Getting the Tax Advantages You Deserve

A look at how one moldmaker is benefiting from the R&D tax credit.

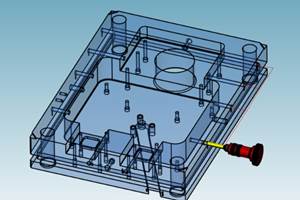

Dynamic Engineering (Minneapolis, MN)—a manufacturer of complex, multi-cavity molds for the medical, electronic and consumer products industries—specializes in precision molds for powder and plastic injection. The shop runs smoothly and meets the stringent leadtimes placed upon it. Recently Peter McGillivray, Dynamic Engineering’s president, attended an AMBA chapter meeting and heard a speech about shops taking advantage of an R&D tax credit. He quickly dismissed it as something that didn’t apply to his shop, until he returned from the convention and learned that a competitor reaped a six figure return from this very credit—which piqued his interest and warranted further investigation.

The R&D tax credit is unfamiliar to most small and mid-size mold manufacturers. It also is unfamiliar territory to many accounting firms and CPAs because it is a very specialized area of the tax code. The definition of the tax credit is as simple as it sounds: it is research and development for tax credit purposes—available on both a federal level and a state level if that state offers it.

Qualifying shops can reap the rewards of a substantial return. Chances are, if a shop is engaged in activities that are developing or improving products, or developing and improving processes, R&D is probably being conducted. While these terms are fairly broad, enlisting help from a tax firm that specializes in the R&D tax credit can help a shop determine if it can generate this tax credit. That is where McGillivray started his quest.

The Tax Relief Process

The seminar McGillivray attended at the AMBA chapter meeting was given by Scott Schmidt, Principal at the Black Line Group (Plymouth, MN)—a company that focuses exclusively on providing R&D Tax Credit expertise to small and mid-size business owners. “Scott was at the right place at the right time,” McGillivray recalls. “After thinking about his presentation again, I liked what I heard and saw no need to contact other firms. Companies like Black Line can educate your shop on what constitutes R&D and walk you through the process. His people educated our internal people and external accounting firm to get us going in the right direction.”

First, a representative from the Black Line Group set up an initial evaluation conference call with key Dynamic Engineering employees to introduce them to the rules of qualifying for the credit and start identifying what activities may fall within the R&D tax credit guidelines. “Working with them was very smooth and very professional,” McGillivray notes. “They took the initiative to make it happen for us. We didn’t have to reinvent the wheel here internally and open communications made things proceed quickly.”

Then, Black Line Group paid Dynamic Engineering a visit to talk to its employees about the definition of research and development (see R&D Activities sidebar), what their daily activities are and how they are spending their time. According to Schmidt, it is through this education that the tax credit firm can help the moldmaker accumulate all of their costs associated with R&D activities. “During this phase, in addition to the employee interviews, the tax credit firm should examine the moldmaker’s tax return, payroll information, and any other information available that can help establish some historical data. Normally it is readily available information and it is not necessary for the moldmaker to create a project tracking system,” Schmidt says.

“This helped us tremendously,” McGillivray notes. “Prior to them coming on board, if someone said R&D to me I would have pictured a shop with some big lab and thought this credit would not apply to us.” The process took several months, McGillivray notes, with back-and-forth communications between Black Line and Dynamic Engineering. “Sometimes we held Black Line up during our very busy times!” he laughs. “Here and there some Dynamic employees needed some extra time. Fortunately applying for the credit isn’t constant work.”

From the meetings and conversations, Black Line Group created a supporting binder, which contained the quantitative part of the analysis—including the calculations as well as the input for the calculations—and write-ups of all of the activities and costs that are considered “Qualified Research Expenditures” (QREs). Then, the firm worked with Dynamic Engineering’s Accounting Department and the company’s outside accounting firm Carlson Advisors (Minneapolis) to help them file amended returns and decide how to best use the credits. “Since Black Line Group took the time to educate our people properly, we can now take care of this credit in the future,” McGillivray emphasizes.

A Profitable Venture

Besides the most obvious advantage—a tax credit totaling “hundreds of thousands” of dollars—McGillivray notes that obtaining this credit has leveled the “global” playing field for his company. “Our industry talks about how the playing field isn’t level in the global marketplace,” he states. “However, if you consult a tax credit firm and put a little time and effort into the R&D aspect of what the government says you are entitled to, it helps to re-level the table a little bit.”

Additionally, McGillivray says that consulting the experts saves time because “they are the professional and know exactly what to look for—and for what the IRS is looking.” Furthermore, his employees now know what activities can generate this lucrative credit. As a result, Dynamic Engineering has started to track specific projects that entail a lot of R&D. “By directly documenting all of these efforts that are put into a specific part of the job that are R&D related, it makes obtaining future tax credit easier,” he comments.

“Moldmakers who don’t take advantage of the R&D tax credit are really missing out on a great opportunity,” McGillivray states. “It is a no-brainer.”

Related Content

CAD/CAM Software Reduces Delivery Times by 70% With a Six-Month ROI

Single integrated CAD/CAM package reduces translation errors, simplifies design process, improves shop efficiency and shortens tool lead times.

Read MoreCAM Automation Increases Mold Production, Quality

Mold builder switches CAM software package after 20 years to take advantage of innovative programming strategies that reduce mold machining programming and processing times.

Read MoreIntegrated CAD/CAM Streamlines Electrode Manufacture, Improves Quality

A focus on electrode design and automation helps toolroom improve efficiency, reduce tooling costs and deliver higher quality products.

Read MoreOEE Monitoring System Addresses Root Cause of Machine Downtime

Unique sensor and patent-pending algorithm of the Amper machine analytics system measures current draw to quickly and inexpensively inform manufacturers which machines are down and why.

Read MoreRead Next

Are You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read More

.jpg;maxWidth=300;quality=90)

.jpg;maxWidth=970;quality=90)