Creating a Competitive Cost Model in the U.S.

Recent China trends present opportunities for U.S. manufacturers and supply chains.

Let’s examine the answers to three critical questions, which reveal current opportunities for revitalizing U.S. manufacturing.

China

Question: Is China’s labor cost/sourcing advantage shrinking?

Answer: (Subramaniam (Mani) Manivannan): A review of the following recent developments will reveal the answer.

- Strikes over the past two months and other developments have been a rude wakeup call for many foreign companies that depend on China’s low costs to compete overseas. The EU knocked China’s amended purchasing rules recently. European Union Trade Commissioner Karel De Gucht said that European businesses are increasingly worried about the “lack of intellectual property” protection in China and so he criticized China’s procurement rules, saying recent changes to legislation favoring indigenous innovation are not enough to address complaints of discrimination against foreign firms. China needs to improve opportunities for foreign companies.

- Two of Germany’s prominent industrialists—Siemens and BASF—have attacked the business and investment climate in China, complaining of foreign companies being forced to transfer business and technology know-how to Chinese companies in exchange for market access.

- Chinese factory workers at two suppliers for foreign automakers have returned to work after winning a hefty pay rise, ending strikes that once again highlighted the car maker’s vulnerability to their suppliers in China. The strikes at Atsumitec—which supplies Honda Motor’s China operations—and Japanese electronics maker Omron Corp., were the latest in a series by workers demanding a bigger slice of China’s growing economic wealth.

- A recent newspaper article reported that a Japanese manufacturing company in Guangdong Providence China received a formal letter from the local government informing it to increase the minimum monthly wage by approximately 20 percent.

- The Guangdong government announced plans to double income for workers in five years, and the July wage increase signals the first step in this overall plan.

- The Shanghai government announced a 14-percent increase in the minimum wage beginning in April. This was the second increase in the last seven months, raising the minimum wage in Shanghai by more than 27 percent in one year.

- Hong Kong lawmakers passed the city’s first minimum-wage bill marking a victory for labor unions and activists who sought statutory wage protection for low-income workers. The bill comes nearly two years after the government bowed to immense public pressure and announced plans to seek a minimum wage. The new bill doesn’t stipulate the actual wage level.

- Makers of toys and trinkets, Christmas trees and cheap shoes already have folded by the thousands or moved away—some to Vietnam, Indonesia, Cambodia and Laos. Where is the next move after these countries?

Reshoring

Question: Will we see more reshoring by many customers who have grown weary of offshore suppliers delivering poor quality and reliability, and with unpredictable delivery?

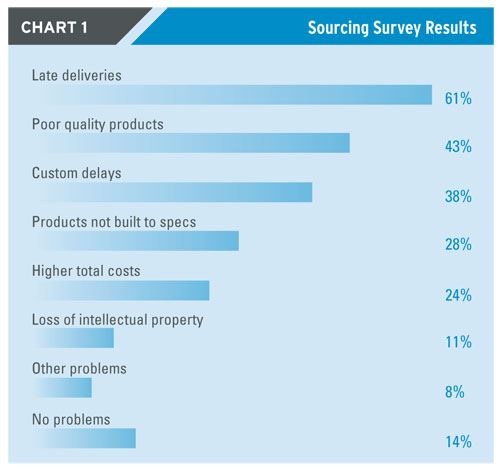

Answer: (Harry Moser): According to a January 2010 Grant Thornton international sourcing survey published in Supply Chain Solutions, 25 percent of companies mentioned late international deliveries; 23 percent mentioned quality issues; 51 percent of companies that offshored found no financial advantage in doing so; 20 percent brought work closer to home in 2009; and, 59 percent of those brought work back to the U.S. (see Chart 1).

Two U.S. trade associations—the National Tooling and Machining Association (NTMA) and the Precision Metalforming Association (PMA)—and the related Reshoring Initiative (www.reshoringnow.org) are taking direct action to reverse the decline of U.S. manufacturing.

The Reshoring (synonym for back-shoring and onshoring) Initiative promotes returning work to the U.S. by assisting companies to more accurately assess their total cost of offshoring through the Total Cost of Ownership (TCO) Estimator software.

