Shops Remain Very Optimistic about Next Three Months

The Original Equipment Suppliers Association (OESA) and Harbour Results, Inc., (HRI) offers the results of its Q2 2017 Automotive Tooling Barometer.

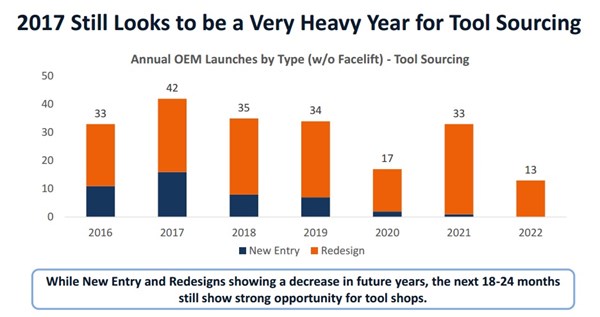

The tooling industry is experiencing a slightly slower second quarter compared to quarter one, however capacity utilization for both mold and die tool makers is still well above 80 percent. Shops with revenue ranges of $40M and above are experiencing peak capacity utilization rates of 95 percent.

“There is still a large discrepancy between tool shops who are very busy, and those who are not,” said Laurie Harbour, president and CEO of HRI. “In fact, we’re seeing the standard deviation in the market widening as the year progresses, and the smallest mold shops are struggling to even maintain 60 percent utilization.”

The clearly cyclical nature of work-on-hold continues, as it rises back above 11 percent. The Detroit Three (D3) are driving significant delays for suppliers. Despite increased program delays, overall sentiment (a tool shop’s general outlook for the next three months) is still at record highs at above 80 points.

The study also addressed differences between supply chains in the industry. Primary tool shops are generally larger, with better relationships at the OEM and Tier 1 level, while secondary shops are more focused on developing niches to fill capacity. Primary shops have consistently had higher utilization (95 percent) than secondary shops (78 percent), yet are more exposed to work on hold, and receive fewer progressive payment terms.

“Each supplier has distinctly different approaches in the marketplace,” said Julie A. Fream, president and CEO, OESA. “As a result, primary shops typically oversell to maintain revenue size and turn to outsourcing to help level loads during particularly busy periods.”

The survey population was comprised of mold shops (72 percent) and die shops (28 percent), both in the U.S. (68 percent) and Canada (32 percent). Shops with revenue ranges less than $5M up to greater than $40M were represented, with the largest percentage of shops coming from the $10-$20M (26 percent) range.

For full report click here.

The OESA/HRI Automotive Tooling Barometer survey series was created by the OESA Tooling Council with the partnership of Harbour Results, Inc. to provide an indicator of the current state of the automotive tooling industry, and the perception of the near-term prospects for the industry. The OESA Automotive Tooling Barometer captures the sentiment of the major companies in this market.