It’s Gut-Check Time for Tool Builders

It’s time to adapt or die as business evolution dictates development of new business and manufacturing approaches.

Automotive moldmakers will need to explore new business models in addition to adapting new technology in order to survive a dramatic restructuring of the North American auto industry.

There is as much as 30 to 50 percent overcapacity in mold building due to increasing foreign competition and decreasing business from domestic OEMs. Problems are particularly acute in Michigan, where public and private interests are banding together to fight the battle. The Center for Automotive Research in Ann Arbor, MI, and kaizen experts from the University of Michigan are coaching several tool and die makers in Michigan in new approaches that could make them more productive and potential suppliers to the growing transplant OEMs, particularly Toyota and Honda. Some Michigan tool builders also are receiving tax breaks that are enabling them to invest in new equipment.

The new business processes include:

Collaboration: Several tool and die makers in Michigan have joined coalitions that work together to produce a collection of molds for an assembly, such as an instrument panel.

Functional Build. Tooling is specified to perform a certain function, with tool builders being given the latitude to solve the problems. In the current system, domestic OEMs issue purchase orders loaded with tool specifications, many of them counterproductive.

Lean Approach. Tool and die firms analyze how processes are done within their own shops and take steps to remove complexity and waste.

Workload Balancing. Each member of the coalition would specialize in that part of the assembly in which they have the most expertise and advanced technology.

Economies of Scale. Tool and die makers band together to buy materials and components. They also sell and market their services collectively, emphasizing their ability to meet large orders as a turnkey project on a single purchase order.

More than 30 Michigan tool and die builders have banded together to form half a dozen coalitions and collaboratives, which are moving toward these new business processes.

“We have gone through best practices training as well as lean initiatives and we have been reformatting our entire process from the front door to the back door,” says Dave Martin, owner of Accu-Mold in Portage, MI, and spokesman for the United Tooling Coalition, which includes 17 tool and die makers. Operations at the companies were studied by doctoral students of Jeffrey K. Liker, professor of operations and industrial engineering at the University of Michigan and the author of The Toyota Way. Work processes were studied and optimized after the 90-day “kaizen” (continuous improvement) event.

Each member of the coalition focuses on a specialty. “If one of us gets overflow work, we’re required to offer it to those shops that have a core competency in that area,” comments Martin. Accu-Mold, for example, has a core competency in laser welding. The shop bought a new Trumpf laser welder that operates 50 percent faster than the previous model. The tool uses the high power-density of a focused laser beam to make efficient changes and repairs on molds—an area that will grow in importance as commodity tool building migrates to low-cost countries, such as China and India.

About half of the tool and die industry in Michigan is automotive-related, prompting the state government to create programs to keep the industry healthy. In the first step, the State of Michigan made a grant to the Center for Automotive Research to implement improved business practices at carefully selected and technologically diverse tool and die companies in the state. Training focused on lean initiatives, functional build, workload balancing as well as collaboration on procurement and marketing.

Tax-Free Zones

Recent amendments to the Michigan Renaissance Zone Act allowed the Michigan Economic Development Corp. (MEDC) to designate up to 20 tax-free zones where state and local taxes may be abated for up to 15 years. A total of 14 applicants from individual companies and tool and die coalitions, which include two or more companies, were considered for the eight spots that received the designation.

To qualify, property must be used primarily for tool and die operations. The company must have fewer than 50 full-time employees and local government boards must be willing to abate the business’ local taxes. Tool and die shops also must show interest in collaborating with other affected business in the zone. Collaborative efforts include marketing and development of standardized processes and management methods.

Thirty-three Michigan companies organized within these groups received Tool & Die Recovery Zone designation: Coopersville Tooling Coalition, Great Lakes Tool & Die Collaborative LLC, LS Mold Inc., Lansing Tool & Engineering Inc., Precision Tooling Coalition, Tooling Systems Group, United Tooling Coalition and West Michigan Tooling Coalition.

