Coming Back Strong

Investment in machining centers, injection molding machines and complete molds is projected to increase significantly in 2015. Our latest capital spending survey reveals the trends leading to this upswing.

Share

The mold and die industry has come roaring back the last couple of years, and the trend should continue in 2015. U.S. manufacturing companies say they plan to invest very heavily in machine tools to manufacture molds, injection molding machines and in molds themselves. In fact, a survey of equipment buyers predicts that the mold industry will increase spending by more than 30 percent on these types of purchases compared to 2014.

Last summer, Gardner Business Media surveyed readers of MoldMaking Technology and three of its sister publications, asking them about their plans for spending on capital equipment in 2015. The result is Gardner’s Capital Spending Survey.

To realize how believable this projected increase in capital equipment spending is, consider:

• According to the U.S. Federal Reserve, capacity utilization at automotive parts manufacturers was 88 percent in July—the highest level in 25 years—reflecting that automakers are busier than they have been in years. More models, higher vehicle sales and production, stepped-up marketing, and easy-to-get below-prime car loans are some contributing factors.

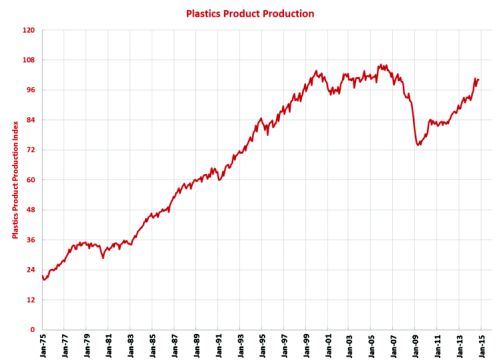

• The staggering number of new car models set to begin production in the next few years means a lot more plastic injection molding capacity is needed. Also, the complexity of molds is increasing as automakers design distinctive features into bumpers, taillights and other plastic parts (see Chart 1).

• Medical companies are scrambling to keep pace with an aging population here and abroad. People are getting older, and as they do, their knees, hips and backbones are wearing out.

• Reshoring and near-shoring, particularly in the appliance industry, are picking up momentum. Having production facilities and factories close by is proving to be a smart strategy.

If your company is considering the purchase of capital equipment next year, take these projections seriously. They show that you are not alone in your confidence to invest in manufacturing in the U.S., and you may have to wait longer and pay more for the equipment you need to get on your shop floor. Also, pay attention to what other companies (and your competition) are buying as the type of manufacturing resources that they consider the best investments right now.

Leading Indicators All Positive

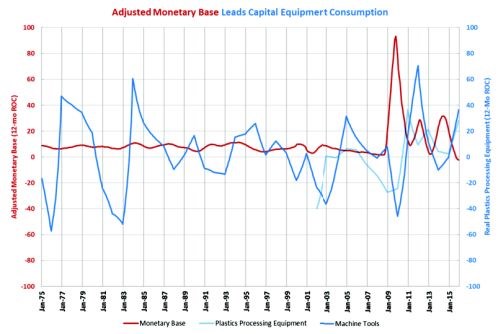

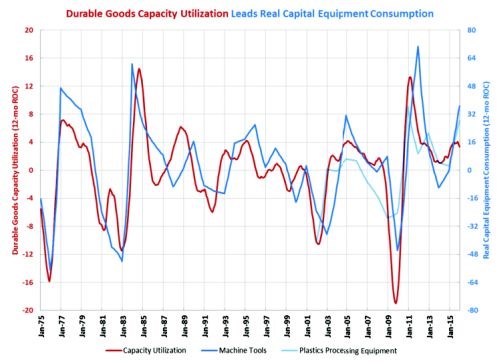

Gardner Business Media’s department of market intelligence tracks four leading indicators of capital equipment spending: the monetary base, capacity utilization, the MoldMaking Business Index (see page 44 of this magazine) and industrial production. All four point to significantly higher spending in 2015, but two are more important than the others.

The monetary base. The monetary base is equivalent to the size of the balance sheet of the Federal Reserve or the amount of physical money in circulation. The Federal Reserve controls these numbers through the purchase or sale of bonds and other securities. When the government pumps more money into the economy, it generally leads to capital equipment spending. Prior to 2008, the annual rate of change in the monetary base ranged roughly from 5 to 15 percent. Since the financial collapse in late 2008, the Federal Reserve has increased the U.S. monetary base by more than 400 percent, so that the annual rate of change has stayed above 15 percent for nearly five straight years (see Chart 2) with peak rates of growth higher than 28 percent three separate times during this period.

