August MoldMaking Business Index: 46.6

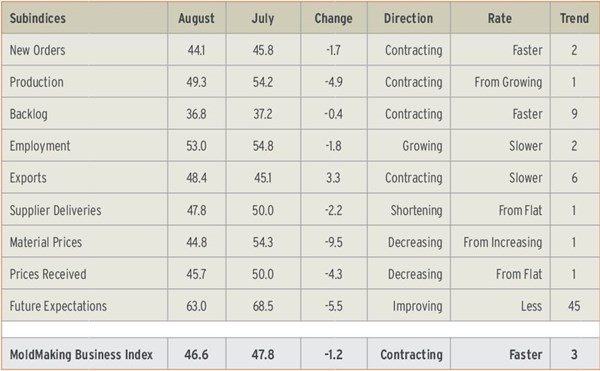

With a reading of 46.6, the Gardner Business Index showed that the moldmaking industry contracted in August for the third month in a row. The rate of contraction accelerated in each of those three months. The index generally has trended lower since this past February, and this August, it contracted at its second fastest rate since August 2013.

With a reading of 46.6, the Gardner Business Index showed that the moldmaking industry contracted in August for the third month in a row. The rate of contraction accelerated in each of those three months. The index generally has trended lower since this past February, and this August, it contracted at its second fastest rate since August 2013.

New orders also contracted at an accelerating rate for the second month in a row, with a drop that was particularly sharp in July and August. Production contracted for the second time in three months. However, the rate of contraction in production for both of those months has been quite minimal, therefore the production index has remained significantly higher than the new orders index. As a result, the backlog index continued to contract at an accelerating rate and has contracted at a steadily increasing rate since November 2014. In fact, August’s contraction was at the fastest rate since December 2012. The trend in backlogs indicates that capacity utilization will fall heading into 2016.

Employment expanded for the second month in a row. Despite one month of contraction in June, the employment index has trended up since September 2014. Exports contracted for the sixth straight month, but the rate of contraction decelerated for the second month in a row. Supplier deliveries shortened for the first time since November 2013, which indicates slack or available capacity in the supply chain.

In August, material prices decreased at their fastest rate since the survey began in December 2011. Prices received have decreased every month but one this year. Future business expectations have trended lower since March, and in August they were are their lowest level since November 2012. Expectations have been below average six of the last seven months.

After one month of contraction, plants with more than 250 employees and 100-249 employees returned to growth. Companies with 50-99 employees expanded for the third time in five months, and in August, the index for these facilities was higher than 60.0. The total index was dragged down by the performance at smaller facilities, as those with 20-49 employees contracted for the fifth time in six months. Companies with fewer than 20 employees have contracted every month since December 2014. Custom processors contracted for the second month in a row, however, the rate of contraction slowed from July. Metalcutting job shops contracted for the fourth time in the last six months, and August’s rate of contraction was the fastest since August 2013.

While future capital spending plans remained nearly 50 percent below average, they did reach their highest level in the last five months. Compared with one year earlier, future capital spending plans have contracted at least 30 percent every month since November 2014.

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)

.jpg;maxWidth=970;quality=90)