Moldmaking Opportunities in Brazil, Russia, India and China

Estimates as to the future power of the economies of Brazil, Russia, India and China (BRIC) vary greatly. Some sources believe they might overtake the G7 economies by 2027.

Estimates as to the future power of the economies of Brazil, Russia, India and China (BRIC) vary greatly. Some sources believe they might overtake the G7 economies by 2027. More modestly, Goldman Sachs argues that, although the four BRIC countries are developing rapidly, it will take until 2050 for their combined economies to eclipse the combined economies of today’s richest countries. However, while the four BRIC countries accounted for more than a quarter of the world’s land area and more than 40 percent of the world’s population in 2010, they accounted for only one quarter of the world gross national income.

The BRIC economies matter because of their weight. They are the four largest economies outside the Organization for Economic Co-operation and Development (OECD), and they are the only developing economies with annual gross domestic product (GDP) of more than $1 trillion. With the exception of Russia, they sustained better growth than most other economies during the last recession. Without them, world output would have fallen by even more than it did. China also recently became the world’s largest exporter.

In 2012, China, Brazil, India and Russia were the destination for $4.8 billion, $2.0 billion, $736 million and $408 million of U.S. plastics industry exports, respectively. Combined, this represented 14 percent of total U.S. plastics industry exports in 2012.

Macroeconomic Overview

Brazil

With a GDP of $2.253 trillion in 2012, Brazil is the world’s seventh wealthiest economy. It is also the largest country in area and population in Latin America and the Caribbean. The country hosted the 2014 World Cup and will host the 2016 Summer Olympics, which will dictate massive investments in areas such as urban and social development, and transportation infrastructure.

The Brazilian economy slowed significantly from 2010. Its 7.5 percent GDP growth dropped to 2.7 percent in 2011 and fell to 0.9 percent in 2012. Industrial output and investment demand were affected disproportionately. The slowdown was driven by both domestic and external factors, however Brazil’s strong domestic market was less vulnerable to the external crisis. Brazilians are benefiting from stable economic growth, relatively low inflation rates and improvements in social well-being.

The financial sector handled the slowdown fairly well. The banking system remained sound and resilient. Despite rapid credit growth, lower interest rates assisted in containing delinquencies and allowed asset quality to broadly stabilize. Foreign direct investment has been more than adequate to cover the current account deficit, which has remained around 2.2 percent of GDP. In spite of this, portfolio flows exhibited significant volatility because of changing interest rate differentials and the imposition of financial transaction taxes.

Brazil’s overall macroeconomic framework appears strong and sustainable over the medium term. The main risks originate from the external environment, although these are mitigated by high foreign reserve levels (about $380 billion), favorable external debt composition, a current account fully covered by foreign direct investment and an overall low degree of trade openness.

In 2007, the Brazilian government launched a growth acceleration plan to increase investment in infrastructure and provide tax incentives for faster and more robust economic growth. In 2012, the government also launched a range of initiatives to reduce energy costs, restructure oil royalty payments, strengthen investment in infrastructure through foreign participation and reform the subnational value-added tax.

Brazil is a country with extreme regional differences, especially in social indicators such as health, infant mortality and nutrition. The richer south and southeast regions experience a much better quality of life than the poorer north and northeast.

In Brazil, poverty has dropped significantly, from 21 percent of the population in 2003 to 11 percent in 2009. Extreme poverty also has fallen dramatically, from 10 percent in 2004 to 2.2 percent in 2009. Between 2001 and 2009, the income growth rate of the poorest 10 percent of the population was 7 percent per year, while that of the richest 10 percent was 1.7 percent. This helped decrease income inequality to a 50-year low of 0.519 in 2011. (Income inequality is measured by the Gini coefficient, a measure of statistical dispersion intended to represent the income distribution of a nation’s residents.) Even with these achievements, inequality still remains at relatively high levels for a middle-income country. Brazil reached universal coverage in primary education, but despite this accomplishment, the country still struggles to improve the quality and outcome of the system, especially at the basic and secondary levels.