Many companies that chose to off-shore simply compared FOB (free on board) prices. The supply chain managers are often rewarded for savings at the FOB price level, ignoring a broad range of other costs and risks that disappear into lost sales, overhead or the balance sheet. The often-ignored offshoring costs and risks include:

- Rising wage rates, currencies and reject rates in developing countries

- Duty and freight

- Pipeline and surge inventory impacts on balance sheets and JIT operations

- Intellectual property and regulatory compliance risk

- Higher transportation and fuel costs

- Higher prototyping costs (U.S. shops charge more for prototypes because they will not get the production order)

- Higher end-of–life obsolete inventory costs because of higher inventories when the design is changed or the product life ends

- Less effective innovation because manufacturing operations are distant from R&D and marketing (loss of

- clustering effectiveness)

- Travel expenses and personnel cost

- Carbon footprint

Companies that calculate their TCO will discover that they could reshore substantial amounts of work and save money. The Reshoring Initiative’s TCO Estimator software allows OEMs to calculate and compare the total costs associated with outsourcing offshore versus locally. The Estimator includes 18 user-modifiable cost factors and makes it easy for an OEM to compare the full profitability impact of local versus offshore sourcing. The TCO is calculated for the present and then forecast based on user-projected wage inflation differentials and exchange rate changes. Job shops can use the Estimator to help their customers understand and calculate TCO.

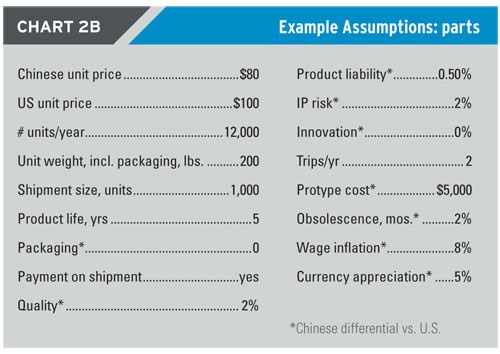

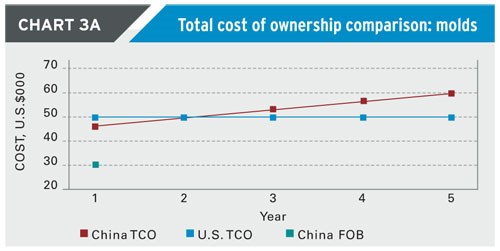

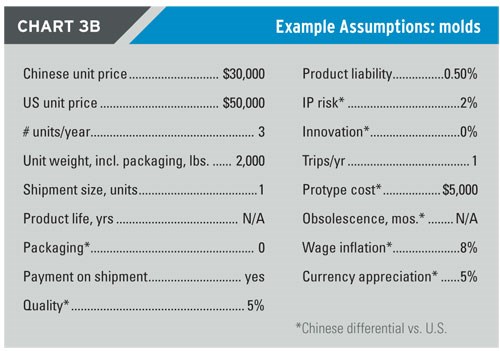

The TCO Estimator shows a substantial difference between the Chinese FOB price and the Chinese TCO cost. See Charts 2a-2b and 3a-3b, which show the assumptions and the output. TCO closes about 80 percent of the cost gap in year one and suggests that the gap is eliminated in year 2.

Note that the assumed 10 percent/year Chinese labor inflation is a small fraction of both the historic rate and the much higher rates described above.

The Reshoring Initiative’s objective is to change the mindset of U.S. supply chain managers from “offshored is cheaper” to “local reduces the Total Cost of Ownership.” We are providing the TCO cost accounting concept to help industry change its sourcing decision process.

To achieve this major cultural change, our effort must be broad. We have created a surge of reshoring publicity with news stories by CBS, USA TODAY, the Wall Street Journal and many industry magazines and websites. Our online Library contains 49 reshoring examples, so OEMs can see how competitors are benefiting from bringing work back to the U.S. Cong. Wolf (R VA) has included in his Manufacturing Strategies Act (H.R.5980) the use of total cost of ownership software. Speaker Pelosi attached to her newsletter, The Gavel, a USA TODAY article in which the Initiative was quoted. We are seeking to work with all government proposals to strengthen U.S. manufacturing.

In addition, the Initiative helps these companies find the most competitive U.S. source through the NTMA/PMA Contract Manufacturing Purchasing Fairs: Emphasizing Reshoring to Bring U.S. Manufacturing Jobs Home. The first Reshoring Fair was held in Irvine, CA on May 12, 2010. The next Fair was in Mashantucket, CT on October 29, 2010 (for details visit www.purchasingfair.com). At the May 12 Fair, 64 percent of the customer companies brought work to be reshored. One hundred thirteen shop salesmen and owners met with the customers to bid on the work.

