Working On My Business: Structural Diversity Enables Nimbleness

Strategies for diversity can pay big dividends. The second part of a three-part series, this article illustrates how diversity of structural capital can be used to create profit.

Diversity of intellectual assets is by far one of the most important business challenges that companies face today. It has major impacts in top-line and bottom-line performance, innovation and product development, leadtimes and responsiveness, employee retention, competitiveness and risk management. In fact, for most organizations, it determines whether a business experiences growth and prosperity or struggles to survive. It's a leadership issue for which there is no option.

In the previous article, the diversity of customer capital as a means to secure the top-line performance (revenue stream and growth) as well as manage the market and customer risk was examined. Each of the five key areas explored help to determine the scale and breadth of the business environment:

- Diversity of market segments.

- Industry seasonality.

- Customer location.

- Business type, maturity, stability and vision.

- Business needs.

This is the starting point as there is no business unless there is a revenue stream. These revenue factors drive the next two levels in the diversity equation. Recall the basic business principle: customers provide revenue and employees create profit. Since human capital represents the moneychangers (i.e., convert revenue to profit), the structural capital merely represents the tools that they use and the operations flow employed to create the profit.

When a company experiences growth, the normal response is to throw more money at one portion of the structural capital (e.g., buy more machines, expand the building, etc.) or expand the human capital (e.g., hire more people - operations staff, more inspectors, etc.). If there is a downturn in revenue because they hadn't managed risk prudently, the management tendency is to layoff the skilled workforce.

When was the last time you heard of a company that sold off machines because sales had slowed? One might initially conclude that this would be a bad decision, but this is not necessarily true. In fact, the human capital is the most expensive asset to replace. In retrospect, one might say that Luca Pacioli - the Venetian monk who is credited with developing double-entry bookkeeping (modern accounting practices) in his writings in 1494 AD entitled Summa de Arithmetica, Geometrica, Proportioni et Proportionalita - had it backwards.

People are the assets and the machines are the expenses. Unfortunately, we have maintained this practice for over five hundred years with the only difference being that instead of amortizing rock throwers over five years, we amortize hi-tech equipment that can cost as much as one million dollars each. While solving the accounting issue may not be possible, what, how and when the intellectual assets are acquired, deployed and utilized can be improved.

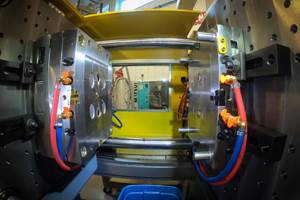

This article will discuss diversity of the structural capital as a toolset used to create profit, further position the company to acquire more revenue and develop a competitive success story. In this context, structural capital encompasses: plant and equipment including space and furnishings; operations layout and flow; and processes, standards and quality. Each of these areas is totally interdependent on each other in terms of costs, throughput, inventory and operations management.

When to Expand?

When does a company decide to expand its physical space? For many companies, the answer is related to a single customer's needs, a hunch about the market or that its current space is so crowded that they literally trip over each other. Seldom does a company truly tie space expansion to market leadership, market demand or market dynamics in general. Even fewer companies link space and its utilization with core competencies like nimbleness, speed or even quality. One might ask why? The answer is that most people believe that it is extremely difficult to accurately compute a return on investment (ROI). Why? Because most companies measure only surface parameters versus shop operations measures. Look around your company. Where could space be better served considering the dynamics of shop flow, people interactions, product flow, scheduling and shipping/receiving? Don't forget that space is three-dimensional - consider the vertical as well.

Ask yourself, if we expand, how will the additional space be used? What are the hidden costs associated with having additional space? When doing the evaluation, consider inventory (raw materials, WIP and finished goods), the interaction of people, the cost-of-capital, more utilities, more demand on current utilities, more insurance, demands on your information systems and the impact on all of the other factors involved in running an effective and efficient operation.

What impact will more space have on flow and productivity? When will the space yield a ROI and how will you measure it? Will you have a quick-turn operations area (sometimes called the hot box)? How will you lay out, position and configure the equipment, conveyers and the staff offices? How well does flow work with inventory management?

Perhaps it may be more productive to have multiple facilities instead of expanding (e.g., one for inventory, one for certain operations, one for assembly, one for distribution, etc.).

Expansion Options

Some companies have even expanded to use space within their customer's walls. One company saw an opportunity to capture additional business from one of its customers who had decided to outsource an operation that was being done inside. Instead of taking everything off-site, the company proposed that they use some of the customer's space (i.e., from that which would be available after the outsourcing) to house a few of the operations. They could then pass on some of the savings back to the customer and facilitate growth simultaneously. The outcome was beyond win-win. Because of the constant presence with the customer, the company was in a position to capture even more new business because they were there.

Another company decided to first evaluate how they were using their current space and compute the costs associated with their current methods. One thing that they found was that they had a tendency to hang on to everything that they ever purchased or made - tools, machines, raw materials, gauges, finished products that were their risk buffers for delivery requirements, partial assemblies, molds, etc. It had nothing to do with whether these items produced revenue or generated profit. Most of the stuff was so old that one could assume that it was stored for the sentimental value alone.