Another area of improvement is in the sustainable use of natural resources. Energy generation relies strongly on renewable sources, and ethanol is a key ingredient of this strategy, but the pricing decisions of the majority government-owned oil company have resulted in petrol prices below import costs, thus undermining the ethanol industry. Carbon emissions have declined and deforestation has slowed, although its current pace still equals the destruction of forests the size of Belgium (or the Brazilian state of Alagoas) every 5 to 6 years. This is occurring even though Brazil has worked to reduce the deforestation of the rain forest and other sensitive biomes.

Russia

Russia’s economy is confronting a downturn with real GDP growth slowing to an estimated 1.3 percent in 2013 from 3.4 percent of 2012. The absence of comprehensive structural reforms has resulted in the erosion of confidence, which became the decisive factor for the downward revision of the World Bank’s recent growth projections for the country.

In the past, the lack of such necessary reforms was masked by a growth model based on large investment projects, continued increases in public wages and transfers—all fueled by sizeable oil revenues. Recent events around Crimea have transformed the ongoing confidence problem into a confidence crisis and more clearly exposed the economic weakness of this growth model.

In 2013, weak domestic demand served as a drag on economic growth and private investors did not start investing more during the second half of 2013 as expected. The combination of no structural reforms and decreasing profit margins weighed heavily on business sentiments and pushed down industrial and investment activities in Russia. Consumption remained the main growth driver, supported by fast credit and wage growth, however the level of growth was less than half of what it was in 2012. External demand recovered as expected in the second half of 2013 with strong export growth.

Given the higher risk environment due to political uncertainties related to the crisis in Crimea, the World Bank developed two alternative scenarios for Russia’s 2014-2015 economic growth outlook. The low-risk scenario assumes a limited and short-lived impact of the Crimea crisis and projects growth to slow to 1.1 percent in 2014 and slightly pick up to 1.3 percent in 2015. The high-risk scenario assumes a more severe shock to economic and investment activities if the geopolitical situation worsens and projects a contraction in output of 1.8 percent for 2014.

Russia’s long-term outlook depends on a sustained positive improvement in investor and consumer confidence. Structural reforms should be started in the coming years. The inefficiencies in factor allocation across the economy must be addressed to attract larger private investment in a sustained manner and on a larger scale. The quality of regulatory and market institutions will have to improve so that rules are implemented uniformly.

With energy prices stagnating and labor and capital becoming fully utilized, growth is falling behind pre-crisis rates. Making the economy stronger, more balanced and less dependent on natural resource extraction is a crucial challenge. This transition requires higher productivity growth and greater energy efficiency, stronger investment, and better matching of skills and jobs.

Stronger and more sustainable growth is not possible without better use of skills and stronger innovation. In Russia today, considerable resources are dedicated to low-productivity activities. Lifelong learning programs and temporary income support remain underdeveloped. Public spending on education is low, and great disparities in educational opportunities exacerbate the problem.

Despite a long tradition of scientific excellence, Russia performs worse than most OECD countries in terms of scientific output and securing patents, which is partly linked to the unfinished reform of the public R&D sector. Firms infrequently view innovation as a part of their business model. Although recently their innovation policies have become more targeted, results have yet to materialize.

India

With 1.2 billion people and the world’s fourth-largest economy, India’s recent growth and development is a significant achievement. Since gaining independence from Britain, the country has brought about an agricultural revolution that has transformed it from chronic dependence on grain imports into a net exporter of food. Life expectancy has more than doubled, literacy rates have quadrupled, health conditions have improved, and a sizeable middle class has emerged.

After recovering from the 2009 global downturn, the Indian economy experienced another drop in economic growth in 2011. GDP increased by 6.5 percent from 2011 to 2012—the slowest annual growth in almost a decade—and the weaker growth has continued. The composition of that growth has also become less resilient. Prior to the economic slowdown, capital formation underpinned the heady growth. Now it is languishing, while manufacturing, another key engine of growth, has been chronically weak. This slowdown is only partly cyclical and reflects the emergence of energy, infrastructure, human capital and institutional hindrances.

