Total MBI for April 2014

54.3

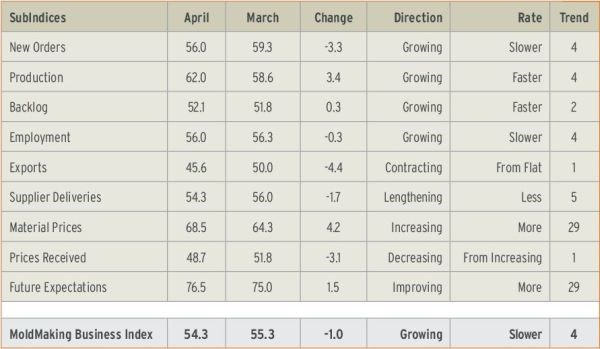

With a reading of 54.3, Gardner’s moldmaking business index showed that the moldmaking industry expanded in April for the fourth consecutive month and the sixth time in the previous seven months. The industry has been generally growing at an accelerating rate since August. The month-over-month rate of change was 10.8 percent, the second fastest monthly rate of growth since the index began. The annual rate of change grew at an accelerating rate in both March and April.

New orders grew for the fourth month in a row and the sixth time in seven months; they have been growing at an accelerating rate since December. Production has expanded every month but two since January 2013. Backlogs increased in April for the second month in a row at the second-fastest monthly rate of change since the index began in December 2011. This trend in backlogs is indicating higher capacity utilization levels and capital spending. Employment has been increasing faster so far this year than it has since the spring of 2012. Exports remain mired in contraction, however. Supplier deliveries continue to lengthen; delivery times have generally been growing longer since August, although the pace slowed down in March and April.

Material prices have increased significantly in 2014, growing in April at their fastest rate since February 2013. At the same time, prices received have contracted two of the previous three months. Future business expectations remain strong and are near the highest levels since the index began.

Business conditions at facilities with 50 or more employees fell in April, as did the rate of growth at plants with 100-249 employees, although only marginally. However, at smaller plants with 50-99 employees and larger ones with more than 250 employees, the rate of growth slowed more significantly. At facilities with fewer than 50 employees, business conditions improved; plants with 20-49 employees grew at a faster rate and facilities with fewer than 20 employees contracted at a slower rate.

Both custom processors (molders) and metalcutting job shops (moldmakers) grew three of the first four months of the year. In April, the rate of growth at custom processors was the strongest since September, while, in contrast, the rate of growth at metalcutting job shops has slowed somewhat, hitting its slowest rate since November.

Three of the four regions expanded in April, with the fastest growth in the North Central-East region, which has grown for four consecutive months and is growing at its fastest rate since March 2012. The Northeast region grew for the third time in four months, and the West region grew at an accelerating rate for the second month in a row. The North Central-West region contracted for the first time since December.

Capital spending plans reached their second highest level since the survey began. Compared to one year earlier, future capital spending plans increased 25 percent in April, and their annual rate of growth remains quite strong.

To see the historical breakdown of our business index and each of its subindices, visit gardnerweb.com/forecast/moldmaking.htm.

Related Content

-

How Hybrid Tooling Accelerates Product Development, Sustainability for PepsiCo

The consumer products giant used to wait weeks and spend thousands on each iteration of a prototype blow mold. Now, new blow molds are available in days and cost just a few hundred dollars.

-

MMT Chats: Digitalizing Mold Lifecycle and Process Performance

MMT catches up with Editorial Advisory Board member Bob VanCoillie senior manager of Kenvue’s mold management center of excellence outside of Philadelphia to discuss mold management via tooling digitalization and OEM expectations and opportunities.

-

International Partnership Improves IBM Preform Precision

Hammonton Mold Co. and ADOP France team up to bring injection blow mold preform design and service to the next level.

.jpg;maxWidth=970;quality=90)

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)