Efforts by the State of Michigan, including the tax abatement program, have led to $2.1 billion in private investment in the tool and die industry as well as the creation of more than 7,500 jobs. Accu-Mold, for example, is now 90 percent tax free on building, property and equipment. The shop also is exempted from the Michigan single business tax of 2 percent.

Role of Technology

Technology, of course, is an important part of the equation in the rebound of the North American moldmaking industry. “We took that money and we’re investing it in people and equipment,” says Martin. Accu-Mold took delivery at the end of last year (2005) on a Mitsubishi Roku-Roku hard-milling machine—an investment that amounted to about 12 percent of Accu-Mold’s annual sales. “We will be able to hit 10 times the tolerances at 40 percent greater speed,” adds Martin. “Everything we are buying is computer-controlled and lights out. We call it our third shift.”

New technology also is helping automotive moldmakers in other states to become more competitive. Foreman Tool in St. Charles, IL, is using the Flush Fine advanced milling process on the Makino V33 to achieve excellent accuracy (0.0002 inches in hardened steel such as S7 and H13) and ultra-fine finishes. Foreman says it can virtually eliminate EDMing and hand work because of the finishes achieved with the new vertical machining center. “Flush Fine is a high-speed, high-definition and low heat machining process pioneered by Makino (Mason, OH),” says John Smith, the Makino applications engineer who worked with Foreman Tool, which was founded in 1984 as a toolmaking shop.

Another productivity focus is high-feed milling, which is almost the opposite of high-speed milling, says Bob Goulding, director of product marketing at cutting tool producer Seco-Carboloy (Warren, MI). “We still use high revs, but we take a very small depth-of-cut (0.02 to 0.04 inches),” he said in an interview with Moldmaking Technology. “The position or the design of the insert allows us to push the feedrate very high.” The angle pushes the force back into the spindle rather than sideways to avoid vibration. By dropping the depth-of-cut with a high feedrate method, it’s possible you can boost a feedrate of 15 to 20 inches per minute to 100 to 300 inches per minute, depending on the material.

“Another advantage of high-feedrate milling is that it causes a lot less strain on the machine,” adds Goulding. Tool wear also is reduced. Investment required to implement the process is said to be minimal, although machines must have high table feed capability. Several Seco Carboloy tools now offer high-feed milling. The Minimaster, which can get down to a 6-mm diameter, provides high metal removal rates in cavity milling. “The real opportunity,” says Goulding, “is to open up the cavity in a linear way. You can do it with other tools, but you tend to fill up the channel with chips.”

Goulding feels adoption rates for high-feed milling are high in the top-tier shops that are actively re-investing and improving productivity.

Faster feedrates are one of the features of the new Form-MasterV cutters from Ingersoll Cutting Tools (Rockford, IL), which are especially designed for semi-finishing and finishing the contoured, drafted and vertical side-walls of dies and molds. Ingersoll says that the cutters’ unique design increases productivity over other indexible back-drafted cutters by allowing faster feedrates and larger step-downs.

In EDM, the emphasis in automotive moldmaking is clearly on more use of automated cells that integrate wire EDM, ram EDM, milling and even inspection on a coordinate measuring machine. For example, the new Charmilles Robofil 2050TW incorporates Windows P and Twin Wire software technology into the machine control to create an interface that facilitates integration of automation.

Automotive moldmakers also are putting more emphasis on Web-based business tools that improve productivity and competitiveness.

One example is Seco-Carboloy’s new SecoPoint program. The first element of the software package measures a process or a workpiece as it moves through production, providing an analysis of the process, machine utilization and cutting tool optimization. Opportunities for improvement are pointed out. Improvements in productivity of up to 40 percent have been reported. The tool is combined with point-of-use dispensing systems provided by Supply Pro, Inc. The tool dispensing system is called SecoPoint with the featured unit being called SmartDrawer where an operator can choose just a single insert.