This dramatic surge in the monetary base has spurred significant increases in capital equipment spending in recent years. Typically, changes in the monetary base lead changes in capital equipment spending by 24 months. With the monetary base hitting its peak rate of growth in the summer of 2014, capital equipment spending should see accelerating growth through 2015 and perhaps into 2016.

While the fantastic rate of growth in the money supply has helped manufacturing and, to some extent, the entire economy in the short term, it is a disastrous policy for the long term. At some point in time, the money printing will have to end. Last October, the Federal Reserve ended its quantitative easing program (a policy by which the Fed injects money into the economy by purchasing securities, typically government bonds, with electronic money that did not exist previously). Will this cause interest rates to rise or the U.S. dollar to rise against other currencies or the stock market to fall? If any of these events happen to a significant degree, will the Federal Reserve then reinstitute some form of quantitative easing? The answers to these difficult questions will likely have a major impact on investment in machine tools in the upcoming years.

Capacity utilization. Of course, most manufacturers do not watch the monetary base as an indicator of when they should buy capital equipment. Most companies make investment decisions based on capacity utilization—how busy existing equipment is at the moment. The Capital Spending Survey generally shows that the need to increase capacity has been the top motivator for shops to buy capital equipment. This finding has not changed in 25 years.

In facilities producing durable goods, capacity utilization is at its highest level since early 2008 and has been increasing at an accelerating rate. Shops are getting busier at a quicker pace. This accelerating growth is likely to continue, based on the correlation between backlogs in our business index and capacity utilization. Durable goods capacity utilization could reach 80 percent in 2015 for the first time since June 2000, and durable goods capacity utilization could average more than 80 percent for the first time since 1998 (see Chart 3).

Equipment Purchasing Trends

According to the survey, moldmakers will spend nearly $500 million on machining centers, grinders and EDM equipment in 2015. That’s an increase of 32 percent over 2014, and it’s nearly 10 times the average amount moldmakers spent annually from 2008 to 2012 on these equipment types.

Spending on vertical machining centers is expected to total a little more than $250 million, or more than 50 percent of all machine tool spending. Within the VMC category, about 67 percent of the spending will be on machines with a Y axis of more than 20 inches while the remaining dollars will be spent on smaller machines.

Spending on EDM equipment should nearly double in 2015 compared to 2014 to close to $70 million. About 55 percent of that spending will be on ram-type EDMs, and about 40 percent will be on wire-type machines.

Moldmakers expect to increase their spending on grinding equipment by about 24 percent to $81 million, concentrating on centerless, flat/surface and cylindrical/external grinders.

Of the almost $1.3 billion expected to be spent on injection molding machines in 2015, more than 60 percent will come from custom processors, the electronics/computers/telecommunications industry and metalcutting job shops. Custom processors alone will account for nearly half of this spending. Based on demographic data collected by Gardner Business Media, 69 percent of custom processors make parts for the automotive industry, 57 percent for the medical/pharmaceutical industry, 41 percent for the electronics/computers/telecommunications industry and 39 percent for the aerospace/aviation industry. Electronics/computers/telecommunications and metalcutting job shops should spend about $120 million each on injection molding machines.

The vast majority of injection molding machines purchased are horizontal. However, the market for vertical machines is expected to grow in 2015 and account for more than 20 percent of all injection molding machines, compared to just 12 percent in 2014. While hybrid machines were the fastest growing part of the market last year, spending on strictly electric or hydraulic injection molding machines should increase in 2015.

Spending on complete molds is expected to rise more than 20 percent in 2015 to $1.262 billion. This is after a nearly 100-percent increase in such spending in 2014. Hot runner molds will account for about 75 percent of the spending on complete molds, while cold runner molds will make up the remaining 25 percent. Spending on both types of molds has grown significantly since 2013.

What Does It All Mean?

If the survey proves accurate, it would show that American manufacturing has made a dramatic recovery from the two recessions it has experienced this century. In fact, one could argue that this level of investment is necessary to support the current level of durable goods production, which is the highest it’s ever been in the history of the country.