The NTMA has held 51 Purchasing Fairs in 25 years and NTMA and PMA have broadened the Fairs. The Fairs not only match OEMs and suppliers already sourcing domestically, but also increasingly emphasize opportunities for reshoring. The Fairs provide a venue for OEMs to conveniently find competitive domestic job shops for custom machined, stamped,

fabricated and injection molded parts, special tooling (molds, dies and fixtures) and special machines.

Before the crash in 2008, the U.S. trade deficit peaked at about $700 billion/yr. Since manufacturing company sales average about $150,000/yr/job, about five million manufacturing jobs would be added if the trade deficit could be balanced by reshoring. The accepted manufacturing multiplier of 1.4 means an additional 7 million other jobs would be created. Thus a total of 5 to 12 million more jobs would be added, reducing U.S. unemployment as low as 2 percent. The resulting increased income and corporate taxes, and reduced unemployment and stimulus program expenses would cut the budget deficit by 30 percent or more. Of course, for some goods, other changes are needed (e.g. a much higher Chinese currency, more domestic energy production, etc.)

The Obama Administration has called for doubling exports in five years and has threatened to tax companies that move jobs offshore. The Administration would strengthen the economy and employment more powerfully and faster by encouraging companies to embrace the Reshoring Initiative, showing the companies that it is in their own interest to keep the jobs here or bring them back. It is far easier for U.S. companies to be competitive on their home field than competing offshore.

Improving U.S. Competitiveness and Capabilities

Question: How can we build more effective U.S. manufacturing and supply chain capabilities, and revitalize and reshore jobs from overseas?

Answer: (Harry Moser and Subramaniam (Mani) Manivannan):

- Innovation. This will help to preserve manufacturing and grow it in the future. Among the most interesting opportunities are those that are the complex, difficult to copy and involve core competence technology. Innovation will be enhanced by reshoring because of the clustering benefits of proximity.

- Technology Investment. Invest in advanced technology and follow the trends of smaller lot sizes, more complexity and multitasking.

- Flexibility. Manufacturers and supply chains that aren’t flexible are significantly behind and will struggle for survival in the global marketplace.

- More Capacity. This must come in the form of justifying and investing in new technology; more cost-effective methods; overall leadtime improvement; setup time reduction; a focus on personnel opportunities; and, implementing more value-add into your product.

- Lean. All supply chains and manufacturers need to think and run a “real lean oriented” sustainable model. One that removes all nonvalue-added costs and earns enough margin to invest in your future by creating a low-cost model in U.S. AME (Association for Manufacturing Excellence) is a good source for lean training benchmarking.

- DFMA. By offering Design for Manufacturability and Assembly services to their customers, U.S. shops differentiate themselves via their proximity and reduce their and their customer’s labor content so that more work at both tiers will be competitive in the U.S.

Summary

U.S. OEMs have offshored work that is demonstrably in their immediate economic interest to reshore. The share of the

offshored work that companies can profitably reshore is increasing due to the wage increases in China and the adaptation of lean, DFMA and increased innovation by U.S. companies. By advancing reshoring and competitive processes at our companies and with our customers we can accelerate the revitalization of U.S. manufacturing.

Related Content

Top 10 Topics to Cover During an ISO 9001 Manufacturing Audit

Take a look at this practical hands-on approach to conducting a quality audit.

Read MoreDynamic Tool Corp: Leadtime Leader Insights and Bold Plans for the Future | MMT Chats

MoldMaking Technology Editorial Director Christina Fuges gets the scoop from our 2024 Leadtime Leader Award Winner Dynamic Tool Corp., on the company's future, their trade show experience, finding new talent and the impact of this industry recognition.

Read MoreShift in U.S. Mold Imports: Emerging Countries Gain Ground in Market Share

The dynamic nature of the U.S. mold industry's global trade landscape offers challenges and opportunities for growth.

Read MoreFAQs: What Are the Leadtime Leader Awards?

Here are answers to some frequently asked questions about MoldMaking Technology's annual Leadtime Leader Awards competition.

Read MoreRead Next

How to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read More