“The whole idea is that it centralizes your purchasing,” says Seco-Carboloy’s Goulding. “When someone needs something, they tap in their code and you can control the amount of product that is consumed.” Product is automatically replenished via electronic communication through a proprietary portal.

New Hot Runners and Controls

Significant advances are taking place in hot runner technology targeting the automotive market. The big stories are cost and speed. “We’ve had a 30-percent reduction in selling price over the last two years,” comments Bill Hume, president of Synventive North America (Peabody, MA). In 2005, Synventive announced a new fast delivery program (two weeks) for its Kona XP hot runner systems, which were introduced in 2004 with a four-week delivery program. “Moldmakers and end users are demanding customized systems—not just off-the-shelf units in less time,” says Hume. He credits the cost and delivery improvements in part to a lean manufacturing system instituted at the Peabody plant (see Lean: How to Get There Sidebar above).

Two other major producers of hot runner systems—Mold-Masters (Georgetown, Ontario) and Husky Injection Molding systems (Milton, VT)—also are making major improvements in cost and speed. Mold-Masters’ MasterSPEED program offers eight manifold configurable options, nine gating options and a broad gate-to-gate pitch range. Husky’s fast delivery system, called Pronto, also is automation-based and is targeted at configurable systems. Husky is transferring some of the processes used in the Pronto system to its entire hot runner line. Significant customization in the auto market makes fast delivery times a bigger challenge.

In specific hot runner developments for automotive:

- Husky formed a new hot runners team based at its Detroit Technical Center. “Speed is a key,” says Rich Sieradzki, Husky's vice president of service and sales for North America. “So, we’ve brought hot runner designers to the marketplace. The benefits for our automotive customers include faster deliveries, improved quality and better overall responsiveness from their hot runner supplier.”

- Mold-Masters developed a core ring valve gate, in which a pin injects material into parts with center holes to achieve dimensional stability and no knit lines. Plastics Molding Co. of Cincinnati, OH, recently built a prototype tool incorporating the core ring valve gate to make a small round part used in an ABS braking system control module. The resin is a highly filled crystalline material. “Strength of these parts with knit lines can be 50 percent less than the parent material,” comments Robert Langlois, director of technology at Plastics Molding Co. “A knit line is definitely not a good thing to have.” The new approach also improves parts’ dimensional stability because of superior fiber orientation. The process uses an extra long pin to fill the interior diameter of the part. When the pin is forward, material flows through a small diameter. After the part is packed, the pin is retracted, shutting off flow. That’s the reverse of normal operations, when flow is shut off as soon as the pin in the valve gate is forward. Often disk gates are used to avoid knit lines in round parts. Disc gates; however, require a secondary operation.

- Synventive developed a new valve gate actuator designed for medium to large-part molding. The pneumatic actuator is mounted in the top clamp plate and requires no hoses or hard piping, making installation easy as well. Air and cooling lines are gun drilled in the top clamp plate. Another benefit is the self-contained design: only simple machining is required to the top clamp plate to accept the actuator. The top clamp plate can be easily removed for ease of maintenance.

Similar action is under way in sophisticated temperature control units for hot runner systems. The Altanium CX controller from MSI Moldflow (Moorpark, CA) features a scalable modular design with advanced control capabilities at a 30 percent reduction in price from similarly featured preceding models. The new LEC from Gammaflux (Sterling, VA) has a wide palette of capabilities at a 30-percent reduced price.

Tight temperature control for hot runner systems is particularly important in automotive applications because parts and tools tend to be large. “By controlling temperature tightly, you can better control part weight and make sure you are not shipping dollars out the door,” comments Mike Brostedt, director of market development at Gammaflux. Polyolefin prices have run up better than 50 percent in the past year, grabbing the attention of the increasingly cash-strapped auto producers when making parts such as bumpers and fascia. A Mold Monitor on the Gammaflux controller features a resistance monitoring alert that lets you know if a heater may fail. “Losing one heater, typically shuts down an entire cell,” says Brostedt. It takes six hours to change out a tool on a 3,000-ton press. The Gammaflux control checks resistance every 15 minutes while the machine is operating and compares that resistance to a baseline.

