The USMCA Trade Agreement: Impact and Next Steps for Moldmakers

The U.S.-Mexico-Canada trade agreement (USMCA), aka the “new NAFTA” should benefit the majority of North American molders and mold builders.

The United States, Canada and Mexico reached established the U.S.-Mexico-Canada trade agreement (USMCA), aka the “new NAFTA.” Mold builders and molders should evaluate the impact the USMCA will have on their businesses despite many of the provisions not going into effect until 2020 and requiring the approval of the U.S. Congress and similar Canadian and Mexican bodies of government. The USMCA agreement should benefit the majority of North American molders and mold builders. However, those manufacturers with sources in China may need to reconsider their supply chains.

Key USMCA provisions include many of the priorities outlined by PLASTICS (Plastics Industry Association), CPIA (Canadian Plastics Industry Association), and ANIPAC (Asociación Nacional de Industrias del Plástico A.C.), such as harmonizing regulations, streamlining procedures, improving rules of origin (ROO) and eliminating new tariffs.

New labor and content requirements for automotive production are one example of a USMCA provision set to help bring more manufacturing back to the U.S. For example, for products to qualify for zero tariffs, 40 – 45 percent of the content must be done by workers who earn a minimum of $16 per hour and the North American vehicle content is increased from NAFTA’s 62.5 percent to 75 percent. Together these changes will motivate more manufacturing in the U.S. and Canada, and eventually increase worker pay in Mexico.

Next Steps

Although the new USMCA is a win for several key industries and workers, the Reshoring Initiative proposes an agreement that would have a larger impact with longer-term value. For example, a strategy that builds upon the massive U.S. and Canadian markets, Mexico’s proximity to those markets and low-labor costs, and the collective trade deficit in this reshoring and nearshoring era. A recommended next step is to partner with Mexico and Canada to:

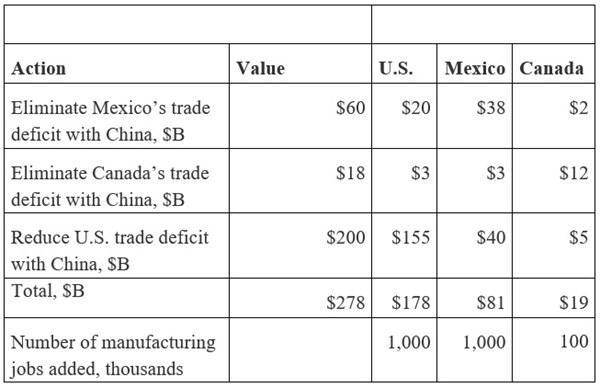

- Eliminate Mexico’s $60 billion and Canada’s $18 billion trade deficits with China. In 2016, the Reshoring Initiative first proposed that Mexico focus on reducing its trade deficit with China instead of increasing its trade surplus with the U.S. and cautioned that an ever-increasing surplus with the U.S. would result in a backlash from their best customer. Mexico’s incoming president, Andres Manuel Lopez Obrador, and his team support this view. Marcelo Ebrard, the incoming foreign minister, said, “We want to reduce the imbalance which is unfavorable to us,” after a meeting between Obrador and China’s ambassador Qui Xiaoqi.

- Shift $200 billion of U.S. imports from China to North America.

- Split the manufacturing to the U.S., Canada, and Mexico based on each country’s strengths.

Now it’s time to work together to eliminate the collective trade deficits with China to strengthen North American manufacturing and bring back millions of manufacturing jobs.

The plan’s economic benefits are:

- Lower offshore prices are driving 70 to 90 percent of U.S. imports. Mexican manufacturing wages average $2.30/hour, which are lower than Chinese wages, so the ex-works price in Mexico should be similar to the ex-works price in China. (Ex-works is a widely-used international shipping term. When importing on Ex-Works terms, the buyer is responsible for the whole shipment from door to door. All costs and liabilities are with the buyer.)

- Lower hidden imports costs (duty, freight, inventory, travel, quality, stock-outs, and IP risk), lower landed cost and lower Total Cost of Ownership from Mexico rather than China.

- Increased market for U.S. exporters of plastics products in Mexico ($16.0 billion in 2017), which is also the largest importer of U.S. tools, dies, jigs and industrial molds (2016 International Trade Administration Industry and Analysis study).

- Increased U.S. content in imported automotive products from Mexico (40 percent vs. 5 percent from China). Every dollar shifted from China to Mexico increases U.S. manufacturing of tooling, automation, electronics, and other products that are still not readily available in Mexico (see Chart).

- Large, underemployed workforce in Mexico ready to work, while the U.S. manufacturing workforce is in critically short supply.

The Reshoring Initiative believes that this plan would increase U.S. sourcing from its neighbors, improve self-sufficiency in case of offshore instability, speed up Mexican manufacturing growth (up to 10 percent a year instead of the typical 3 percent), increase Mexican wage rates (10 percent a year), lessen Mexican drug trafficking, reduce the number of Mexicans migrating to the U.S. and yield long-term North American stability and prosperity. The USMCA changes largely benefit the U.S.. Now it’s time to work together to eliminate the collective trade deficits with China to strengthen North American manufacturing and bring back millions of manufacturing jobs.

Related Content

Treatment and Disposal of Used Metalworking Fluids

With greater emphasis on fluid longevity and fluid recycling, it is important to remember that water-based metalworking fluids are “consumable” and have a finite life.

Read MoreShift in U.S. Mold Imports: Emerging Countries Gain Ground in Market Share

The dynamic nature of the U.S. mold industry's global trade landscape offers challenges and opportunities for growth.

Read MoreCertified Quality Management for Plastics Professionals – Materials to Tooling to Recycling

Why is certification of a shop’s quality management system to ISO 9001, AS9100, IATF 16949 or ISO 13485 so special? What does the certification signify? And what supports the paper behind the framed certificate?

Read MoreVIDEO: What You Need to Know about the R&D Tax Credit Today

A team member from Strike Tax Advisory reviews the tax changes that are impacting the R&D credits for mold builders.

Read MoreRead Next

How to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More