India will soon have the largest and youngest workforce in world history. At the same time, the country is undergoing a massive wave of urbanization, as some 10 million people move to towns and cities each year in search of jobs and opportunity. It is the largest rural-urban migration of this century.

The potential for sustained strong growth is high. A very young Indian population together with declining fertility has resulted in a falling youth dependency rate. The national savings rate is also high and, given favorable demographics, could well rise further in the medium-term. This could provide the much needed capital to fund investment in infrastructure as well as a strong expansion in private enterprise. Furthermore, despite more people being employed in the industrial and service sectors, around half of all workers remain in low-value-added agriculture jobs. The scope is therefore enormous for economy-wide productivity gains from the further migration of workers into high-value-added economic activities.

India will require huge investments to create the jobs, housing and infrastructure necessary to meet rising expectations, and make towns and cities more livable and green. Sufficient economic growth will be key to lift the more than 400 million people out of poverty. Another concern is those who have recently escaped poverty (53 million people from 2005 to 2010 alone), but who are still very vulnerable to falling back into it. In fact, due to population growth, the absolute number of poor people in some of India’s poorest states actually increased during the last decade.

The inequity that exists regionally and by caste (a social stratification system) and gender must be addressed. Poverty rates in India’s poorest states run three to four times higher than those in the wealthier states. In 2011, India’s average annual per capita income was $1,410. This places it among the poorest of the world’s middle-income countries. It was just $436 in Uttar Pradesh (which has more people than Brazil) and only $294 in Bihar, one of India’s poorest states. Disadvantaged groups will need to be brought into the mainstream to reap the benefits of economic growth, and women will need to be empowered to take their place in the socioeconomic fabric of the country.

Fostering greater levels of education and skills will be critical to promote prosperity in a rapidly globalizing world. Primary education has largely been universalized, however learning outcomes remain low. Less than 10 percent of the working-age population has completed a secondary education, and too many secondary graduates lack the knowledge and skills to compete in today’s changing job market.

Improving healthcare will be equally important. Although India’s health indicators have improved, maternal and child mortality rates are still very high, and in some states are on par with those seen in the world’s poorest countries. Of particular concern is the nutrition of India’s children, whose health will determine the scale of the country’s much-anticipated demographic dividend. Today, 40 percent (217 million) of the world’s malnourished children are in India.

The country’s infrastructure needs are staggering. One in three rural people lack access to an all-weather road, and only one in five national highways is four-lane. Ports and airports have inadequate capacity, and trains move very slowly. An estimated 300 million people are not connected to the national electrical grid, and those who are face frequent disruptions.

In the face of these challenges, a number of India’s states have come forward with bold new initiatives to tackle many of the country’s long-standing challenges and are making great strides towards inclusive growth. Their successes are leading the way forward for the rest of the country, indicating what can be achieved if the poorer states learn from their more prosperous counterparts.

China

Since initiating market reforms in 1978, China has moved from a centrally planned economy to a more market-oriented one, and has experienced rapid economic and social development. GDP growth averaging about 10 percent a year has lifted more than 500 million people out of poverty. With a population of 1.3 billion, China recently became the second largest economy and is increasingly playing an important role in the global economy.

Despite these achievements, China remains a developing country, and its market reforms are incomplete. Official data shows that 99 million people still lived below the national poverty line of 2,300 renminbi per year at the end of 2012. With the second largest number of poor in the world after India, poverty reduction remains an ongoing challenge.

China’s rapid economic rise has brought a number of challenges as well, including high inequality, rapid urbanization, challenges to environmental sustainability and external imbalances. The country also faces demographic pressures related to an aging population and the internal migration of labor. If China’s growth is to be sustainable, then significant policy adjustments are required. Successfully transitioning from middle-income to high-income status is oftentimes more difficult than moving up from low to middle income.