Hot runner temperature controls are sold to molders and moldmakers, who include them in packages. If a moldmaker has no say in the temperature controller choice, make sure you consider poor temperature control as a source of operating problems, particularly if problems come and go. For automotive, that generally means part weight fluctuations. It also could mean that knit lines or blush marks are moving around. “Gammaflux will send a free controller to anyone who asks” for a two-week test, says Brostedt. It’s a good way to see if the molder’s hot runner control is causing the problems. The moldmaker still must pay shipping costs.

Selling to moldmakers also is a large part of MSI Moldflow’s business, says Dave Rotondo, director of technology for Moldflow Manufacturing Systems in Moorpark, CA. Providing a NEMA-rated enclosure is a special twist for the demanding automotive market. “One of the biggest issues we see in automotive applications is the use of more steel for bigger molds,” says Rotondo. “That means heaters require more amperage. All of our control zones are rated at 15 amps. That means you can be running a control on a smaller mold and then roll it over to a big mold and it will run just fine.”

One example of a component that improves productivity for automotive moldmakers is CamActions, a side action from Progressive Components (Wauconda, IL) that helps pull core pins or detail, such as undercuts, out of parts that are being injection molded or die cast. To reduce design time, Progressive Components provides CAD data online, available in five different formats, for all models, plus replacement parts are available in stock, every day. Cams can be top- or bottom-mounted and are available off the shelf.

Faster Deliveries

One of the goals of new business processes and technology is faster automotive mold builds. “The current development time for a new platform cycle is estimated to be between 29 to 34 months,” says the Center for Automotive Research in a report released in 2005. “This time is expected to get shorter, approaching 23 to 26 months for a new platform.” Japanese auto producers lead North American and European OEMs, but the gap is narrowing.

“When we started making molds in 1988, the leadtimes were 16 to18 weeks,” comments Gordon Lankton, chairman of Nypro, an integrated injection molder based in Massachusetts that operates three tool building plants in the United States and three in China. “Those leadtimes gradually have gone down to 12 to eight and six and now our guys say they can do it in two weeks with a patented new modular technology.” The new technology, called Maxis, is aimed, at least initially, at the cell phone industry, where product life cycles are dramatically shorter than automotive. Nypro relies on lean systems and new equipment to achieve low costs and rapid delivery times.

The best-in-class are automating and upgrading equipment to best in class, and paying attention to improved business practices such as lean or improved purchasing control. Many have already decreased dependence on automotive as a market. There is a future, however, with the transplant auto companies, particularly Honda of America and Toyota (see Automotive: The Future below), which require high levels of reliability and quality—areas where the best toolmakers shine. There also is a future in specialty tools, such as two-shot and high-end lens molds.

