Driving Cost Out of the Value Chain

Study reveals cost challenges among the automotive tooling supply chain and recommendations for driving profitable growth.

Three times a year, Harbour Results Inc. (HRI) and the Original Equipment Suppliers Association (OESA) survey senior leadership at U.S.-based mold, tool and die companies to assess the current state of the automotive tooling industry as well as near-term trends impacting the industry. This year’s initial survey delivers in-depth analysis of issues driving cost throughout the automotive supply chain.

This Automotive Tooling Barometer survey, which was distributed in late January, was responded to by shops with annual revenue ranging from less than $5 million to greater than $75 million. Fifty-six percent of respondents produce molds, 41 percent produce stamping tools and dies, and 3 percent produce fixtures and jigs. It is apparent from survey feedback that the end of 2015 and beginning of 2016 have been very challenging for the mold, tool and die industry. Approximately 50 percent of tool shops that responded to the survey reported that more than 10 percent of their work was “on hold.” This may be due to automakers delaying program launches, or late changes in design and processes based on manufacturing, mold or tool-build feasibility, or cost-saving activities.

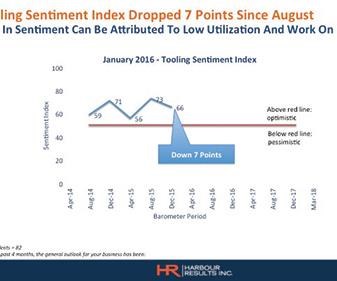

The survey also measures tool shop sentiment, which is defined as the general outlook on the industry. This most recent survey reports a seven-point drop in overall sentiment in the four-month period since the last survey, conducted in August 2015. Jobs on hold and the fact that overall shop capacity utilization remained flat at 82 percent are key drivers of this decrease.

Despite this drop in overall sentiment in the first part of the year, 75 percent of survey respondents are optimistic about the remainder of 2016. This optimism is supported by a recent forecast by LMC Automotive, a provider of market intelligence on the automotive industry, which indicates that new vehicle launches will remain high into the near future, with 49 and 39 launches predicted for 2018 and 2019, respectively. A large majority of these new vehicle launches are expected to be sourced in the second and third quarter of this year, as per the average lead time required for tool development.

Growth Barriers and Strategies

However, as we look to the future of the automotive industry, volumes are expected to start to plateau. The same forecast from LMC Automotive also indicates that North American light vehicle demand will level off at 20 million units through 2020. This, coupled with the increased number of models being launched, creates a high-mix-low-volume scenario that could likely strain automaker profitability. From 2015 to 2018, the number of North American vehicle models in production will jump 18 percent from 243 to 287. In that same time period, the number of models with fewer than 100,000 units will increase 21 percent. This translates to more than 800 trim levels (different versions of the same model, with different features and equipment) on the road by 2018.

For continued profitable growth, the automotive industry must address the rising cost of manufacturing. This fact drove HRI/OESA to delve further in analyzing the Automotive Tooling Barometer to uncover key issues that are adding unnecessary cost to vehicle design and development, and vehicle tooling, in particular. Traditionally, this survey only secures feedback from mold, tool and die shops. However, for this added research, automakers and Tier 1 suppliers were surveyed to get more robust insights. To better understand their responses, we break down the feedback

by audience:

Automakers. The overall feedback from automakers is that tools are over-engineered, and Tier 1 suppliers and tool shops create overly complex tools. Specifically, this group said Tier 1 suppliers implement excessive design standards related to materials and tool requirements.

Traditionally in the building of a mold or tool, automakers provide a set of requirements to the Tier 1 supplier, which coordinates with the tool shop to produce that mold or tool. In some instances, the suppliers and tool shops are adding to those requirements, making a tool increasingly more complex and costly. For example, a tool might be designed for quick change on the assembly line to accommodate a Tier 1 supplier’s requirements, when, in reality, the tool could run on the line for extended periods of time without requiring a quick-change design. Another example is a Tier 1 supplier specifying a tool that is larger than necessary so it can be run in high-tonnage pressure machines or including scientific mold devices to ensure their processes. These examples drive additional cost into mold/tool development.

The survey also indicates that automakers believe there is a lack of transparency throughout the quoting, design and build process for molds. Oftentimes, the three parties—automakers; Tier suppliers; and mold, tool and die shops—do not communicate directly. This can result in critical information being miscommunicated or not communicated at all, which can impact how a tool is quoted. For example, if unneeded work and cost are added to a project, or the project does not have an accurate timeline for production, overtime work and the associated costs might be required to complete the tool on time.

Automaker respondents also indicated three ways that tool shops create increased tooling costs. First, they sometimes use custom-built components when off-the-shelf components would suffice. Commonizing parts, such as using a standard-size hole across all models, can save costs in their manufacture all the way down to mold/tool production. By not making use of these commonized parts, both time and cost are added to the mold/tool development process.

The automakers highlighted insufficient quoting processes used by tool shops as a second way that these shops increase tooling costs. Typically, quoting is not standardized within or across tool shops, and this makes it difficult to accurately determine the cost of developing a tool. This can lead to higher quotes to cover any quoting errors.

