GBI: Moldmaking for January 2016 - 43.1

Future capital spending plans continue to increase, hitting $1 million for the first time since July 2014.

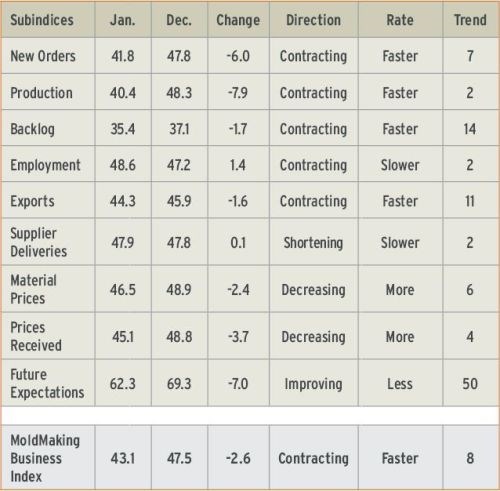

With a reading of 43.1, the Gardner Business Index showed that the moldmaking industry contracted in January for the eighth month in a row. While the index had improved notably in November, it declined in the following two months and now is at its lowest level since November 2012.

New orders contracted for the seventh month in a row, dropping significantly in January to where they were in October. Production contracted for the second month in a row after just one month of expansion in November. The backlog index remained mired in contraction. This subindex has been below 40 in six of the previous seven months, indicating that capacity utilization in the industry will continue to fall through at least the first half of this year. Employment also contracted for the second month in a row. Because of the strong dollar, exports continued to contract in January, with a rate of contraction that has been fairly constant since October. Supplier deliveries shortened for the second straight month.

The material prices index contracted for the sixth month in a row, reflecting the fall in almost all commodity prices due to the weak global economy. Prices received contracted for the fourth month in a row, although the rate of the decrease accelerated from the previous two months. Future business expectations, which have bounced around in recent months, fell to their lowest level since November 2012.

The index for companies with more than 250 employees contracted for the second month in a row. Plants with 100-249 employees had their lowest index since November 2012, which was a significant drop from December 2015. Facilities with 50-99 employees expanded for the second month in a row. Companies with 20-49 employees grew for the first time since April 2015, while companies with fewer than 20 employees posted an index below 40 for the third time in four months.

Custom processors contracted for the seventh month in a row, although January’s index improved somewhat from the month before. Meanwhile, metalcutting job shops contracted for the eighth time nine months to the lowest level since the survey began in December 2011.

For the second month in a row, the Southeast was the only region to grow, having expanded for three consecutive months. The Northeast contracted at the slowest rate of the other regions, followed by the North Central-East, North Central-West, West and South Central. Both the West and South Central posted an index below 40.

Future capital spending reached $1 million for the first time since July 2014. This was above the historic average and an increase of almost 82 percent compared with January 2015. It was the second month in a row that future capital spending plans have increased month over month.

Related Content

-

Tackling a Mold Designer Shortage

Survey findings reveal a shortage of skilled mold designers and engineers in the moldmaking community, calling for intervention through educational programs and exploration of training alternatives while seeking input from those who have addressed the issue successfully.

-

Mold Design Review: The Complete Checklist

Gerardo (Jerry) Miranda III, former global tooling manager for Oakley sunglasses, reshares his complete mold design checklist, an essential part of the product time and cost-to-market process.

-

Predictive Manufacturing Moves Mold Builder into Advanced Medical Component Manufacturing

From a hot rod hobby, medical molds and shop performance to technology extremes, key relationships and a growth strategy, it’s obvious details matter at Eden Tool.

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=970;quality=90)