Trends Impacting the Supply Chain

The cost of manufacturing and product demand are set to cause financial and business climate changes across the moldmaking industry.

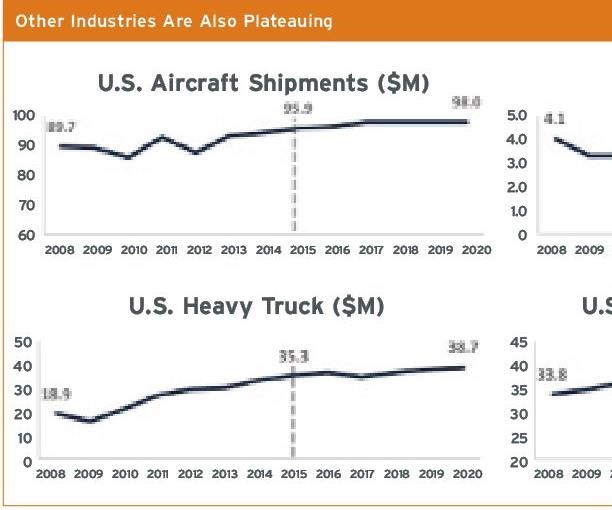

As the foundation on which the United States was built, manufacturing continues to drive our economy. In fact, the Gross Domestic Product (GDP) of U.S. manufacturing is equivalent to that of the 10th largest country in the world. Since the recession, the U.S. has experienced significant growth in many areas, and manufacturing has recovered and grown. However, looking into the future, the industry faces a number of key challenges. The cost of manufacturing is on the rise, and product demand is plateauing across a number of industries, including automotive, aerospace and consumer goods (see Figure 1).

These two critical factors alone will have a long-term impact throughout the manufacturing supply chain and will likely result in some form of financial and business adjustment in the U.S. To be prepared for the future, mold manufacturers must keep an eye on three trends as they implement both near- and long-term strategic planning.

1. Smart Investment

Regardless of the industry, companies are making smart investments in people, processes and technology.

Within the U.S, the average age of a skilled worker is 56. In the tool and die market, the aging workforce and the lack of skilled labor is creating a growing challenge for business owners and they are looking to implement new strategies to attract and retain employees.

In August 2015, the Original Equipment Suppliers Association and manufacturing advisory firm Harbour Results Inc. compiled the OESA/Harbour Results Automotive Tooling Barometer, which found that more than 63 percent of shops polled were planning to hire apprentices in the next 12 months. The industry’s interest in adding apprentices will help address the talent gap challenge but will not put an end to the impending crisis. It takes as many as eight years of training for an apprentice to become a skilled toolmaker. Companies need to look for ways to collaborate with local government, academia and training organizations to build the required workforce (see Figure 2).

In an effort to improve efficiencies and optimize capacity, companies are investing in technology and improved processes. Mid-2015, Harbour Results polled the industry on its likelihood to invest in new machines and found, independent of shop size, there are more than 1,300 planned machine purchases in the next 12 months. Investment in new technology is driving improved throughput and increasing shop capability, which will be critical for businesses to remain competitive and maintain profitability.

Finally, shops are identifying and incorporating new processes to help eliminate waste, reduce rework and deliver overall shopfloor improvements. Shops are tracking internal metrics, reviewing them and utilizing them to make decisions to improve performance. Data is critical for optimizing the shop floor.

The fact is, the best mold manufacturers are those looking to invest in their business while keeping an eye on profitability to meet the growing demand without increasing their footprints.

