A Trade Policy Perspective on the Plastics Industry

Now that the new Democratic majority in the House of Representatives has been sworn in, it’s valuable to take stock of where things sit for the plastics industry from a trade policy perspective.

As the plastics industry has an estimable presence in all 50 states, it counts among its supporters as many Democrats as it does Republicans, but the shift in control of the House could have ramifications on several important issues for the industry, such as tariffs and trade.

Tariffs

President Donald Trump’s administration has pursued a considerably more combative trade position than its predecessors, imposing tariffs on some countries that have been traditionally considered allies in addition to the nation’s typical trade rivals.

So far, the administration has imposed tariffs on $250 billion worth of imports from China, ostensibly citing intellectual property and technology theft concerns as the reasons for the tariffs. It’s also chosen to place tariffs on steel and aluminum imports from most countries, although it has provided some relief with a limited application of exemptions for some countries.

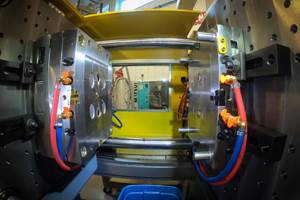

Still, mold bases, molding patterns, molds for metal or metal carbides, molds for rubber or plastics, molds for shoe machinery and molds for the manufacture of semiconductor devices have been subjected to tariffs if companies imported these products from China. In response to the application of these tariffs, China responded, as expected, by placing retaliatory tariffs on a variety of U.S. products, including some that impact the plastic moldmaking industry.

The situation has shifted over the past few months. On November 30, President Trump and Chinese President Xi Jinping agreed to 90 days of high-level trade negotiations until March 1, while a truce remains on the imposition of new tariffs and on the possibility of raising the existing 10-percent tariffs on the third list of Chinese products to 25 percent. They held three days of mid-level negotiations in China from January 7 to 9 and set high-level negotiations in Washington, D.C. late last month.

Also in late December, the Office of the U.S. Trade Representative (USTR) announced that imported injection molds (HTS 8480.71.8045) would be exempted from the 25-percent tariff retroactively from July 6, 2018, until December 28, 2019. They granted the exemption after numerous importers filed exclusion requests with USTR during a product exclusion process in effect from July 6 to October 9, 2018. As of recently, the 25-percent tariffs remain on the other products listed. USTR could announce more exemptions from tariffs for plastics machinery, as requests are still pending.

Nonetheless, the metal tariffs applied so broadly by the administration, in addition to irking China, have also drawn retaliatory responses from countries like Canada and Mexico, America’s closest trading partners. Some have also brought disputes with the administration to the World Trade Organization (WTO), whose influence will be tough to estimate on an administration that’s made a point of defying global bodies like the WTO and the United Nations (U.N.).

A Democratic House of Representatives will have limited tools at its disposal when it comes to directing the administration’s trade policy. However, it could seek to investigate certain aspects of the executive branch’s reliance on Section 232 of the Trade Expansion Act of 1962 to impose the tariffs. Some Republicans in the Senate have discussed this approach. The House could also propose pieces of legislation designed to increase Congress’ role in setting tariffs. Although the President might be reluctant to sign such a piece of legislation, the proposals themselves could ramp up pressure on the administration to take a narrower approach to use tariffs.

Mold bases, molding patterns, molds for metal or metal carbides, molds for rubber or plastics, molds for shoe machinery and molds for the manufacture of semiconductor devices have been subjected to tariffs if companies imported these products from China. In response to the application of these tariffs, China responded by placing retaliatory tariffs on a variety of U.S. products, including some that impact the plastic moldmaking industry.

For its part, PLASTICS has argued that while there are trade imbalances worth addressing, tariffs are not the tool to accomplish this. Moreover, as the industry maintains a trade surplus overall, it should be much lower on the administration’s list when it comes to where and how to apply tariffs.

For moldmaking specifically, the sector notched an increase in its trade deficit in 2017, according to PLASTICS’ latest Global Trends report, but it maintained trade surpluses with our closest trading partners, Mexico and Canada. Imposing tariffs on countries with which the industry has surpluses will do little to address these imbalances.

Additionally, demand remains strong for molds for plastics in the U.S., as apparent consumption increased by 9.2 percent in 2017.

The USMCA

Formerly known as the North American Free Trade Agreement (NAFTA), the U.S.-Mexico-Canada Agreement, or USMCA, was agreed to by the three countries at the end of the summer. Mexico and the U.S. first reached an agreement in August, and then Canada signed on at the end of September. Canada’s inclusion in the USMCA is a very important part of the agreement that makes it much more beneficial and much less disruptive to the North American plastics supply chain. The leaders of the three countries signed the agreement on November 30.