This level of investment also indicates the importance of American manufacturing to the U.S. economy. More and more observers outside the world of manufacturing are paying attention and making the connection between manufacturing productivity and economic prosperity.

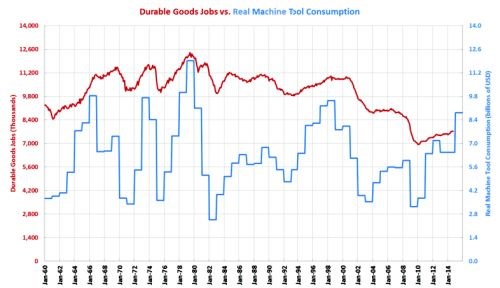

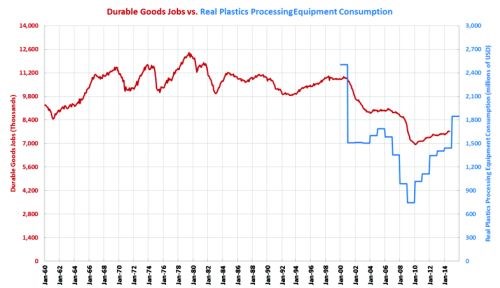

Also, increased investment in capital equipment will result in job growth (see Charts 4 and 5). Throughout the 1960s and 1970s, as spending on machine tools increased, so did jobs in durable goods manufacturing. (This applies to spending on other types of capital equipment as well.) Beginning in 1980, as machine tool consumption fell to lower levels, jobs in durable goods manufacturing also declined. Since 2010, as machine tool consumption has increased, durable goods manufacturing jobs have also been increasing. Increased investment in capital equipment leads to higher productivity, which leads to greater profits, which leads to more jobs.

The results of the survey also have short-term impact. First, longer delivery times should be expected as this year progresses. Machine tools, injection molding machines and molds can take a long time to build, especially if customization and automation are required or the molds are more complex. Like all other manufacturers, equipment builders want to keep their inventory as low as possible. So, when demand increases rapidly, as the survey indicates it will, they may have a hard time ramping up production fast enough. As orders build up in the pipeline, delivery times grow longer and longer. Because a significant amount of the capital equipment acquired in the U.S. is imported, shipping times from overseas can exacerbate the problem.

Second, capital equipment prices are likely to rise during 2015. This is really as simple as supply and demand. When demand for equipment rises rapidly and builders cannot increase the supply as fast as that demand, the price of machines and molds tends to increase. Historical data for the capital equipment market supports this effect. Price increases are even more likely on equipment types that the survey indicates will be in higher demand this year.

Third, the longer you wait to buy, the more likely it is you will not be able to buy the equipment you prefer and will have to settle for your second or third choice. If you cannot accept the extended delivery time for your preferred machine or mold because you have a new order that must be fulfilled right away, then you will have to settle for the next-best machine or mold that will meet your time frame. If the type of machine or mold you really want is in high demand, then the price could rise to a level that makes your return on investment hard to justify. Wise planners will include detailed contingencies that adjust for accepting that second- or third-best type of capital equipment.

If you know you are going to buy a significant amount of capital equipment this year, then it may be better to buy sooner rather than later to avoid potentially longer delivery times and higher prices. This could be a good tactic for staying one step ahead of the competition.

Related Content

Questions and Considerations Before Sending Your Mold Out for Service

Communication is essential for proper polishing, hot runner manifold cleaning, mold repair, laser engraving and laser welding services.

Read MoreMachine Hammer Peening Automates Mold Polishing

A polishing automation solution eliminates hand work, accelerates milling operations and controls surface geometries.

Read MoreWhat is Scientific Maintenance? Part 2

Part two of this three-part series explains specific data that toolrooms must collect, analyze and use to truly advance to a scientific maintenance culture where you can measure real data and drive decisions.

Read MoreConfronting the Mold Design Talent Drought

Recently, I reposted on LinkedIn the results of an informal survey we conducted, which revealed a shortage of skilled mold designers. It quickly gained a lot of traction. Given the response, I thought I'd summarize the feedback and keep the conversation going.

Read MoreRead Next

How to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)