Unfortunately, there is a price associated with sentimental value. These items would show up on the inventory list in accounting as X dollars in value and, in theory, this would make a balance sheet look better - or would it?

In fact, most of the inventory had only a scrap value if one wants to measure true business value. There were hidden costs beyond the expenses for the wasted space. Because this space was occupied, expansion couldn't occur within the current facility's walls. Because this space was occupied, materials and inventory were scattered out across the manufacturing floor and finding that which was needed became a search and rescue mission for the operations staff. Guess how much profit was being generated during these adventures? What do you think happened to the schedules?

What did the company do? First it made a detailed inventory list of everything that it had stowed and moved it all to a single staging area. It then annotated the list as follows:

- Owned by customer (name).

- Acquired or built for customer but owned by company.

- Company-owned equipment (including furnishings and gauges, etc.).

Next, each line item was given one or more of four value ratings:

- Customer potentially sees value.

- Company sees marketing value.

- Company can sell for scrap.

- Company wants to retain for sentimental value.

For those inventory items that were customer-owned: the company called the customer and asked them what they would like to do with this inventory. There were three options: the company would return it to the customer as is - customer pays the freight; the company continues to store inventory as a bonded inventory for $XX per month for a given period of time; or, the company would dispose of the customer's inventory at discretion - customer abrogates ownership. Anything that was left to the company's discretion for disposition and had no marketing or sentimental value was sold as scrap.

Anything that could be used for marketing was assigned to the marketing/sales staff to define usage, compute an ROI (amount and timeframe) and find a place to put the inventory other than stow it in operations. For those companies that had marketing budgets, the inventories were transferred to a marketing inventory and the recurring costs for storage were subtracted from their budgets.

Anything that was to be held for sentimental purposes was stored off-site, placed on storage platforms that were well above the operations areas or given to the employees to remove from the premises.

Everything else was sold as scrap and removed from the premises. The net result was that additional space was made available to better manage shop flow, including material management. Enough money was generated to hire a full-time material manager who facilitated increased productivity. If the company had merely compared the current dollar value of the inventory to its value when produced or acquired, they could rationalize hanging onto the inventory and acquiring more space. When lost opportunity for revenue, lost productivity and the general stress factor were factored into the equation, the answer was obvious.

The same is true for machines and other types of equipment. Do you keep your gauges and measurement instruments and try to force a consensus of readings from several instruments to satisfy your quality inspection requirement during operations or do you acquire accurate instruments, apply a disciplined calibration program standard and procedure and get it right with one measurement?

What Is the Right Purchase?

Which machines should one acquire and when? What bells and whistles are needed? What are the hidden costs associated with having this new modern marvel? When will the machine produce an ROI and how will you measure it? Machines are useless unless they can fulfill requirements determined by real market demand. (The operative words are "real market demand" - as in orders - as opposed to "I love this new machine and want one!") They are inefficient if the job and project scheduling are unstructured and out of control. They are underutilized if the people do not have the appropriate skills to maximize performance, or if the project needs or the machine capabilities are incompatible.

In the article Evaluating New Machine Purchases in Terms of Impact on Operations, in MoldMaking Technology magazine, September 2000 page 77, some of these parameters were discussed. The article identified twenty-five questions that one must answer relative to the purchase of a machine and the relative impact on intellectual assets. Nine of these were related to structural capital. If one reviews the list, it will become obvious that the similarities for evaluating machine and space are nearly identical, albeit from a slightly different perspective.

Each shop is different in its needs and situations. The answer just might be "don't expand space and don't buy more machines." However, the answer is usually to examine the company's basic business and production processes for the interaction of space, people, work tasks and machines, and then decide what to change.

When examining the allocation and usage of capital, you should employ the basic tools for implementing a time-based strategy. On average, 25 to 35 percent of the available operations time is wasted capacity and lost productivity due to the ineffective management of the current structural capital. Further, this waste can be captured rather easily to capitalize on the lost opportunity and improve profitability. And at least that same amount of waste can be found in the deployment of human capital. That's why the philosophy of creative-before-capital makes sense - both common sense and business cents!

Related Content

MMT Chats: Solving Schedule and Capacity Challenges With ERP

For this MMT Chat, my guests hail from Omega Tool of Menomonee Falls, Wisconsin, who share their journey with using enterprise resource planning (ERP)—and their people—to solve their schedule and capacity load monitoring challenges.

Read MorePredictive Manufacturing Moves Mold Builder into Advanced Medical Component Manufacturing

From a hot rod hobby, medical molds and shop performance to technology extremes, key relationships and a growth strategy, it’s obvious details matter at Eden Tool.

Read MoreDynamic Tool Corporation – Creating the Team to Move Moldmaking Into the Future

For 40+ years, Dynamic Tool Corp. has offered precision tooling, emphasizing education, mentoring and innovation. The company is committed to excellence, integrity, safety and customer service, as well as inspiring growth and quality in manufacturing.

Read MoreThe Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

Read MoreRead Next

Reasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read More