Finally, this group indicated that tool shops use dated technology and processes, which results in less efficient tool development and potential quality issues. For example, very few mold, tool and die shops are leveraging advanced information systems like enterprise resource planning (ERP) software that could streamline processes and ultimately uncover some hidden inefficiencies and cost within the shop.

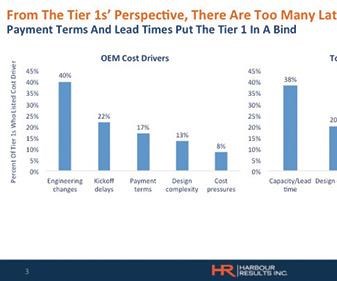

Tier 1 suppliers. The primary issue leading to increased costs, according to this group of respondents, is engineering changes made by the automaker late in tool development. Thirty-eight percent of these respondents also indicated that constraints on current tool shop capacity and lead-time requirements are adding expenses in the value chain. For example, when a tool shop cannot effectively manage its production capacity, it will experience severe ups and downs. As a result, if a Tier 1 supplier needs a tool, but the shop is too busy or doesn’t manage its time well, the supplier will likely pay a premium on the project.

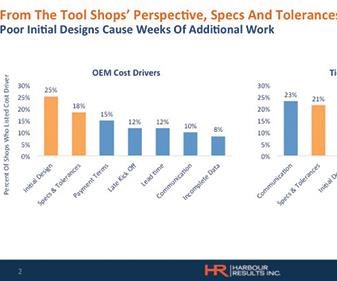

Tool shops. The biggest drivers of unnecessary costs, according to tool shops, are initial designs, and specs and tolerances. Specifically, they cite poor initial design, such as those that are incomplete or unapproved. Once a tool shop receives a design and begins to work on it, any changes to that design will add to not only development time but also overall costs. Depending on its magnitude, the change may require an entirely new tool design and engineering, which would then need to be approved by the Tier 1 supplier and automaker. Frequently, however, the original production timeline is firm, so overtime and/or compression costs will be incurred in order to implement the changes within that timeline.

Additionally, this group of respondents indicated that it also believes that tool specs and tolerances are too tight. It is critical that a mold or tool functions correctly in order to produce a quality part, but tool shops said Tier 1 suppliers and automakers often require fine machining and tight tolerances in areas of the tool that do not impact its functionality. This is true of unnecessary geometric dimensioning and tolerancing (GD&T) as well. Developing a tool is a balance between cost and functionality. Tool shops indicated that by focusing on specs and tolerances for the areas that directly impact the function of the tool, or of the part itself, rather than creating a so-called “perfect” tool, costs could be reduced.

The final issue highlighted by tool shops was lack of communication, the same assertion made by the automakers. Only 24 percent of all tool shops surveyed say they are frequently involved in conversations involving both Tier 1 suppliers and automakers.

Building a Stronger Foundation

Despite the lack of consensus across all three of the automotive groups surveyed as to exactly which factors add unnecessary cost to tooling, there were some common opinions. For example, all three groups believe tools are over-engineered, and that communication and transparency among automakers; Tier 1 suppliers; and mold, tool and die shops is lacking.

It is well-understood that, to drive profitable growth, all three parties must work together to remove cost from the value chain, and one way in which this may be possible is by simplifying the product and processes used throughout the vehicle development process. Then, each link in the automotive supply chain could realize lead time reductions and cost savings. Additionally, tool shops could streamline the quoting process and use standard components, if applicable to the job. Finally, it seems clear that Tier 1 suppliers must improve communications up and down the supply chain while staying focused on balancing the functionality of the mold/tool with the cost targets. This is a sensitive area for Tier 1 suppliers, but absolutely critical for them to remove these barriers to improve costs.

The bottom line seems to be that all three parties within the automotive supply chain are frustrated, and all three believe that, in order for the industry to remain profitable, they must collaborate. Increased trust, transparency and teamwork could build a stronger foundation for surviving a potential slowdown in the automotive tooling industry.

Related Content

The Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

Read MoreEditorial Guidelines: Editorial Advisory Board

The Editorial Advisory Board of MoldMaking Technology is made up of authorities with expertise within their respective business, industry, technology and profession. Their role is to advise on timely issues, trends, advances in the field, offer editorial thought and direction, review and comment on specific articles and generally act as a sounding board and a conscience for the publication.

Read MoreTackling a Mold Designer Shortage

Survey findings reveal a shortage of skilled mold designers and engineers in the moldmaking community, calling for intervention through educational programs and exploration of training alternatives while seeking input from those who have addressed the issue successfully.

Read MoreTop 10 Topics to Cover During an ISO 9001 Manufacturing Audit

Take a look at this practical hands-on approach to conducting a quality audit.

Read MoreRead Next

Trends Impacting the Supply Chain

The cost of manufacturing and product demand are set to cause financial and business climate changes across the moldmaking industry.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read More

.jpg;maxWidth=300;quality=90)