Equipment Leasing: A Popular Alternative to Buying

Leasing equipment provides moldmakers with more purchasing opportunities during tough financial times.

Have you wanted to get new equipment but felt that you could not afford it? Or wanted to upgrade your equipment, but did not know what to do? Well, equipment leasing can come to the rescue. Because leasing is much easier and quicker than dealing with a bank, more and more companies are getting the equipment they need today - not having to wait until a later time. Normally, for equipment costing up to $75,000, all that is required is a one-page application. And the equipment can be new or used. In most cases, a decision is made within 24 hours, but some decisions may only take eight hours. Documents are then received by the buyer (the lessee), signed, and returned to the funding source (the lessor). Equipment is received, the vendor is paid and the lease payments start. Lease terms can be in 12-month increments, with 60 months being the standard. However, 72 or 84 months can be provided if the lessee is credit worthy.

There are many programs that moldmakers can choose from, starting with the standard fixed monthly payment - zero payments for 90 days. Other plans include seasonal; a step-up rate (low at first, then increasing); a 6 x $99 program - six payments of $99, then a set payment after that; and several other options.

Pre-funding is another alternative available, where a vendor can be given up to 50 percent of the cost so that the equipment can be manufactured. This way, you - the lessee - have to only put up two payments as a deposit to start the lease. When the equipment is finally delivered, the vendor is paid the remaining balance due. This program allows all parties to be satisfied, but the biggest benefit goes to the lessee, since they were able to get the equipment they wanted with only a small deposit of monies required.

What if you want to upgrade your equipment? There also is a program that will benefit you - the lessee. A new, state-of-the-art piece of equipment can replace the older piece in your plant very easily. On approval, the funding source will pay off the remaining balance of your older piece, and apply that balance to the cost of the new equipment. You now have the new, modern equipment without the concern about selling the older piece.

What Are Your Terms?

As mentioned, terms can be 12, 24, 36, 48 or 60 months, and end of lease options are either $1.00, a 10 percent option or fair market value (FMV). The $1.00 option is what is due after all payments are made. The 10 percent option is based on the original amount that was leased. If it was $50,000, the 10 percent option is $5,000. The FMV option is based on the value of the equipment at the end of lease term. If the equipment has a high value, your buyout would be high - it could be more than 10 percent. Each program determines your monthly lease payment, with the highest being the $1.00 option, and the lowest being the FMV option. Leases can be structured so that all payments are 100 percent tax deductible. You should contact your accountant to determine the best structure.

Most equipment can be leased - either new or used - as well as rolling stock (trucks, tractors and trailers). Some funding sources lease molds for injection molding machines. Time in business is essential for approval on leasing. The established companies (in business for three years or more) have a much better chance for quick approvals. Businesses with less than one year of business are acceptable, but may require more than the one page application for credit information. Start-up companies can get approved, but usually amounts cannot exceed $25,000 unless it is a special transaction with additional collateral available, such as real estate, CDs, etc.

One other valuable program available is the sale/leaseback program. This is for equipment that the lessee owns and would like to get monies for. The funding source buys the equipment from the lessee, sends the check to lessee and the lease term starts. This program is normally a 36-month lease with a $1.00 buy-out option. However, it can help a lessee acquire monies without affecting a line of credit with a bank.

So why wait to get that new piece of machinery or mold? Call your funding representative today and see how easy it is to lease it.

Related Content

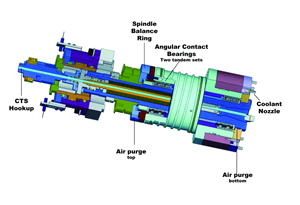

Machining Center Spindles: What You Need to Know

Why and how to research spindle technology before purchasing a machining center.

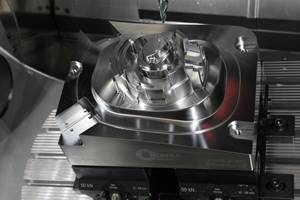

Read MoreFive-Axis Vertical Mill Increases Mold Shop Capacity by Reducing Setups

Zero Tolerance now processes blocks — from squaring to waterline drilling to rough and finish milling — on a single five-axis CNC mill, reducing setups and moving blocks in/out of multiple machines without sacrificing accuracy and surface finish.

Read MoreTen Things You Need to Know about Circle Segment Milling

Considerations for evaluating if circle segment end mills or conical barrel cutters are right for your mold machining applications.

Read MoreDesign Strategy Tackles Big and Small Complexity Challenges for Southeastern Mold Builder

Delta Mold Inc.’s core values, engineering expertise, five-axis machines and molding capabilities help the team turn a proposal into a manufactured mold or part with custom design, finishing and assembly.

Read MoreRead Next

How to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More

.jpg;maxWidth=300;quality=90)