End Market Reports: Automotive & Consumer Products

Automotive manufacturers may be hedging their output despite strong new order demand. Gardner Business Intelligence’s (GBI) review of consumer confidence, employment and credit markets all point to a strong 2017 for consumer spending.

Automotive Shipment Values Falling Despite Strong New Orders

The annual rate of total vehicle sales nearly doubled between February 2009 and May 2015, increasing from 9.2 to 18.1 million units. This is an impressive feat for a pillar of the U.S. economy. The industry’s second notable feat was sustaining that hefty sales level for nearly two more years. Last year ended at an annualized production rate of 18.7 million units.

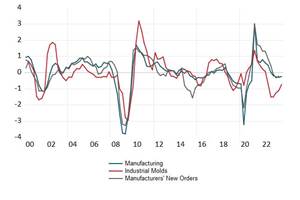

Automotive industry data shows a disconnect between the value of shipments, which has fallen sharply in the last year, and new orders. The 2017 average ratio of the value of new orders is 6.6x greater than shipments—one third higher than the average ratio since 1992 of 4.9x.

This means that the dollar value of new orders is more than six times greater than the value of concurrent shipments, the long-run ratio of which is 4.9. These results suggest that manufacturers may be hedging their output despite strong new order demand.

Among possible reasons for the pull back is the industry’s struggle to earn profits in the sedan and small car markets. According to J.D. Power, incentives in 2017 are expected to exceed $4,000, a near 15-percent increase over 2016 incentive levels. Automotive credit data shows several signs that give cause for concern as well. Because of the growing popularity and availability of 72- and 84-month duration automotive loans in recent years, more owners are finding themselves with negative equity in their vehicle, as the vehicle depreciates faster than their loan balance. The combination of low interest rates and lengthy loan durations make financing payments extremely affordable.

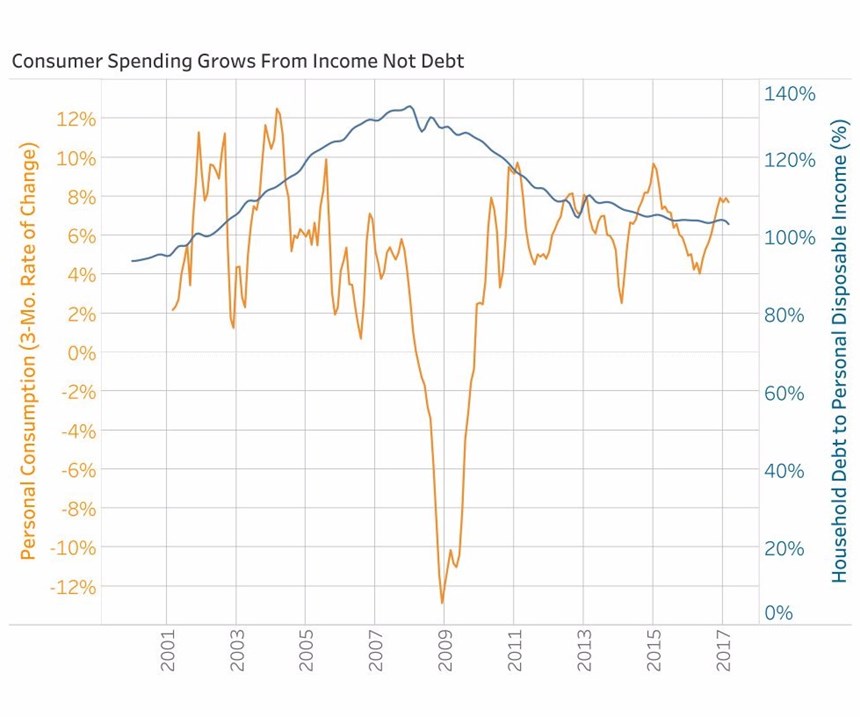

Consumer Metrics Point to a Strong Future

Gardner Business Intelligence’s (GBI) review of consumer confidence, employment and credit markets all point to a strong 2017 for consumer spending. Improved confidence in the economy has already yielded additional spending. Inflation-adjusted data for 2017 through April shows consumer spending on durable goods and total personal consumption increased by 4.9 percent and 7.2 percent, respectively. The increase in spending on durable goods is a result of growth in disposable personal income. The current ratio of household debt to personal disposable income at 103.2 percent is not significantly different than the 2015-2016 average of 104.1 percent.

Data from the Consumer Confidence Indexes measuring the present situation and future expectations both point to an economy of confident consumers. The index measuring the present situation, which increased sharply after the November presidential election, has continued to increase. For the first months of 2017, it averaged 137.9 as compared to 115.4 for the same period in 2016. Expectations data available through May 2017 indicate that consumer outlooks are significantly higher than for the same period in 2016. During the first five months of 2016, the index of Consumer Confidence Expectations averaged 81.4. By comparison, the index averaged 104.7 for the same period in 2017.

There is an opportunity for automotive original equipment manufacturers to continue producing at such elevated volumes. But, there are many financial factors that could constrict potential buyers from purchasing new vehicles in the future. It is for this reason that OEMs may be hedging their bets and holding back on shipment levels.

Related Content

MMT Chats: Digitalizing Mold Lifecycle and Process Performance

MMT catches up with Editorial Advisory Board member Bob VanCoillie senior manager of Kenvue’s mold management center of excellence outside of Philadelphia to discuss mold management via tooling digitalization and OEM expectations and opportunities.

Read MoreHow Hybrid Tooling Accelerates Product Development, Sustainability for PepsiCo

The consumer products giant used to wait weeks and spend thousands on each iteration of a prototype blow mold. Now, new blow molds are available in days and cost just a few hundred dollars.

Read MoreDomestic Collaboration Yields Efficiency and Budget Gains For Innovative Tooling Project

Pyramid Molding Group and Lettuce Grow partner to develop optimal tooling for a compact Hydroponic Farmstand.

Read MoreNavigating Economic Resilience and Consumer Trends

Consumer behavior provides mold builders insight into the evolving market dynamics of goods and services that helps strategic planning.

Read MoreRead Next

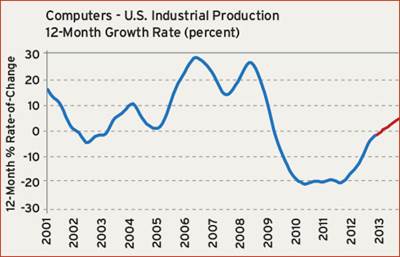

End Market Reports: Computer and Medical

U.S. Computer Industry Emerging from Slump; Production of Medical Supplies and Equipment Is Accelerating

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)