|

Automotive: The Future The headlines out of Detroit are not rosy for North American moldmakers, who have already been battered by low-priced imports and OEM buyers who have focused on lowest bid, not highest value. Some moldmakers, such as integrated supplier Nypro, have made business decisions in past years to focus on more profitable, faster-growing markets, such as medical and electronics. Here’s a quick sampling of future business prospects based on research and analysis by MoldMaking Technology magazine: Honda of America: Established in 1988, Ohio-based Honda Engineering supplies injection molds, dies and other tooling to Honda of America. Honda uses about 40 plastics molds a year for North American operations. About ten are made in-house, 10 to 20 are supplied by third-party moldmakers in North America, and another 10 to 20 are sourced by Honda Engineering in Japan from global sources. Outside tool builders are used when special technologies are required. Mold sourcing tends to follow vehicle development planning. Honda plans to develop more models in North America, so there could be some upswing here in Honda’s mold building. The approach of the Japanese automotive OEMs is quite different from American OEMs, which specify requirements at a much higher level. Japanese OEMs put more emphasis on functional requirements. The United Tooling Coalition is studying the Japanese mold building approach in an effort to boost business with the transplants. Toyota: Anecdotal industry reports indicate that the giant global auto producer is moving more moldmaking business to the United States to support its just-in-time, and mushrooming, manufacturing presence in the United States. Nypro, for example, makes molds for plastics safety products used in Toyota cars at its moldmaking plants in Kentucky and Texas. Toyota declined official comment. Nissan: Also growing its U.S. manufacturing presence, Nissan told Moldmaking Technology that it evaluates mold buying decisions on a “case-by-case basis”, but still keeps most mold manufacturing in Asia. Delphi Automotive: Even before plunging into Chapter 11 proceedings, Delphi failed to update technology on important business segments such as polypropylene battery casings where it typically operates molds than are at least 20 years old on presses that are similarly old. General Motors: Pressure is on top buyer Bo Andersson, a former Swedish military officer, to dramatically cut costs, but to his credit he is not rebidding business if suppliers refuse to make across-the-board cuts—an infamous strategy widely used by GM in the previous 15 years. Andersson told suppliers in a fall summit they must take whatever steps necessary to cut costs. The mandate may force more to establish manufacturing in China. GM has signaled plans to source $1 billion in parts from India by the year 2008, up significantly from the current level of $120 million. The good news is that GM is becoming much more collaborative with moldmakers, even involving hot runner systems suppliers in early discussions about mold design. The bad news is that more plants are closing in the United States. Ford Motor Co.: Also famous for its long-time combative relationships with moldmakers and other suppliers, Ford also is making improvements. Fighting for long-term survival, CEO Bill Ford announced a new emphasis on innovation. Supplier relations for 40 key components and systems, such as seats and steering, will be an initial focus. Ford will reduce the supply base for those components from 200 to less than 100 and develop long-term contracts that include technology partnering and long-range forecasting. DaimlerChrysler: Chrysler was a leader in collaborative relationships in the 1990s, and even pioneered a new approach to mold ownership as part of its battle for survival. More recently, the OEM has reverted to extensive use of electronic reverse auctions to buy tooling and is reporting short-term cost savings of 30 to 40 percent. |

About the Author: Doug Smock, who has written about molding and moldmaking for most of the last 20 years, can be reached at dsmock@globalcpo.com. He is co-author of “Straight to the Bottom Line” a new book on supply management.

Related Content

Harbour Results, AutoForecast Solutions Release Battery-Electric Vehicle Market Study

The study analyzes the transition from an industry dominated by the internal combustion engine to battery-electric mobility and its impact on the supply chain, which will have ripple effects from automakers to tool and die shops.

Read MoreIndustry Report: Automotive Outlook, Forecast, Disruptions and Industry Transitions

A recent presentation by Auto Forecast Solutions shares some interesting trends to help those who work within the automotive industry better understand key trends.

Read MoreU.S. Economy Indicates Prospects for Moldmakers

An examination of the U.S. economy suggests its resilience against a recession, yet a mixed outlook for moldmaking and plastics persists.

Read MoreMold Innovations Power Unique Auto Lighting Elements on Hummer EVs

Diamond machining, electroforming of micro-optical inserts and modified latch-lock system help injection molds produce unique forward lighting elements.

Read MoreRead Next

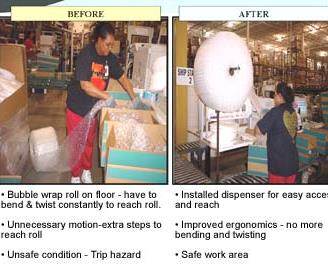

Making Quick and Easy Kaizen Work for Your Shop

Within each person is unlimited creative potential to improve shop operations.

Read MoreHot Stuff!

Advances in valve gating technologies and improved efficiencies heat up the hot runner market in 2005.

Read MoreFocus on Tooling Access to Improve Productivity

How to apply lean tools at leverage points in a mold shop to achieve a focused business objective.

Read More