China’s 12th Five-Year Plan (2011-2015) does confront these challenges. It emphasizes the development of services and measures to address environmental and social imbalances by establishing targets to reduce pollution, increase energy efficiency, improve access to education and healthcare, and expand social protection. Its annual growth target of 7 percent demonstrates a focus on quality of life rather than pace of growth.

From 2008 to 2013, real national income increased at an annual average rate of 8.6 percent, while the share of household income in it stabilized. This process has resulted in growth benefits for a wider section of society. In both urban and rural areas, the income of the lowest decile of households went up faster than that of the top decile. The number of people living in absolute poverty fell from 99 million in 2012 to 82.5 million in 2013 (6 percent of the population).

Therefore, rural poverty is now concentrated in those areas with the most harsh geographic conditions. Although these recent developments have neutralized most of the increase in inequality that occurred between 2003 and 2008, the Gini coefficient still remains high at 0.47. This slightly exceeds the 0.45 weighted average for the three OECD countries with the lowest income per head and the highest levels of inequality (Chile, Mexico and Turkey).

The improvement in income distribution in China in the past five years is largely attributable to two factors: the continued shift from jobs in farming to better-paying, non-agricultural jobs associated with urbanization, and government policies extending the social safety net. A key challenge facing the government moving forward is to facilitate and make the most of rural-to-urban migration, especially in the context of rapid demographic aging. A further challenge for the government is to ensure the removal of barriers to entry for non-public companies in parts of the service and manufacturing sectors.

Ease of Doing Business

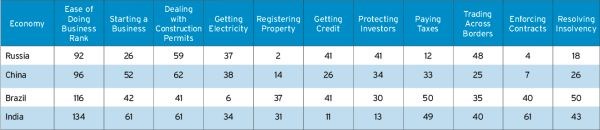

The World Bank has developed an index that ranks 189 economies on their ease of doing business. A high ranking on this Ease of Doing Business Index means the regulatory environment is more conducive to the start and operation of a local firm. The index averages the country’s percentile rankings on 10 equally weighted topics, made up of a variety of indicators. Countries are also ranked in each topic.

Although it is not specific to the plastics industry or exclusively regulatory in focus, this index provides an excellent benchmarking tool to assess a country’s general business climate/environment over time and in comparison to other export markets.

Chart 1 compares the overall Ease of Doing Business rankings and individual indicators for Russia, China, Brazil and India. The following findings reflect reforms implemented from June 2012 to June 2013 that affect all sets of indicators among the four BRIC countries.

Chart courtesy of the World Bank.

Russia

Abolishing the requirement to have a bank signature card notarized before opening a company bank account has made it easier to start a business in Russia. Eliminating several government agency requirements for project approvals and reducing new building registration times has eased the construction permit process as well. Transferring property is now simpler through streamlined procedures and effective time limits for processing transfer applications. An electronic system for submitting export/import documents and a reduction in the number of required physical inspections also has made trading across borders easier. Getting electricity is simpler and less costly due to standard connection tariffs and the elimination of previously required procedures.

China

China improved its credit information system through industry regulations that guarantee the borrower’s right to inspect his/her data. By amending its civil procedure code to streamline and speed up all court proceedings, enforcing contracts is now easier.

Brazil

Brazil implemented no reforms to improve the ease of doing business during this time period.

India

No reforms were implemented in India to improve the ease of doing business during this time period.

U.S. Plastics Industry Exports

This breakdown shows U.S. plastics exports shipped to each BRIC country, ranked highest to lowest total dollar value.

China

From 2000 to 2013, U.S. plastics industry exports to China grew by 546.3 percent from $745.7 million to $4.8 billion, and from 2012 to 2013, they increased by 0.5 percent. Plastics imports from China grew 6.6 percent to $12.2 billion, yielding a trade deficit of $5.6 billion.

