manufacturing and very complex molding, or unique size requirements. This unique set of skills tends to be internally developed and widely shared with a larger number of customers to support the cost of the business model. The customer is focusing on performance/solutions at a reasonable price.

Organizational Structure

As your business environment and business model change, you also must take steps to review and align your organizational structure with your strategy. The misalignment of your structure can result in pet and ignored activities. Pet activities is the need to have two machine maintenance staff when the offending machines that caused the need to have maintenance staff were eliminated two years ago (or vice versa). It also is the need to maintain prototyping service when little work has been done, make all your own mold bases because you have the people and machines available-and will continue to have expensive people around to make parts that are getting cheaper to buy from stock-and have an expeditor when the fix is more visual communication. Both pet and ignored activities rob your company of its profits.

Typically, the mold manufacturer must decide whether to invest in equipment or people, systems or simplicity and depth or breadth.

- Equipment or people-Some mold manufacturers are buying more robust equipment to reduce reliance on skilled people. However, equipment and people go hand-in-hand. Invest in equipment to reduce leadtime, increase efficiency or provide greater moldmaking capability for your customers; do not invest in it to reduce the required skill level of your organization. All of your competitors can buy the same equipment. If you state that people make your shop or company different, you should demonstrate this by spending more than $109 for training (amount is based on the median paid by mold manufacturers on a per capita basis).

- Systems or simplicity-Some mold manufacturers are going back to basics, particularly as the economy falters. While focus is good, turning back the clock to old methods will not improve profitability or differentiate you from your competitors. Many mold manufacturers are pursing aspects of lean manufacturing to eliminate waste. Several mold manufacturers have identified that in 90 percent of the total build time, the mold is waiting for the next movement, process or approval (non value-added time). Lean manufacturing processes or new equipment provides new methods for making molds. Systems need to be developed and shared throughout the organization.

- Depth or breadth-Even though offering more service capability is easier and does increase sales, it does not increase profitability. More services should be offered to differentiate yourself from your competitors; the customer truly wants a one-stop shop. Otherwise, you will be incurring increased costs with new equipment and a potential dilution of your talent without any higher profitability, i.e., more headaches, more risk and same profits.

Operational Efficiency

In today's economic environment, it is imperative that you look at operating costs and ways to make the production cycle more efficient. Being operationally effi-cient is not enough to give you a competitive advantage, unless it significantly reduces your leadtime. It is interesting to note that while operational efficiencies rank as one of the biggest concerns among respondents, most respondents do not measure, or report, many of the metrics that would assist management in determining progress toward becoming more efficient. A system of continual planning and assessment, measurement, change and accountability is key to implementing any plan. In addition, you should not look to equipment alone to solve efficiency and leadtime problems. The survey indicated that those with any of the capabilities in Chart 2 were not more or less profitable than those without certain capabilities.

While certain capabilities should add value in a time where there is excess capacity (i.e., not enough work to fill up the machines), it is hard to cash in on the investment made. In addition, there is a lot of untapped potential that has not been explored by talented mold manufacturers with more sophisticated machines. For example, Tech Group produces dozens of cavities for a tool based solely on math data-no spotting press is required to ensure fit. Other molders have eliminated some level of benching based on machining methods. There may be reduction of EDM time through creative design and machining of electrodes, enhancements to mold productivity with the use of conformal cooling techniques or mold building effi-ciencies and cost reductions through the use of multiple tool steels in one mold. There are a lot of machines with awesome capability that the machinist may be uncomfortable using due to very high speeds, faster travel rates and smaller/longer cutting tools. In addition, there are laser probes for automatically validating cutting tools, use of cutting path templates for common cuts and standardized cutting tools (so cutting path templates can be used more frequently and there is a reduction in cutting tool inventories).

Taking an Adaptive Approach

There is no magic pill to cure your lack of sales growth, competitive position or low profitability. However, you can increase your chances of success by taking a holistic approach to looking at your business-surrounding yourself with talent that can keep up with today's pace of change and becoming an adaptive enterprise. Molders also need to become interested in how the part is removed and how the next part operation can be performed in a work cell (tied to the molding operation). In addition, the responsibility appears to end at customer acceptance. Many molders still have annual givebacks they need to find for their customers; the mold manufacturer can be an integral part of identifying process improvements and making adjustments to the tool (at a cost). A combination of the business climate, excess capacity and disruption of business relationships has caused this to be an industry where the status quo, inflexibility and faint of heart will not survive.

|

Related Content

Overcoming Barriers to Automation Integration in Precision Moldmaking

It’s easy to imagine the advantages automation offers the moldmaking process, but it's challenging to change one’s mindset, develop a plan and invest.

Read MoreTechnology Roundup: New/Improved Technologies You Don't Want to Miss

With all the technology joining the market, moldmaking is a versatile, ever-evolving industry. As such, this technology roundup has no specific theme — it features a variety of products for applications and solutions across the industry.

Read MoreMold Builder Meets Increased Domestic Demand With Automated Cells

Burteck LLC experienced significant demand increases due to reshoring and invested in automated machining cells to step up its production output quickly and avoid losing business.

Read MoreHow to Automate Process and Design

Moldmakers can improve their operations and stop wasting time by taking these six steps for process and design automation.

Read MoreRead Next

How to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More

.jpg;maxWidth=300;quality=90)