2. Increased Complexity

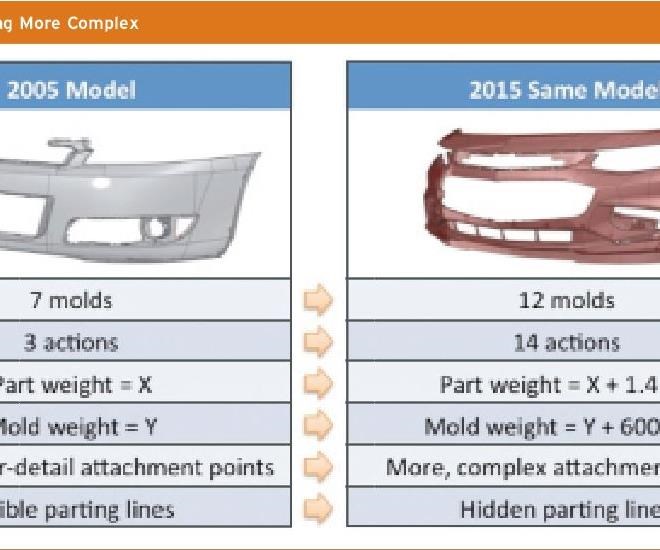

Product complexity continues to be on the rise as new technologies are introduced and consumer preferences evolve (see Figure 3). A great example of this can be found in the automotive industry. Comparing a 2005 vehicle door panel to one produced in 2015 shows an increase in the number of materials used. For example, lighting is now often found within the door, and additional electrical features need to be accommodated. Vehicles in general are more complex, including, for example, in the steering wheel, center stack and front bumper fascia. Additionally, automakers continue to be driven by fuel economy requirements and have turned to new materials such as high-strength steel, aluminum and plastics.

Increased complexity in products can be found across nearly all industries, from washers and dryers to airplanes and more. Some manufacturers are developing methods and strategies to assist in managing the complexity, while others are not. Companies that do not address it face increased product development time and costs, as well as additional costs associated with the need for more tools and higher launch costs. This is not sustainable in the long term.

For mold manufacturers, increased product complexity results in an increased demand for tools, which, of course, is positive for the industry. However, with manufacturing costs on the rise, companies will be looking for ways to squeeze cost out of the manufacturing process, especially at the tooling level. It will become increasingly important for mold manufacturers to drive efficiency improvements and focus on the customers and programs that are profitable.

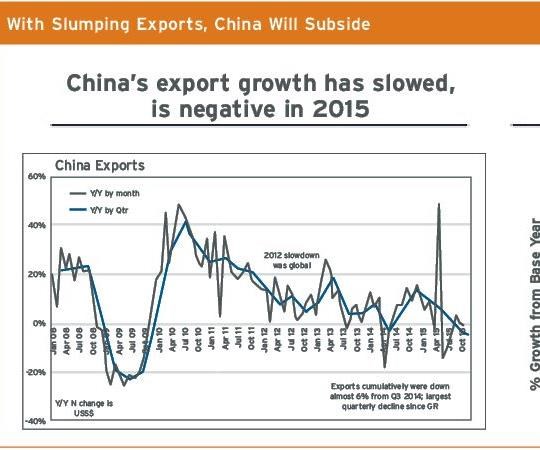

3. China

Since recording double-digit growth in 2010, the Chinese economy has significantly slowed, and the world’s second-largest economy is expected to continue to deteriorate in the near term. China’s exports are significantly decelerating as well, which indicates a decrease in the global economy leveraging the country as a low-cost resource (see Figure 4).

However, in the tool and die segment, demand from North America is on the rise with a compound annual growth rate (CAGR) of 13 percent since 2010, and it is predicted to continue to rise. As manufacturers look for ways to reduce costs, sourcing tooling in China is delivering a price advantage of as much as 35 percent while providing a comparable product.

With the Chinese government supporting manufacturing there by providing subsidies to develop new shops and grow existing ones, domestic shops will continue to face expanding competition from this region. In addition, tool shops in China are delivering better quality than in the past. It is true that some Chinese-made tools still are not the best, but the level of quality and professionalism from that nation has risen dramatically. In fact, many Japanese automotive manufacturers currently are using Chinese tool sources and teaching its suppliers more efficient processes.

Now more than ever, it is critical that mold manufacturers work on “the business.” Companies can no longer afford to guess or to do things the same way they were done in the past. Leadership must gather and review both internal and external data. Triangulation of customer information, industry knowledge/historical performance/experience and external market intelligence are the cornerstones of developing a strategic plan. Near- and long-term strategic plans, coupled with a culture of continuous improvement, will help ensure that they are able to manage adversity within their businesses and leverage today’s trends to optimize business performance.

Related Content

The Trifecta of Competitive Toolmaking

Process, technology and people form the foundations of the business philosophy in place at Eifel Mold & Engineering.

Read MoreThink Safety: Eliminate Hazards Throughout the Shop

The tooling community is taking advantage of new products for safer mold shops and molding facilities.

Read MoreMMT Chats: Solving Schedule and Capacity Challenges With ERP

For this MMT Chat, my guests hail from Omega Tool of Menomonee Falls, Wisconsin, who share their journey with using enterprise resource planning (ERP)—and their people—to solve their schedule and capacity load monitoring challenges.

Read MoreHow to Improve Your Current Efficiency Rate

An alternative approach to taking on more EDM-intensive work when technology and personnel investment is not an option.

Read MoreRead Next

How to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More

.jpg;maxWidth=300;quality=90)