U.S. plastics industry exports in 2013 by core segments were:

Resins: $3.5 billion (0.6 percent increase)

Products: $1.2 billion (2.3 percent increase)

Machinery: $137 million (15.7 percent decrease)

Molds: $15 million (27.8 percent increase)

Brazil

From 2000 to 2013, U.S. plastics industry exports to Brazil grew by 191.6 percent from $770.3 million to $2.3 billion, and from 2012 to 2013, they increased by 11.4 percent. Plastics imports from Brazil dropped 0.9 percent to $232.2 million, yielding a positive trade surplus of more than $2.0 billion.

Resins: $1.7 billion (13.4 percent increase)

Products: $461 million (5.6 percent increase)

Machinery: $64 million (7.9 percent increase)

Molds: $7 million (20.4 percent decrease)

India

From 2000 to 2013, U.S. plastics industry exports to India grew by 770.7 percent from $80.7 million to $702.3 million, and from 2012 to 2013, they decreased by 4.6 percent. Plastics imports from India fell 0.5 percent to $435.5 million, yielding a positive trade surplus of $266.8 million.

Resins: $504 million (4.1 percent decrease)

Products: $170 million (3.3 percent decrease)

Machinery: $27 million (19.1 percent decrease)

Molds: $1 million (0.3 percent decrease)

Russia

From 2000 to 2013, U.S. plastics industry exports to Russia grew by 739.3 percent from $47.2 million to $395.9 million, and from 2012 to 2013, they decreased by 2.9 percent. Plastics imports from Russia increased 20.2 percent to $24.8 million, yielding a positive trade surplus of $371.1 million.

Resins: $303 million (-9.1 percent)

Products: $73 million (+18.3 percent)

Machinery: $20 million (+55.4 percent)

Molds: $377 thousand (+272.1 percent)

Export Opportunities for Moldmakers

In evaluating the BRIC countries for moldmaking-specific export opportunities, only China and Russia showed overall growth for molds from 2012 to 2013. The top growth areas identified by mold type being exported were: injection (74.6 percent), injection/compression for semiconductor devices (198.9 percent), injection/compression for shoe machinery (25.4 percent) for China and non-injection/non-compression (62.2 percent) for Russia. The most consistent mold type performer for China from 2000 to 2013 was injection. Even Brazil and India showed some growth from 2012 to 2013 when evaluated by mold type being exported.

Brazil saw growth in compression molds (52.9 percent), injection/compression for shoe machinery (38.4 percent) and injection/compression for semiconductor devices (978.9 percent), although the latter category had some years without any exports and exhibited significant ups and downs from 2000 to 2013.

India’s growth by mold type exported was in injection/compression for shoe machinery (3,211.6 percent) and compression (1,476.2 percent). For these two categories, however, India had years without any exports and exhibited significant ups and downs from 2000 to 2013.

Related Content

The In's and Out's of Ballbar Calibration

This machine tool diagnostic device allows the detection of errors noticeable only while machine tools are in motion.

Read MoreMantle TrueShape Advances Medical Mold Manufacture

In a recent case study, Mantle’s 3D-printed inserts enabled a medical device manufacturer to reduce 12-week lead times for prototype mold production to 4 weeks and at one-third of the cost.

Read MorePredictive Manufacturing Moves Mold Builder into Advanced Medical Component Manufacturing

From a hot rod hobby, medical molds and shop performance to technology extremes, key relationships and a growth strategy, it’s obvious details matter at Eden Tool.

Read MoreInternational Partnership Improves IBM Preform Precision

Hammonton Mold Co. and ADOP France team up to bring injection blow mold preform design and service to the next level.

Read MoreRead Next

Moldmaking Opportunities in NAFTA Markets

North America contains the two largest trading partners for the U.S. plastics industry—Mexico and Canada. In 2012, these two countries were the destination for $13.6 billion and $12.5 billion worth of U.S. plastics industry exports, respectively. Combined, this represented 31 percent of total U.S. plastics industry exports in 2012.

Read MoreMoldmaking Opportunities in Central and South America

In addition to the Asian region, Central and South America represent a high growth area for the U.S. plastics industry.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read More

.jpg;maxWidth=300;quality=90)