The focus now turns to the legislatures of the three countries for ratification. The U.S. Congress will have an up-or-down vote on finalizing the agreement, which could be complicated now that there’s a Democratic House in the mix. While Democrats were largely supportive of modernizing the existing trade regime between U.S., Mexico and Canada, the momentum has stalled as Democrats take a closer look at the agreement. Many Democratic representatives have concerns with the labor, environment and enforcement provisions in the USMCA. In response, President Trump has threatened to withdraw from the existing NAFTA if Democrats demand that the agreement is reopened to address their concerns. The six-month period of withdrawing would force the Democratic House to pass the agreement or risk not having a trade agreement in force within North America.

Don’t expect any action on the USMCA until spring. In late February or March, the White House will send to Congress its Statement of Administrative Action, effectively starting the process of ratification. Sometime this spring, the International Trade Commission will submit an economic impact report on the USMCA to Congress. Further complicating the goal of quiet ratification is the partial government shutdown, which has furloughed federal government personnel in departments and agencies that deal with international trade. PLASTICS continues to follow the USMCA toward ratification and is advocating for its passage on Capitol Hill.

If it’s eventually finalized, PLASTICS believes that the USMCA should make things on the continent easier to predict than they might’ve been in the months after the renegotiation of NAFTA began.

What’s good about the USMCA is that it generally does a great deal to bring the old NAFTA into the 21st century. It preserves duty-free treatment on goods between the three member nations, modernizes customs and trade facilitation, eases employee access across the three countries’ borders and updates the rules of origin for chemicals. It also offers new rules for small and medium-sized enterprises. These are changes that garner bipartisan support, and they’re unlikely to create many waves except among some of the least business-friendly members of Congress.

No agreement is perfect, however, and for the plastics industry, among the biggest issues with the USMCA is that the agreement doesn’t address the aforementioned steel and aluminum tariffs. PLASTICS had hoped the new agreement would put those to rest, but the administration still has to find a way forward with Mexico and Canada separately, which will take more time and cost more money. Additionally, the USMCA includes a sunset provision to terminate itself in 16 years, although a joint review by the three countries can be held on the agreement’s sixth anniversary for automatic renewal for another 16 years.

Though 16 years feels like a long way off, PLASTICS argued that any sunset clause would undermine the certainty that plastics companies relied on when it came to NAFTA and other free trade agreements. While we continue to work with the administration and Congress to firm up the details of the USMCA, there are promising aspects of the agreement that the industry supports. If it’s eventually finalized, we believe that the USMCA should make things on the continent easier to predict than they might’ve been in the months after the renegotiation of NAFTA began.

Other policy and regulatory issues will inevitably arise during the new Congress. PLASTICS will continue to rely on its members for guidance about what’s impacting their businesses on a day-to-day basis and will continue making the case on behalf of every sector of the U.S. plastics industry, from the companies that make the products to the companies that build the molds that make these products possible and every company in between.

Members of the plastics industry supply chain will be on Capitol Hill on March 27 during the 2019 Plastics Industry Fly-In. On the agenda will be educating new members on the benefits of the plastics industry and its products, as well as discussions on recycling infrastructure, open competition for plastic pipe, trade and tariffs and workforce development. Click here for more information on the fly-in.

About the Author

Suzanne Morgan

Suzanne Morgan is the Senior Director of Government Affairs and Grassroots Advocacy for the Plastics Industry Association (PLASTICS).

For More Information

Plastics Industry Association (PLASTICS)

202-974-5200

Related Content

Editorial Guidelines: Editorial Advisory Board

The Editorial Advisory Board of MoldMaking Technology is made up of authorities with expertise within their respective business, industry, technology and profession. Their role is to advise on timely issues, trends, advances in the field, offer editorial thought and direction, review and comment on specific articles and generally act as a sounding board and a conscience for the publication.

Read MoreThink Safety: Eliminate Hazards Throughout the Shop

The tooling community is taking advantage of new products for safer mold shops and molding facilities.

Read MoreMold Design Review: The Complete Checklist

Gerardo (Jerry) Miranda III, former global tooling manager for Oakley sunglasses, reshares his complete mold design checklist, an essential part of the product time and cost-to-market process.

Read MorePredictive Manufacturing Moves Mold Builder into Advanced Medical Component Manufacturing

From a hot rod hobby, medical molds and shop performance to technology extremes, key relationships and a growth strategy, it’s obvious details matter at Eden Tool.

Read MoreRead Next

Reasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More

.jpg;maxWidth=300;quality=90)